Sentimental Journey

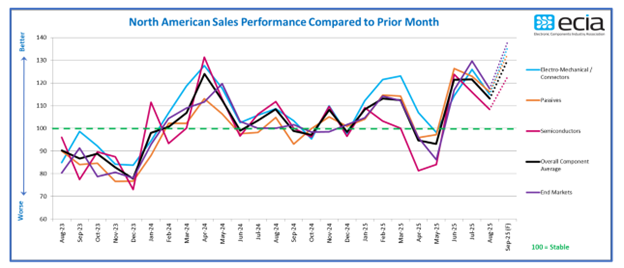

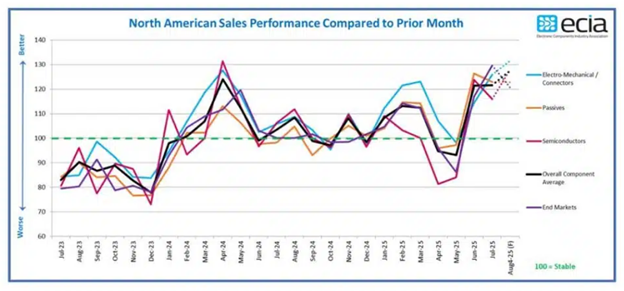

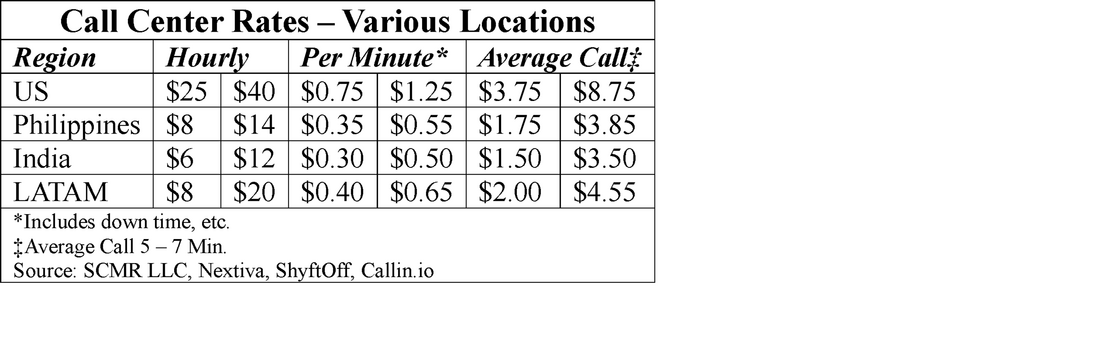

The ECIA component survey queries three groups for its responses; component manufacturers, distributors, and manufacturer representatives from 6 component categories, 6 semiconductor categories, and 8 end markets to get a broad view of the component industry and the prevailing sentiment for the month, quarter and year, along with a forecast of the upcoming month, all generating a compiled index. The index value represents the overall sentiment of these groups, with a reading below 100 indicating a negative growth outlook for the industry and over 100 a positive one, as shown in Figure 1 and Figure 2.

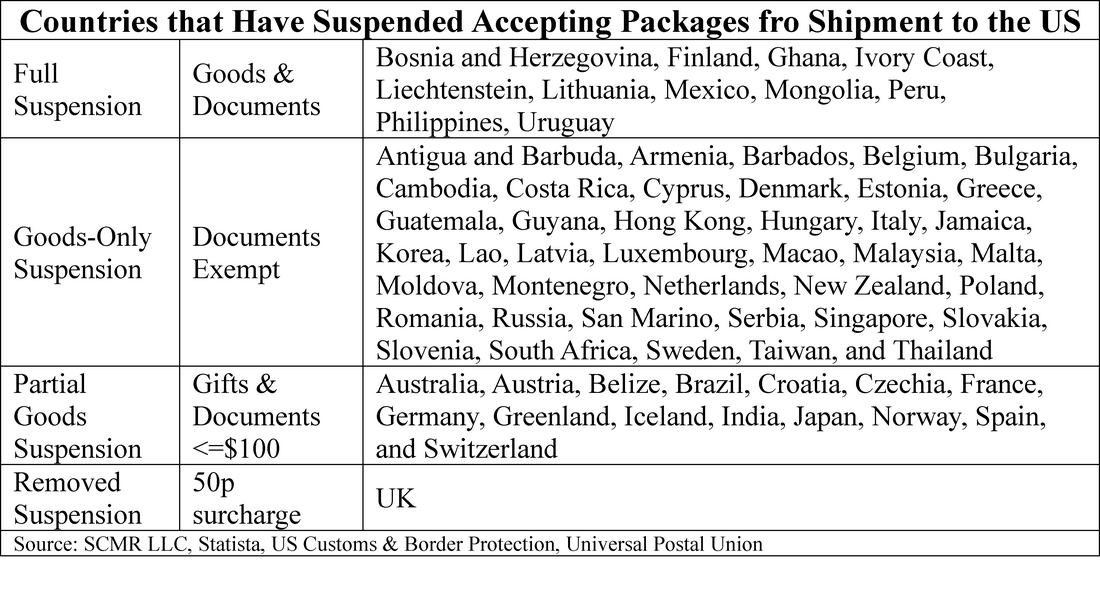

After a dismal end to 2024, component sentiment has been positive for most of this year, although the ‘fear of tariffs’ turned sentiment negative toward the end of 1Q and into 2Q. Since then overall sentiment has been quite positive, between 10% and 20% above the growth line. As can be seen in Figure 2, the July sentiment forecast (dotted lines) was quite optimistic, with expectations of a move from 121.6 (actual) to an additional almost 5% boost for August (127.5 forecast), indicating a continuation of the optimistic spirit seen in much of 3Q. However it was not to be, with the actual August sentiment reading not up 5% but down 7%, a surprising turnaround, with all three product categories declining similar amounts.

While the ECIA did not give a reason for the large misstep, we surmise it was again the tariff situation and the prospects of extended negotiations to reduce recent high tariff rates. The most optimistic group were manufacturers’ representatives, with distributors seeing some improvement based on component demand conditions, while manufacturers, who are most directly affected by import tariffs, were pessimistic. Similarly at the top of the optimism scale were participants from the Industrial & Avionics segment (includes military & space) and the bottom of the list were those from the consumer electronics industry, the only end market group with a sentiment index below 100, neither of which seem out of line with one might expect given the political and trade agenda.

But have no fear, as it can be seen in Figure 1 that overall optimism remains the watchword for September, with all product groups spiking upward, some reaching new highs for the year. Again, after a big miss last month, one would expect a bit more caution, but that does not seem to be the case, either because of a sense of strong demand from customers at the end of 3Q or just end-of-the-year optimism. Still, on a more general basis, optimism remains for 3Q and 4Q, although we expect that a second month of less than expected survey results might dampen that enthusiasm. Another 4 weeks and we will know…

RSS Feed

RSS Feed