Fun With Data – Smartphone Share

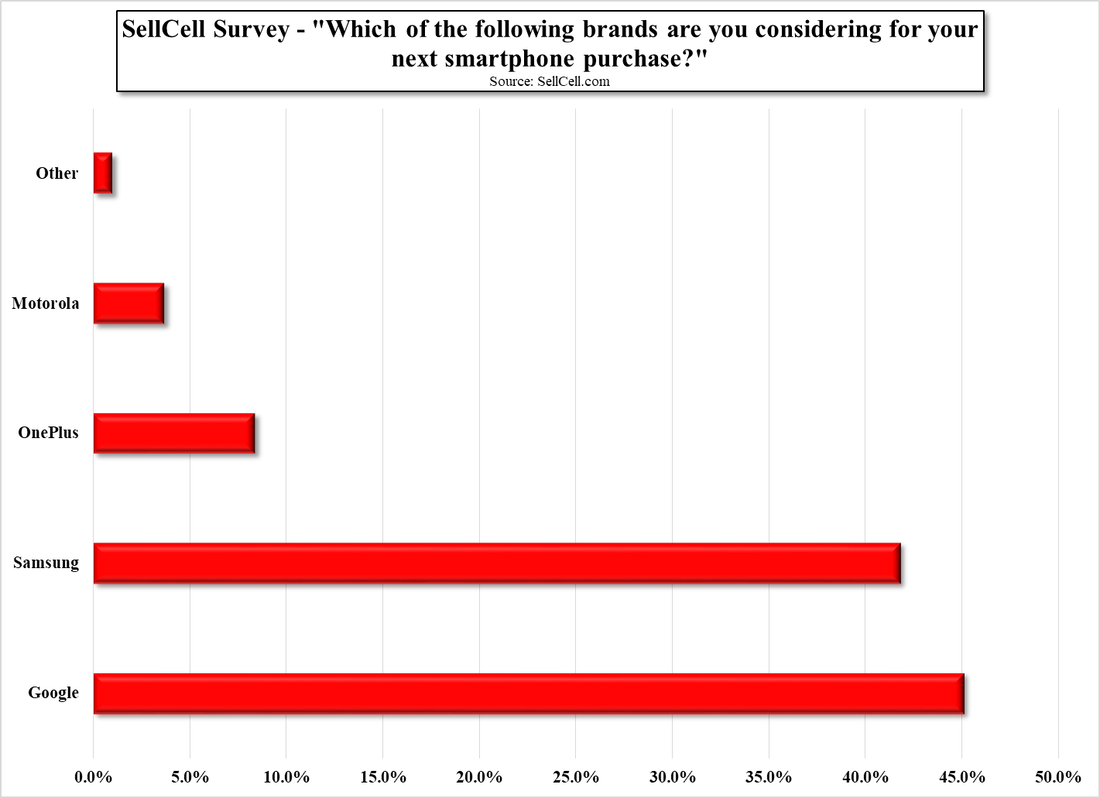

In the US Apple was the share leader in 3Q at 42%, growing 3% from last year’s 3Q, while Samsung took a 35% share, up 5% from last year. LG Electronics, who last year had a 13% share in the US market (3Q) is defunct, with much of that share falling to Apple and Samsung. There were two Chinese brands that registered in the US smartphone market in 3Q, TCL and OnePlus (pvt), with 5% and 3% respectively, while Samsung did not register in China, although Apple had a 13% share in 3Q. Oppo (pvt) and Vivo (pvt) were the two brands in China with the largest share in 3Q, at a combined 43%, both of whom are owned by the same private company, and Honor (pvt), formerly a Huawei (pvt) sub-brand, came in just above Apple (13%) and Xiaomi (14%) at 15%.

Last year in 3Q, the Chinese market was dominated by Huawei with a 35.6% share, which is now down to 8% because of trade restriction imposed by the US that limit the company’s ability to access Google (GOOG) store applications. So, while the US is a diverse smartphone market in terms of brand source, China is not, with 89.9% of new models released in 3Q coming from Chinese based brands. With Apple and Motorola the only US based brands in the US market, there is plenty of room for competition for US smartphone dollars, although based on what is currently available from US carriers, there are really few choices other than Apple, Samsung, and Google, with a smattering of Nokia and last year’s LG phones.

RSS Feed

RSS Feed