Old Reliable?

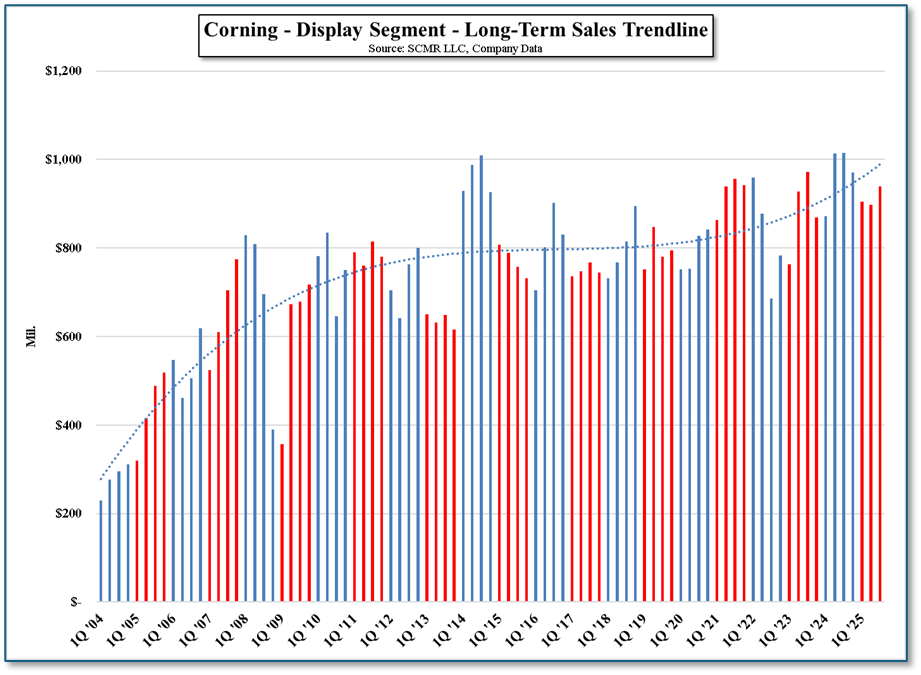

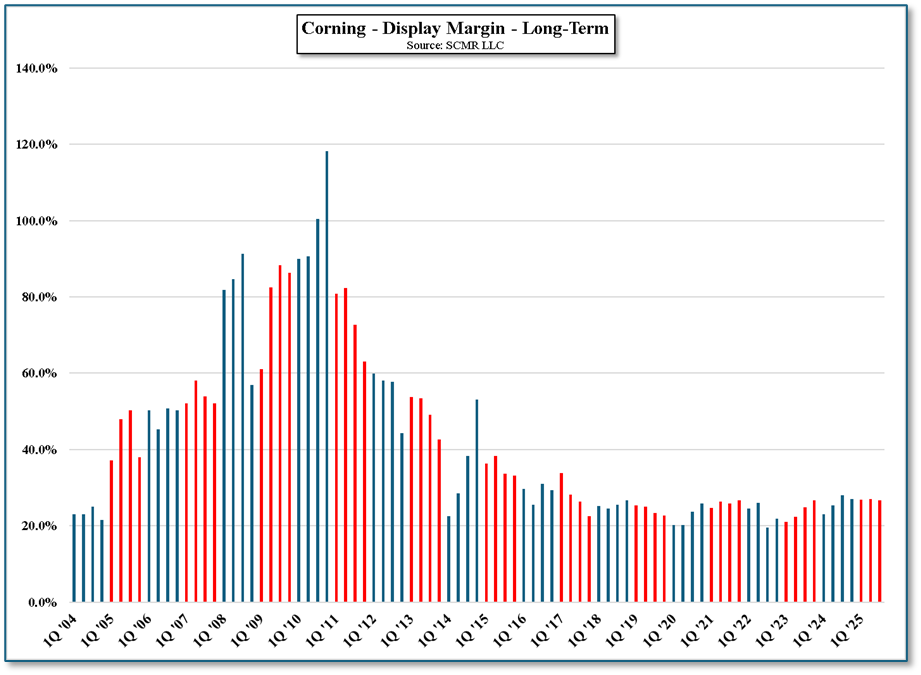

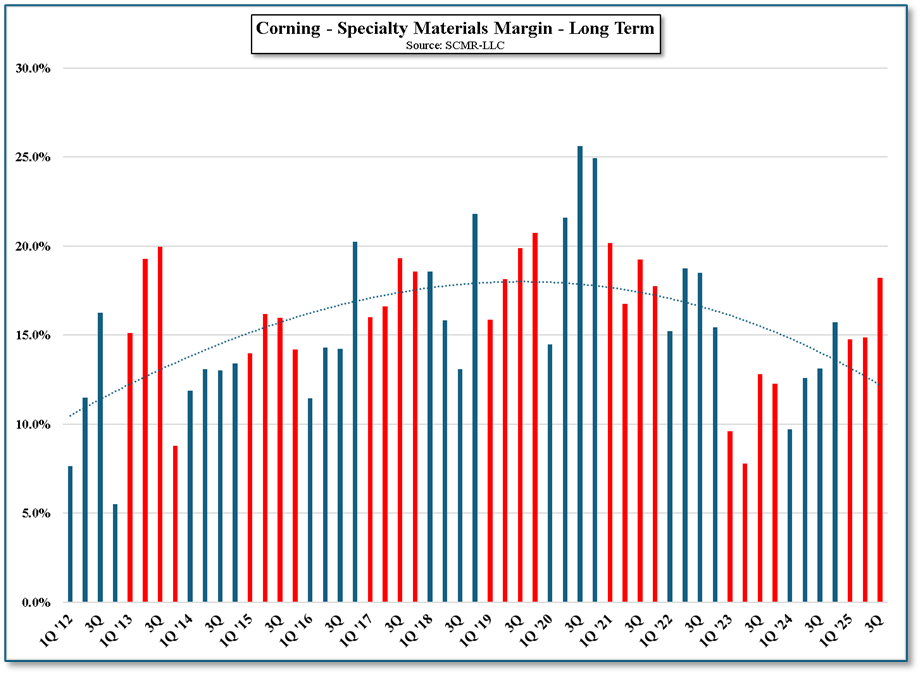

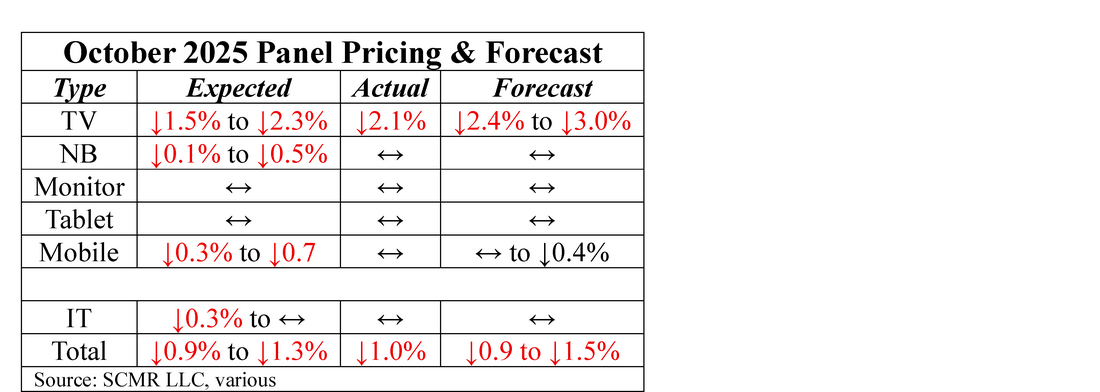

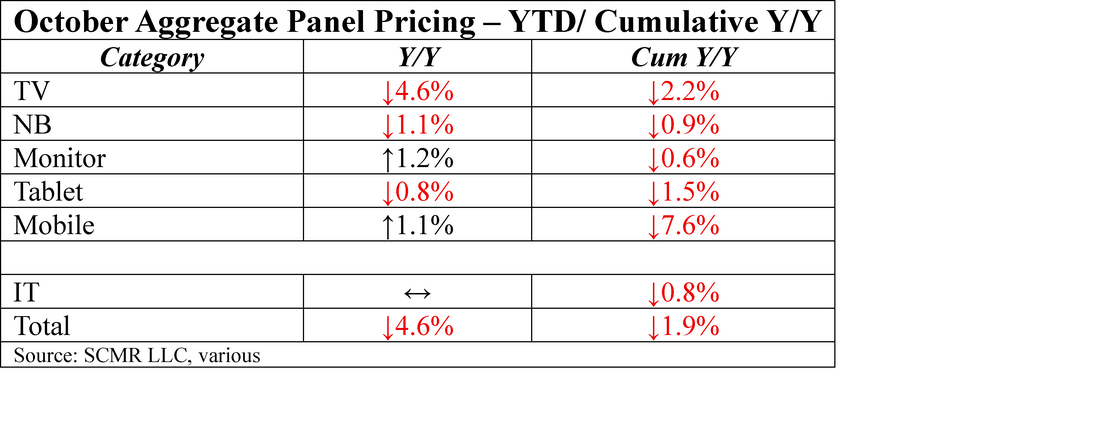

Figure 1, Figure 2, and Figure 3 show Corning’s display division sales on a long-term basis, and segment margins on both a long-term and 5-year basis. The charts show that 2022 was a correction year for much of the CE space after the surge in demand during the COVID pandemic and the inventory build that fed such demand, Corning’s display segment recovered in 2023 and continues to follow a positive trendline. During 2023 the company announced a substrate glass price increase (~20%), the first since mid-2021, helping to bring prices in-line with rising production costs due to inflation. This has helped to bring display segment margins back to more normal levels after hitting 5-year lows in 3Q 2022. Since then display sales have been relatively steady as the price increase held and inventory levels remain normal.

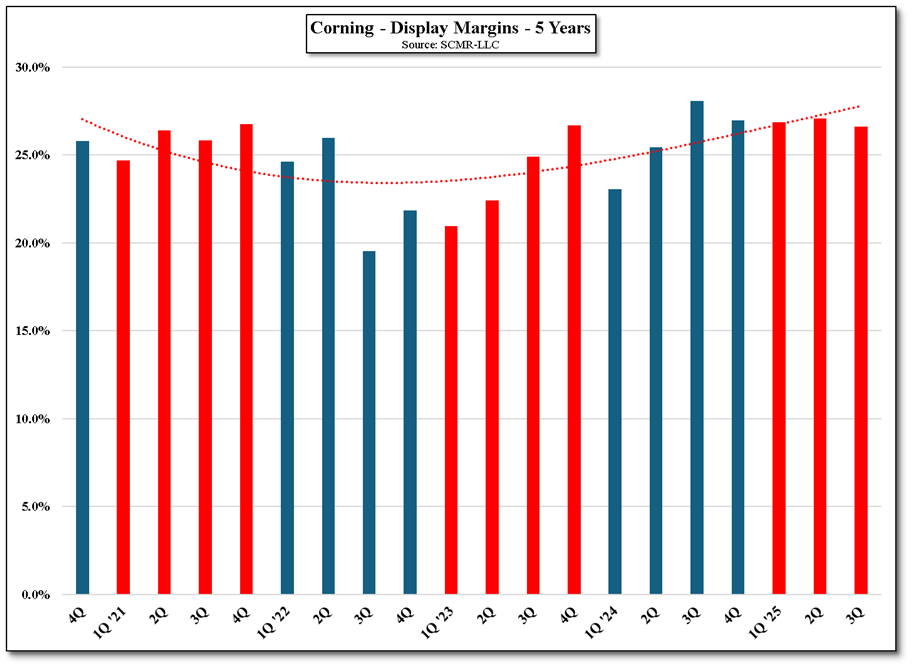

Display margins have also recovered, to the mid 20’s and more recently the upper 20’s, with every quarter this year at least 2% higher than the 5-year average quarterly margin. We expect margins to remain under 30%, but as Corning’s highest margin business, it is critical that display margins remain in the mid to upper 20% range. The company projects that display margins will be at least 25% for the full year on between $900m and $950m in sales but indicated that they expect sales to come in at the high end of that range, likely pushing margins above 26% once again.

On a longer-term basis we see the display segment maintaining sales in the $3.7 to $3.9b range and margins between 26% and 27%. While we expect substantial growth will be difficult as the display space itself remains in stasis, as long as Corning is able to maintain consistent volumes the display business should continue to generate substantial margins. We note that Corning management also noted that as the only US display glass supplier, those panel producers looking to increase their US ‘content’ to offset trade restrictions have only Corning as an alternative.

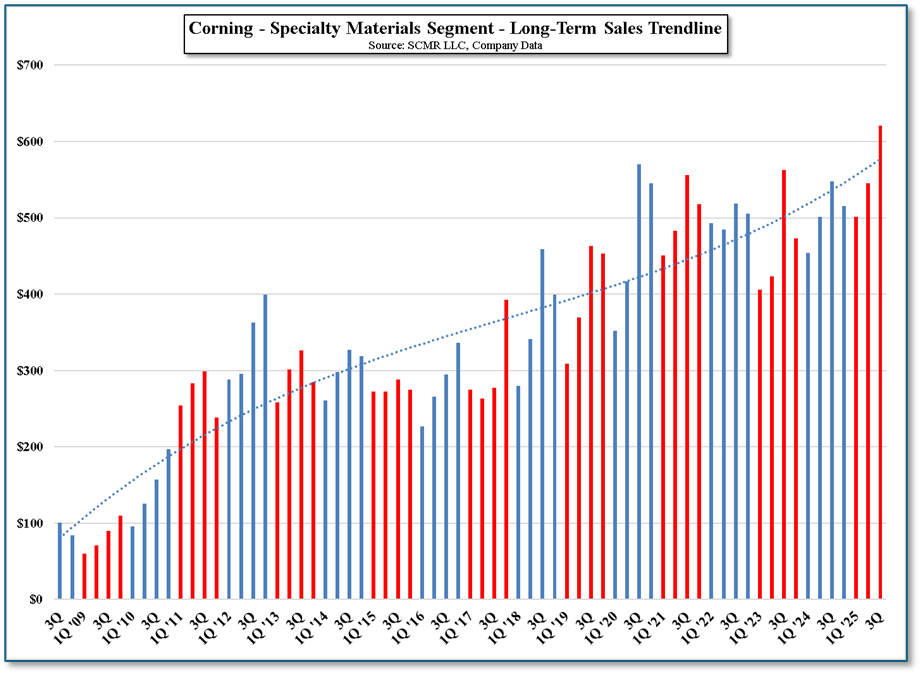

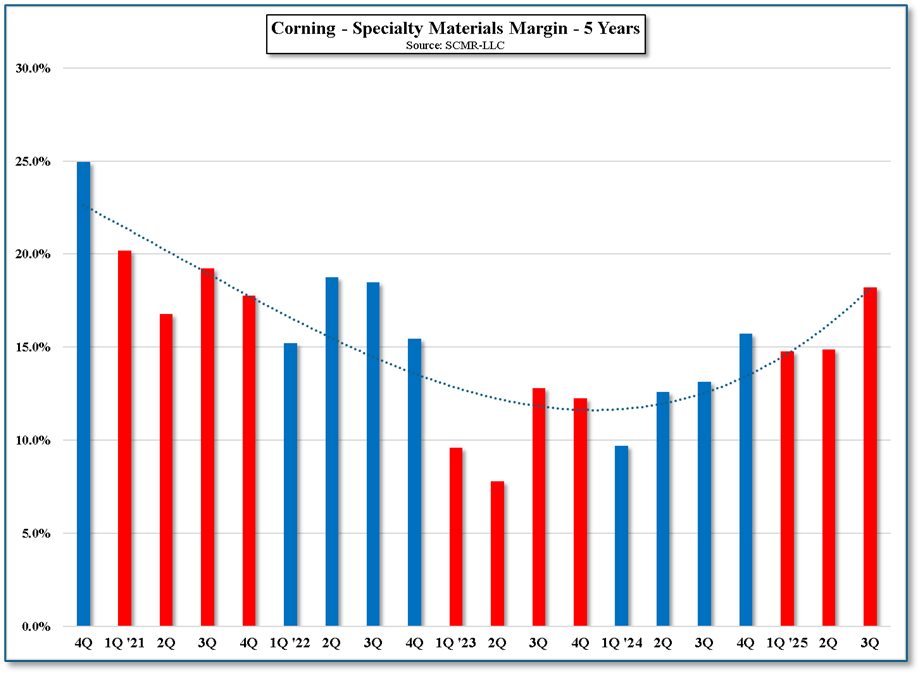

The Specialty materials segment at Corning saw a strong quarter with sales setting a new company record, which we suspect might include some additional Apple (AAPL) business, apropos of the announcement made in August in which Apple committed $2.5 billion to Corning’s Harrodsburg production plant, making it the exclusive supplier of cover glass for all iPhone and Apple Watch products, part of Apple’s commitment to invest $600 billion in US manufacturing over the next four years. That said, as OEM Gorilla Glass is refined outside of Corning[1] sales of Gorilla Glass do not always correlate to smartphone sales.

Corning’s Specialty Materials segment saw the same sales and margin contraction that affected the display space in 2022, but about a year later as smartphone shipments continued while other CE products slowed. Specialty materials’ margins have been improving since, currently reaching 18.2% on record sales, which we believe would typically be at or near the high end of the long-term range. However we expect that the Apple deal might give some room for margin expansion as Corning not only supplies cover glass for the iPhone and Apple Watch but is also the finisher for Apple. This should lead to some margin improvement over time as Apple moves all of its cover glass production to Harrodsburg and that facility no longer produces any raw glass for OEMs.

While we are certainly cognizant of the effect AI and data center build outs are having and will have on Corning’s sales and profitability, we are less sure about the long-term sustainability of that growth and look to Corning’s other CE related businesses for steady sales and profitability. While growth might be a struggle for the display segment, it is a reliable source of sales and income for the company, and as the Trump administration will likely continue to hammer on CE brands to source from US companies, Corning has the competitive upper hand for the next three+ years. Specialty materials carries a bit more risk in that it is focused primarily on the smartphone segment, but the concept of using more glass per device seems to be keeping demand growing despite the ups and downs of the smartphone market.

[1] The ion exchange strengthening process is done at the OED level

RSS Feed

RSS Feed