CE Spending Baseline

Data

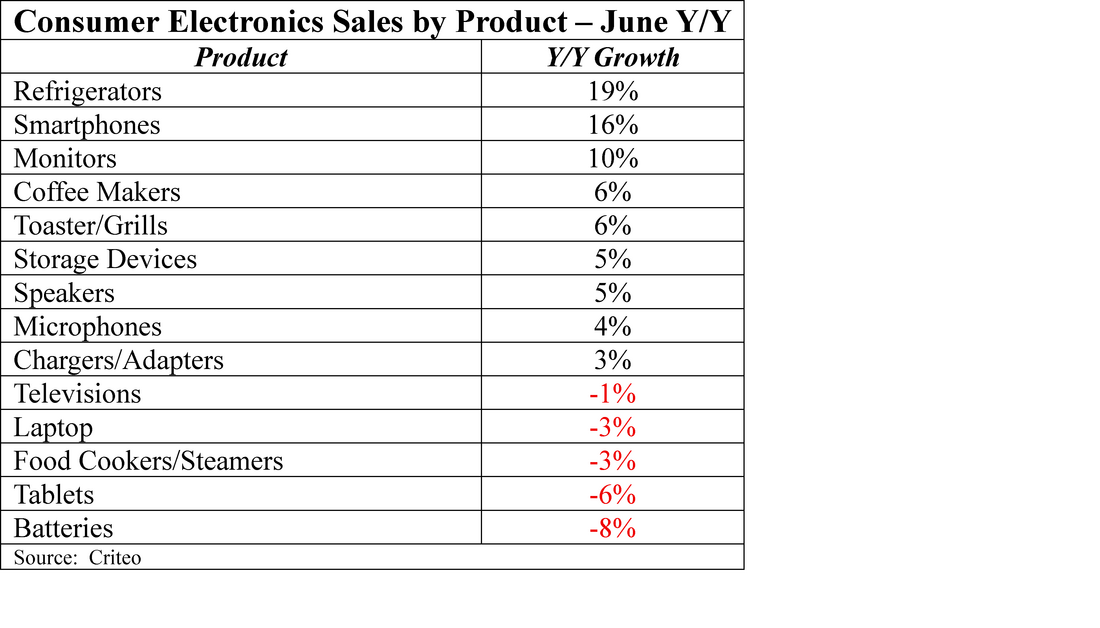

In June of this year the consumer electronics market in the Americas saw a 22% y/y increase in traffic which translated into an 18% y/y increase in sales. In EMEA the traffic increase was 12% but was fully converted into a 12% increase in sales. APAC saw the least traffic growth at only 3% but was able to convert that traffic into 12% sales growth. Most surprising were the consumer electronics growth categories, as the CE category that grew the most between June 2024 and June 2025 was refrigerators with 19% growth y/y, followed by a somewhat more expected category, smartphones, which grew 12% y/y. Here are the rest:

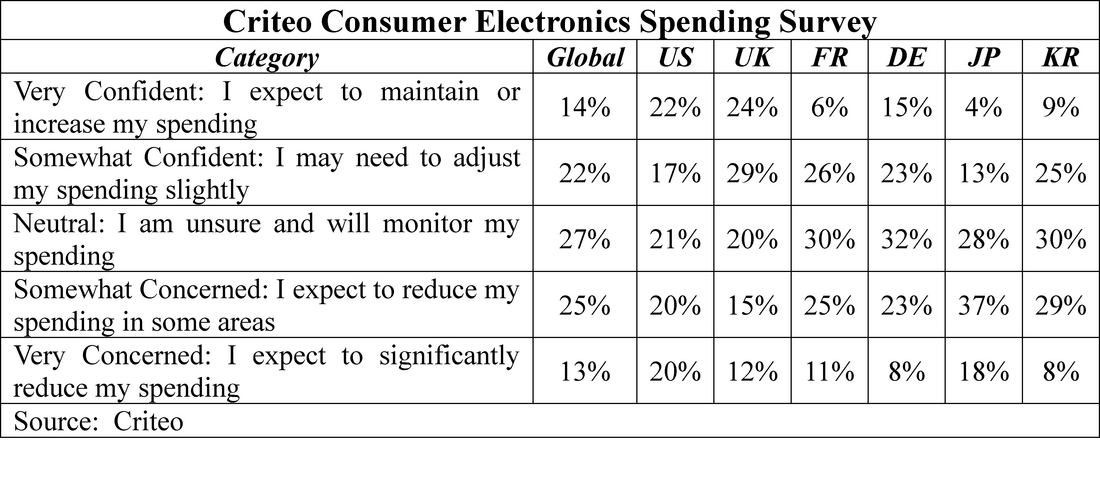

The June survey data on consumer confidence was a bit trickier in terms of classifying the responses. The survey asked which of these 5 categories would you, as a purchaser of consumer electronics, fit into? We tried to combine the 5 into three (Up, Flat, Down) but they don’t quite fit the broader categories, so here’s the actual data.

RSS Feed

RSS Feed