Tesla Trouble?

The Democratic Republic of the Congo produces ~74% of the world’s supply of cobalt and has ~54% of the world’s reserves of the metal, and while Australia produces between 2% and 3.5% of global supply, it is the only other country with more than 4% or 5% of global reserves (~15.5%). This means that the DRC essentially controls the world’s supply of cobalt. This is not a new occurrence, but something has changed recently that makes Trump’s tariff threats look mealy-mouthed in comparison. On February 22 of last month the government of the DRC decided to halt all cobalt exports for four months.

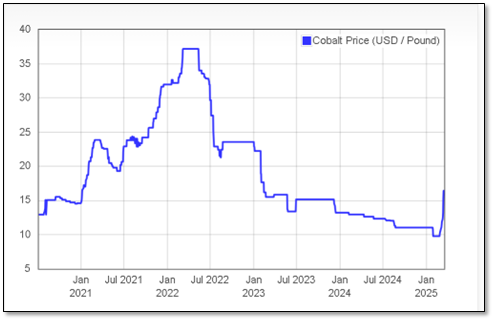

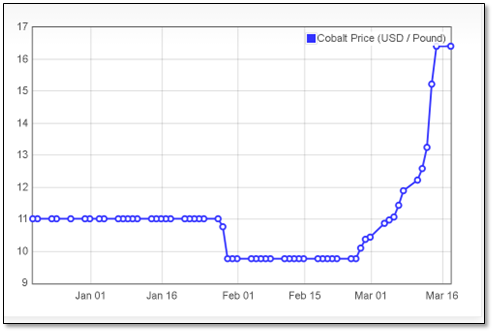

The DRC statement indicated that the ban was put into effect “to regulate supply on the international market which is faced with a supply glut”, a reference to China’s CMOC Group (603993.CH), the globes largest miner of cobalt, more than doubling production last year, amid slowing demand. The reaction was quick, as can be seen in the long-term and short-term charts below, with prices rising every day since the ban was announced. That said, the long-term chart also indicates that the material is down severely from its peak in 2022, hitting lows last year not seen in over a decade.

The DRC has indicated that it will revisit the ban after three months to decide further action, but with the country holding more than half of the world’s cobalt reserves, it is expected that stockpiling has already begun. Hopefully you bought that Tesla last year and won’t need another battery for 15 – 20 years unless it gets damaged. Wait, do I smell something burning?

RSS Feed

RSS Feed