Apple Meta

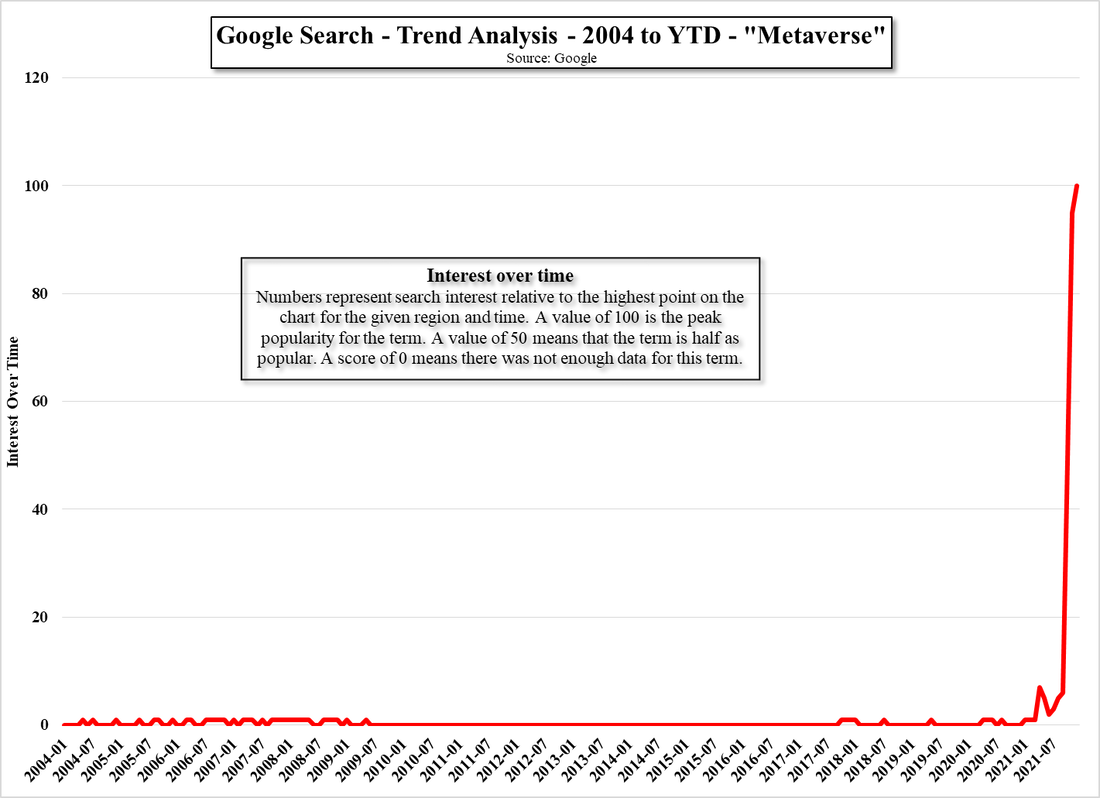

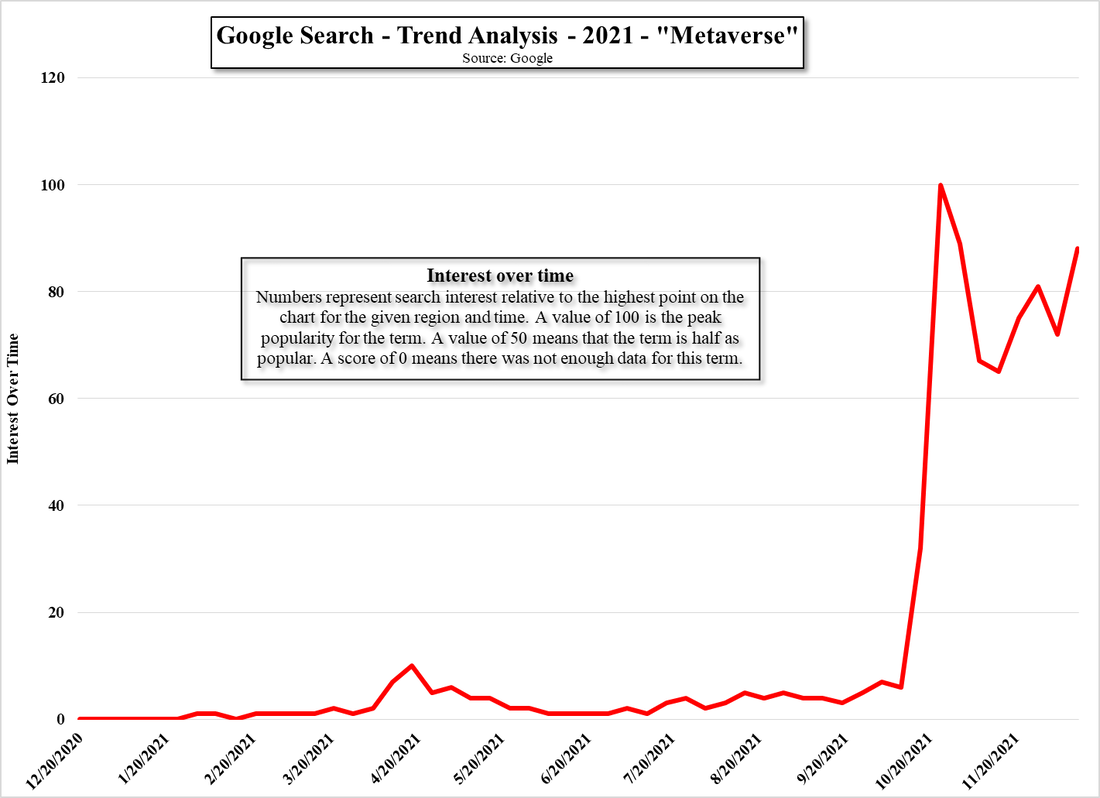

Google (GOOG) search results are a basic way to track how much interest is being generated by a topic or specific word and the results seen in Fig. 2 and Fig. 3 indicate that there was little interest in the term until October of this year, when Facebook rebranded itself ‘Meta’ and teased the world into the Metaverse concept. While we have mentioned China as a region where the Metaverse has been a focus of attention, on a regional basis there seems to be no rhyme or reason as to regions where search results for ‘Metaverse’ are the highest. Singapore is at the top of the list, but neither China, the US, or South Korea was in the #2 spot, which was given to Myanmar, followed by Turkey, Hong Kong, Cyprus, and Nigeria, with South Korea #7 and the US #14, indicating that ‘Metaverse’ interest seems to be boundless across the globe.

Since the term Metaverse’ is relatively new, but the concept for immersive 3 dimensional worlds has been around for many years, we took a look at a number of companies and how they have been involved in what could be construed as the Metaverse, starting with Apple (AAPL). We chose Apple as they have a reputation for secretive in-house technology development but are quite conservative about implementing said new technology, and while they acquire many small companies each year, the Metaversey acquisitions Apple has made point to where Apple’s development focus has been oriented.

As far back as 2010 Apple has been interested in the technologies that are or will be part of Metaverse development, and facial recognition was among the earliest Metaversy acquisitions. While the idea of facial recognition was focused on identification, eventually leading to Apple’s Face ID system, it is a key component in developing a Metaverse that looks realistic and lifelike and PrimeSense was a key asset as it was the basis for the Xbox Kinect (MSFT) system, with similar systems used for VR gaming movement analysis.

In the 2015’s Apple was interested in navigation and positioning, and while much of that interest was to offer a competitive map solution for the iPhone line, positioning is also a key component for the Metaverse, as the concept allows users from any location to be positioned in an open Metaverse, along with the concept that real estate in the Metaverse can mimic physical real estate, which makes precise location necessary. However by the end of 2015 Apple was back to looking at ways in which it could capture physical objects and convert them to 3D graphical images in ways similar to how object overlays can be inserted in AR images. Apple does have its own AR SDK (ARKit) that supports a number of AR/VR development engines and states that more than 10,000 iOS applications support AR and has added over 100 patent filings in the AR space this year.

While many of Apple’s Metaversy acquisitions were software based, they did purchase a company in 2017 that had developed (but not released) a combination AR/VR headset, and while the device never saw the light of day, the team became part of Apple’s AR/VR headset development team that gets a bit of publicity every time someone predicts an imminent AR or VR headset release from Apple. Later acquisitions focus more on 3D content creation systems and animation and editing systems, as we expect Apple would be remiss if they were to eventually release an Apple VR/AR headset that did not have an Apple content platform able to be accessed directly. While VR and AR headsets could eventually be a viable and profitable product for Apple, the real game is in the services space, where an ‘Apple Metaverse Store’ would open up Apple users to content developed for the platform, just as it does for games and other applications.

As we noted, Apple is slow to add new technology, but they have been developing software and hardware related to AR/VR for many years, a luxury afforded those who have billions in FCF, and we expect when the company does release a device, it will be sleek, sophisticated, and expensive, and will legitimize the Metaverse far more than any other CE company. More to come…

Apple Metaverse related acquisitions (not all):

- 2010 - Polar Rose – Sweden - ~$25 - $30m – Add –ons for browsers that used facial recognition to tag people in photos

- 2013 - PrimeSense – $360m – Fabless semiconductor development company that created sensors that used structured light to create 3D object maps. Eventually used by Microsoft for Kinect™ gaming system.

- 2015 - Coherent Navigation – Location based navigation and precise positioning

- 2015 - Metaio – Germany – SDK AR Applications – Junaio (AR Browser) – The company’s tool was used to produce AR type videos and had 150,000 users until it was purchased by Apple in 2015. Most of the information on the company has been taken down.

- 2015 - Mapsense - $25 - $30m – SF Startup – Cloud-based developer platform for graphical model data

- 2015 - Faceshift – Zurich – Markerless Motion Capture SDK – Used in film and animation. (https://youtu.be/RLfAmNDNgHk)

- 2016 - FlyBy Media – US – 3D sensor based application that scans objects and builds virtual maps (objects) that can be used in messaging, advertisements, or any applications. Originally developed as part of a Google (GOOG) project.

- 2017 - Vrvana – Canada - $30m – Combination VR/AR headset – Announced but never released. Had early 6DoF (6 degrees of freedom) capabilities, something not every current headset is capable of.

- 2017 – SensoMotoric – Germany – Eye-tracking hardware

- 2018 – Alkonia Holographics – US - Lenses for AR glasses

- 2020 - NextVR – US – ~$100m - Specialized cameras for recording sporting events, concerts, etc, in VR format

- 2020 - Camerai – Israel – Computer vision and AR editors and SDK for mobile and web based content

- 2020 - Spaces – US – VR avatars for videoconferencing. Originally game development and VR location based content used at theme parks. Former DreamWorks execs.

RSS Feed

RSS Feed