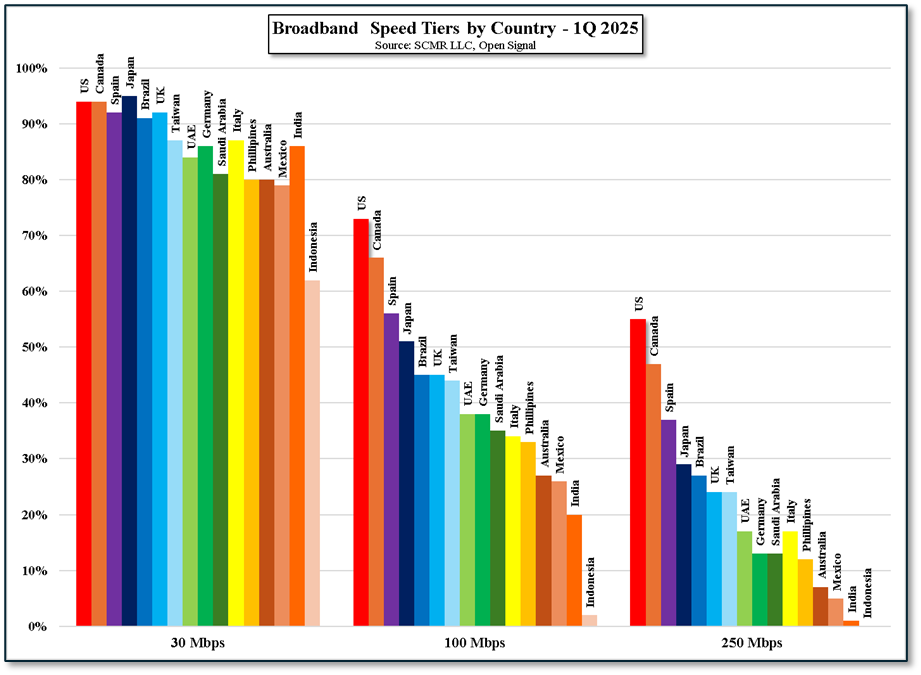

Fun with Data – Who is the Fastest of Them All?The US wins this race! It’s the race to the fastest broadband, although in this case it is not information reported by those who are being tested (carriers) it is actual recorded speeds from the content source to the end-point, meaning not only is your carrier broadband included, but your gateway, and home Wi-Fi are also, making this data far more practical than the iffy data reported by carriers. While more than 50% of broadband users in all countries listed receive at least 30Mbps, at 100 Mbps things change quickly. At 30Mbps 86% of users reached that level, but at 100 Mbps that average dropped to a mere 40%, and at 250M bps the average fell to 21%, meaning at 250 Mbps (despite carrier promises) only 21% of broadband users realized that target speed. The US was the leader in all three speed categories but only 55% of those broadband users in the US who were promised 250 Mbps actually received it. We don’t blame carriers as much as usual with this data as home Wi-Fi can do some serious damage to broadband speeds if the equipment is old or set-up improperly. So if you find you are not close to what you carrier promised (and you are paying for), call them and tell them to pay a visit because they will either fix their equipment or tell you what’s wrong with yours, usually for free.

0 Comments

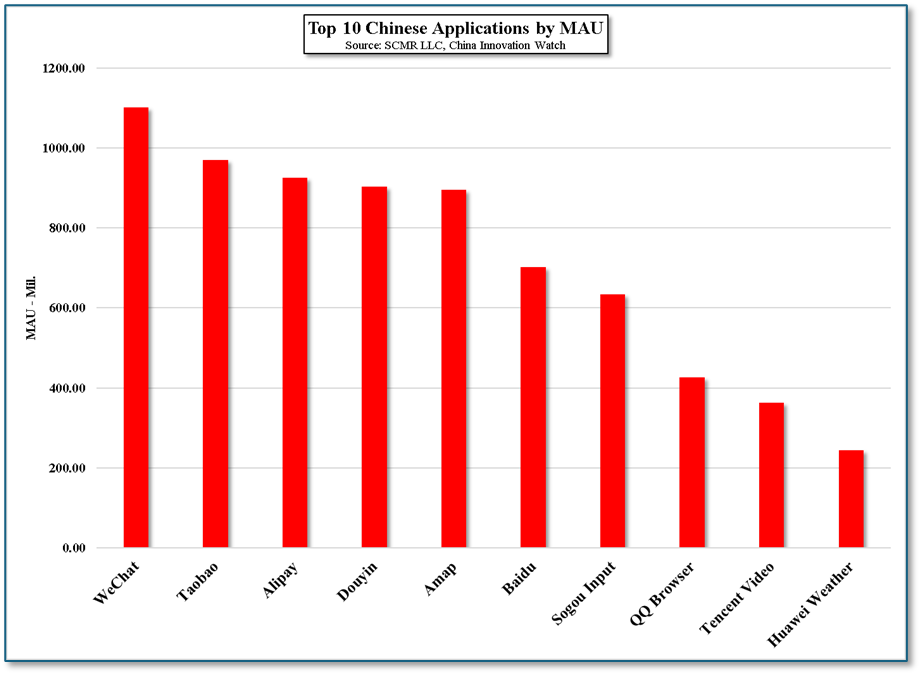

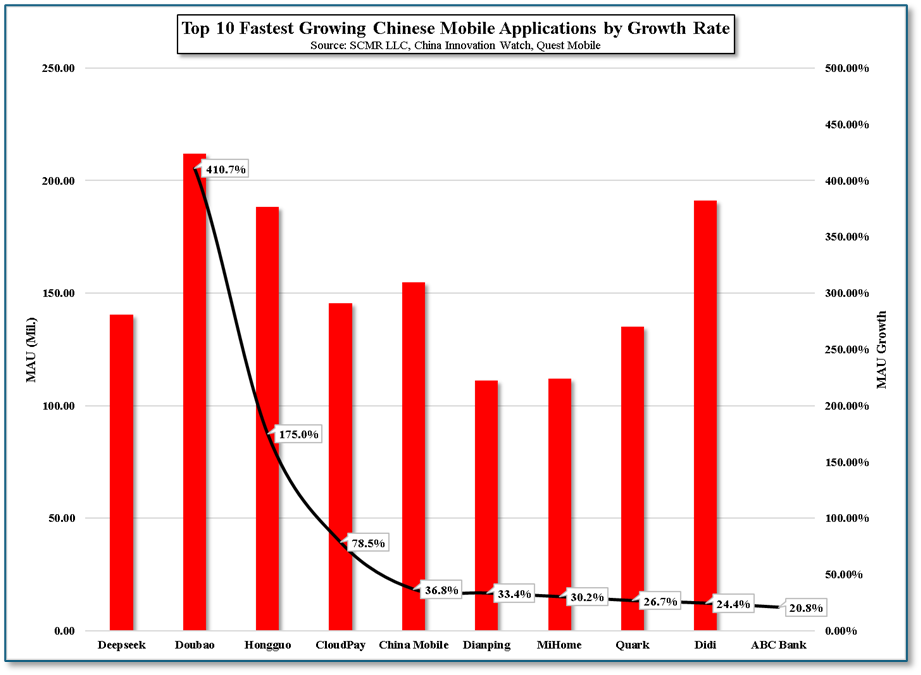

Fun with Data – Chinese MAUs |

AuthorWe publish daily proprietary market research focusing om consumer electronics and the global supply chain. The archieved notes represent a selection of our proprietary analysis and forecasts. please contact us at: [email protected] for detail or subscription information. Archives

January 2026

|

RSS Feed

RSS Feed