BOE Invests Again & More

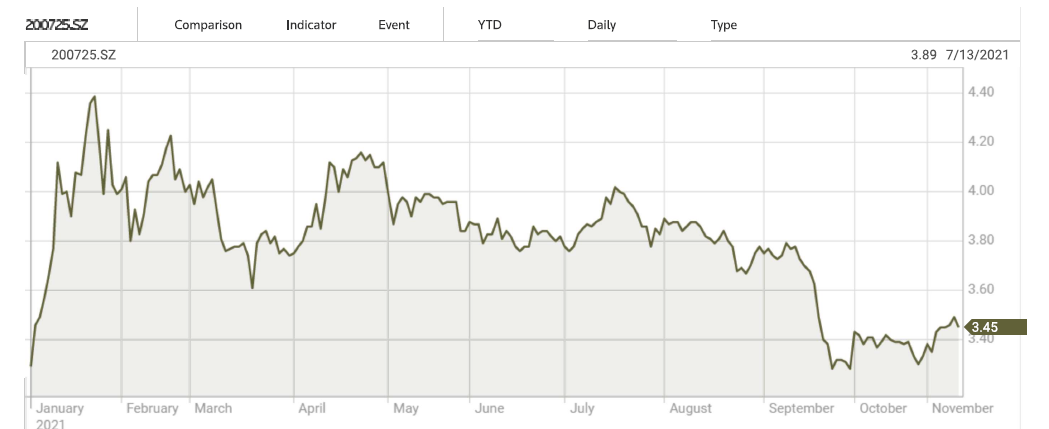

Honor has done well for itself over the last few years and has challenged Xiaomi (1810.HK), typically the smartphone share leader in China, a number of times since its divestiture from Huawei and continues to grow its base in China while expanding its product offerings to laptops, tablets, and wearables. With just a bit under 50% of Honor’s phones being OLED based, a number of Chinese OLED producers are vying for the company’s smartphone business. China’s Visionox (002387.CH) has most recently supplied the OLED display for the Honor 70, released in June, while BOE (200725.CH) has supplied displays for the Honor 60, Magic 3, and Honor’s Magic V foldable.

It seems that BOE is not taking any chances that it might fall behind other suppliers with Honor as the fastest growing Chinese smartphone brand, and has taken a stake in the company, although has not disclosed the size of the investment, stating, “It has not reached the disclosure standards”, meaning it is not large enough that it has to be disclosed in a filing. That said, with BOE’s investment, once again rumors that Honor will be filing for listing on one of the Chinese exchanges have resurfaced, as they have a number of times since the spin-off. Some Chinese tipsters have insisted that there was a requirement in the purchase agreement that the company would submit an IPO within 3 years from its separation from Huawei, which would be November of 2023, although that remains unconfirmed.

This is the second recent investment BOE has made recently, after taking a ~$291m controlling stake in HC Semitek (300323.CH), a supplier of LEDs for BOE’s mini-LED array business, so it seems that BOE is bent on making sure it has a favorable position with suppliers, in this case both semiconductors and LEDs. BOE calls these acquisitions ‘anti-cyclical’, which seems a bit confusing as we expect the LED business in China follows the same basic economic patterns as does the display business, and while the semiconductor business is a bit more of a wild card (or has been recently), we expect the ‘anti-cyclical’ theory is really the idea that under poor macro-economic situations, BOE will still have direct access to basic components, avoiding the shortages that plagued the CE space last year and earlier this year, and even more pressing problem that could recur in the future.

These protective moves by BOE are commendable, and while the company will still be at risk for display glass substrates, given China’s lack of reliable large-area display glass production, BOE has had a long-standing relationship with Corning (GLW), who has built glass substrate production facilities alongside BOE display fabs. Further, they would be in the same situation with Universal Display (OLED), who is the exclusive supplier of phosphorescent OLED emitters that are the basis for BOE’s OLED display production. We only mention this because there has been considerable chatter about the US government adding the display industry to the trade restrictions it has imposed on the Chinese semiconductor industry, and while we expect a portion of BOE’s motivation for its recent acquisitions and investments might have something to do with that fear, we expect the shortages the company experienced is the key motivation.

From the perspective of how a ban on trade with the Chinese display industry would affect the companies mentioned above, 31.8% of Corning’s sales in 2021 were in China, along with 23.2% of its long-term assets, while UDC saw 34.7% of its revenue in 2021 come from the Mainland. Aside from the considerable damage such a ban would do to the two companies mentioned above, there are innumerable other US companies in the display supply chain that would also be affected if such a ban were to be enacted. Since the US does not have a localized ‘display’ industry that competes directly with China, it seems a stretch to envision such a ban, so we are doubtful that there is reasoning behind such talk, other than from a political standpoint, but we also note that the semiconductor trade bans have gone further than we would have thought, so we cannot rule anything out. As BOE seems to be proactive, even in the midst of a weak CE scenario, we give them credit for at least trying to avoid the same issues that caused problems during the throes of the COVID pandemic and perhaps the foreshadowing of another potential issue that could face the Chinese display industry.

RSS Feed

RSS Feed