Best of a Bad Situation

As the display and CE market deteriorated this year Chinastar, while having ordered a considerable amount of fab equipment form a variety of vendors, seems to have pushed out the delivery dates, some of which were to have been delivered this month. Two South Korean equipment suppliers indicated that they had seen such delays for contracts with near-term delivery dates, totaling $24.2m US, one of which seems to have been pushed into late 2023 (unconfirmed), and the potential micro-LED project seems to have been indefinitely postponed. While last year panel producers were competing with semiconductor manufacturers for equipment for the TFT portion of display production, causing unusually high demand and long delivery schedules, display tool vendors are now putting the breaks on those deliveries, causing serious problems at equipment vendors who have invested in materials and labor but cannot claim customer acceptance.

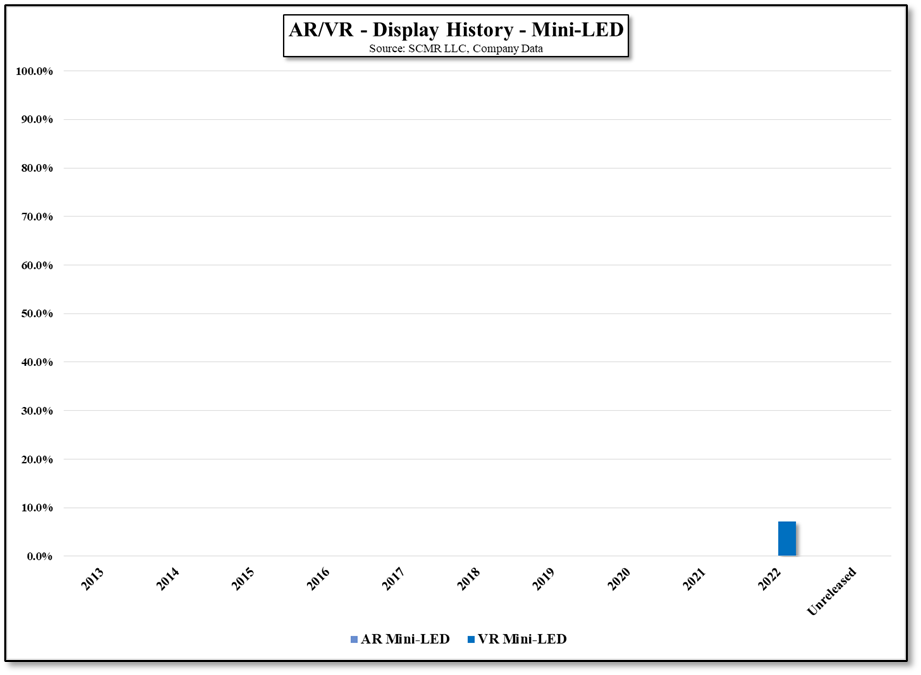

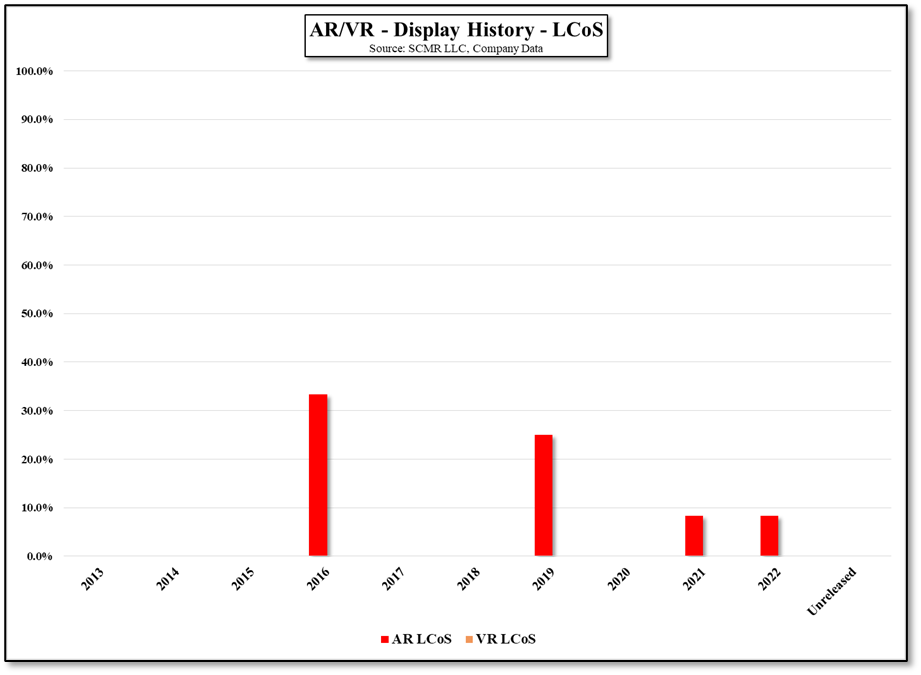

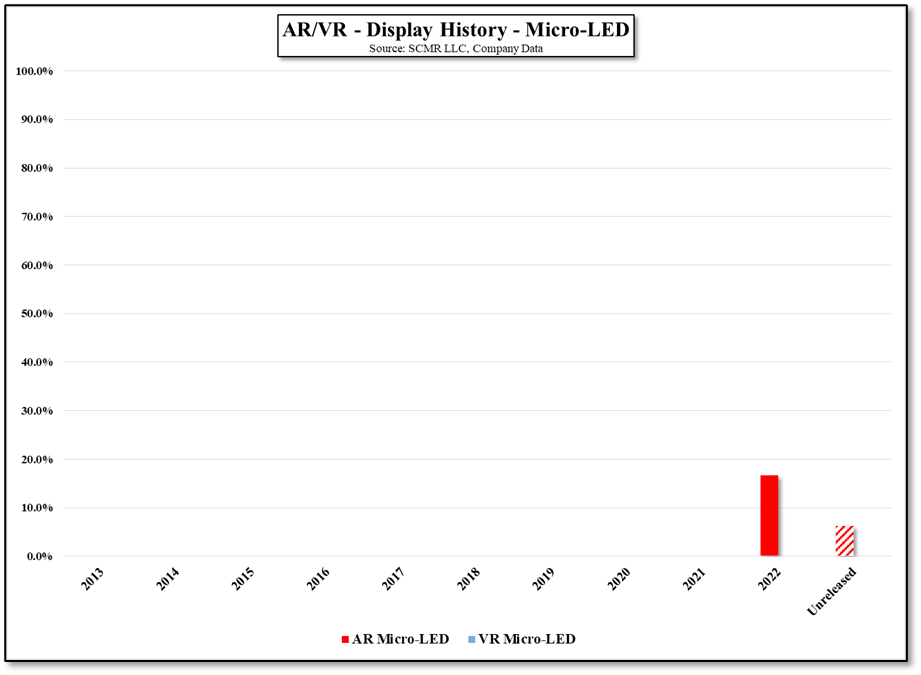

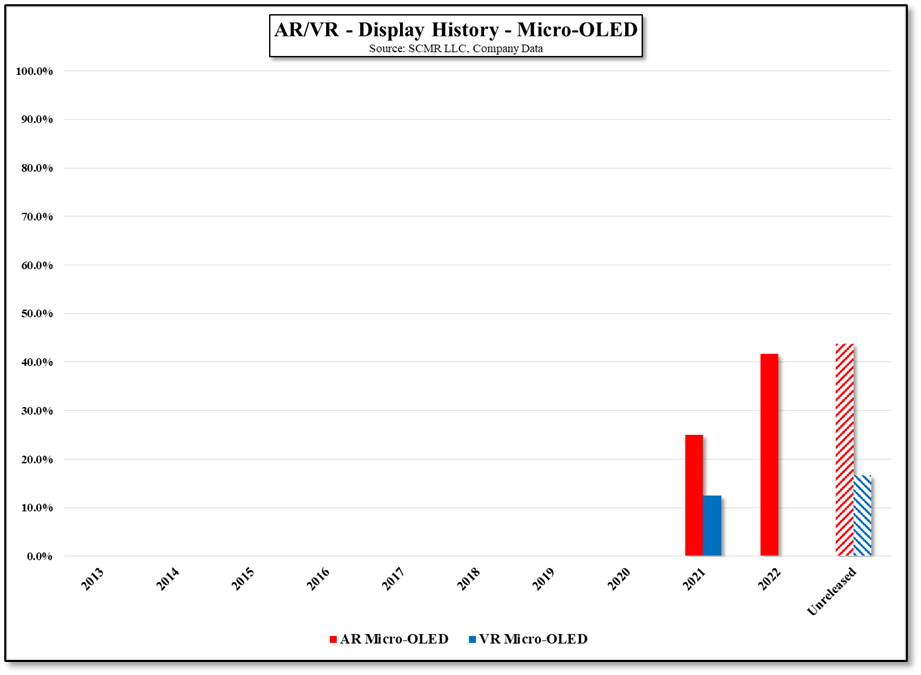

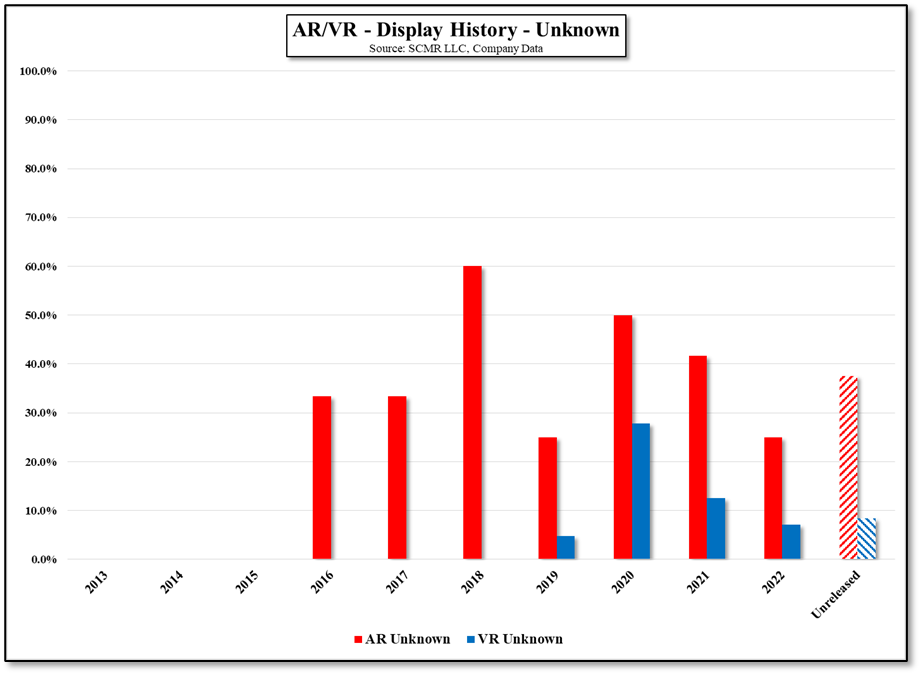

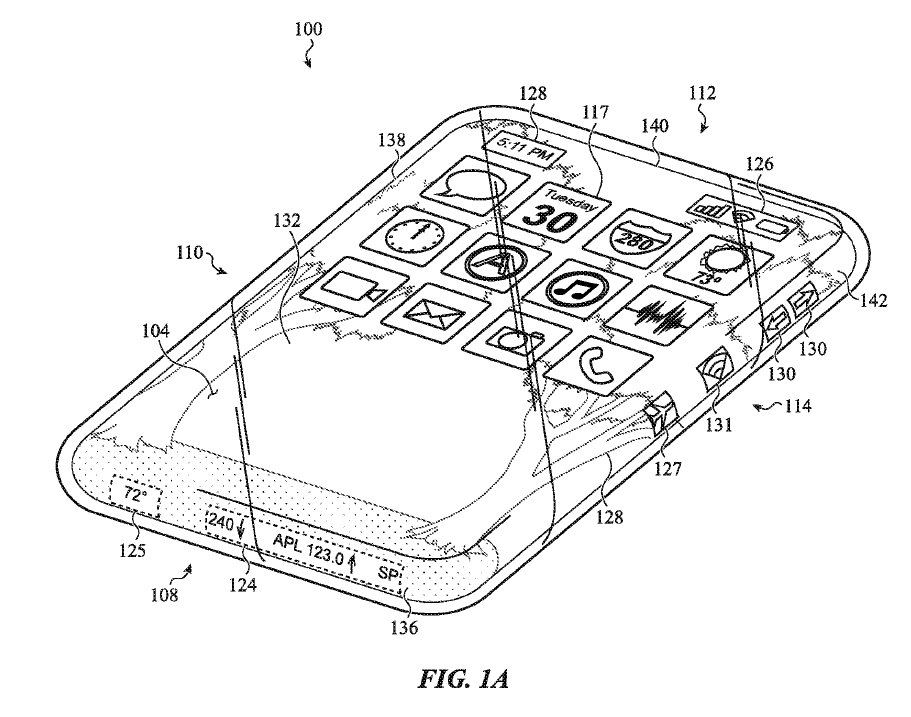

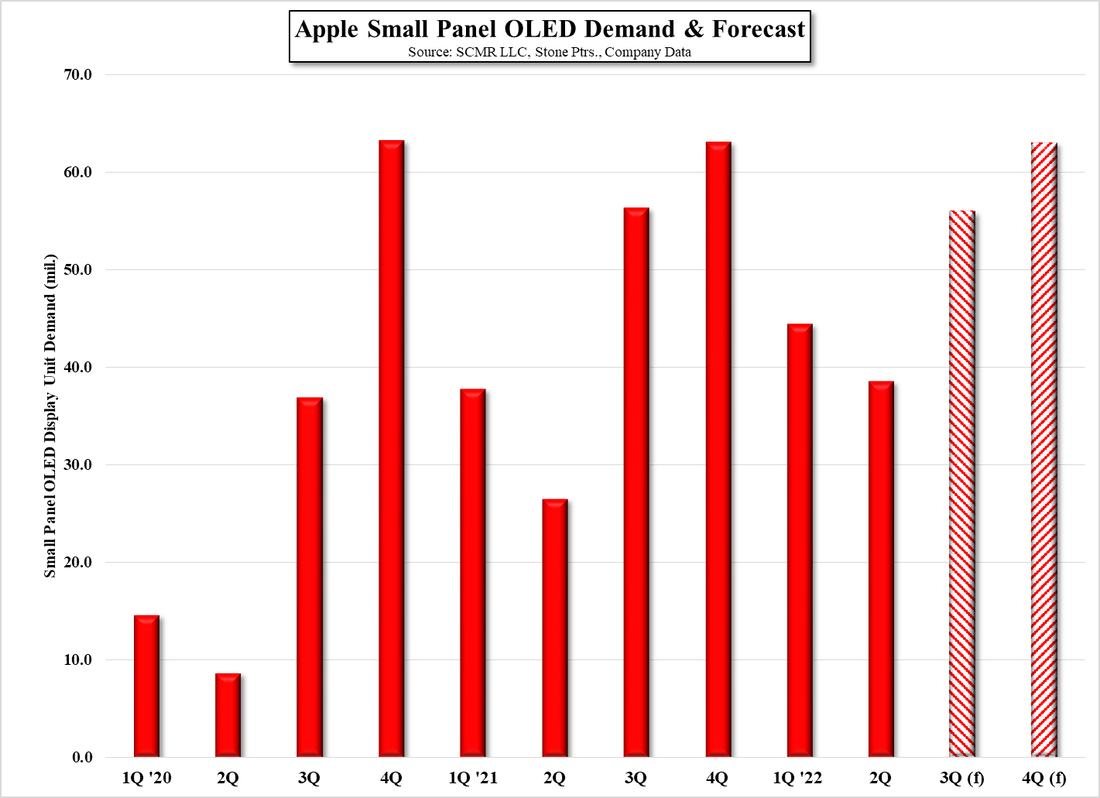

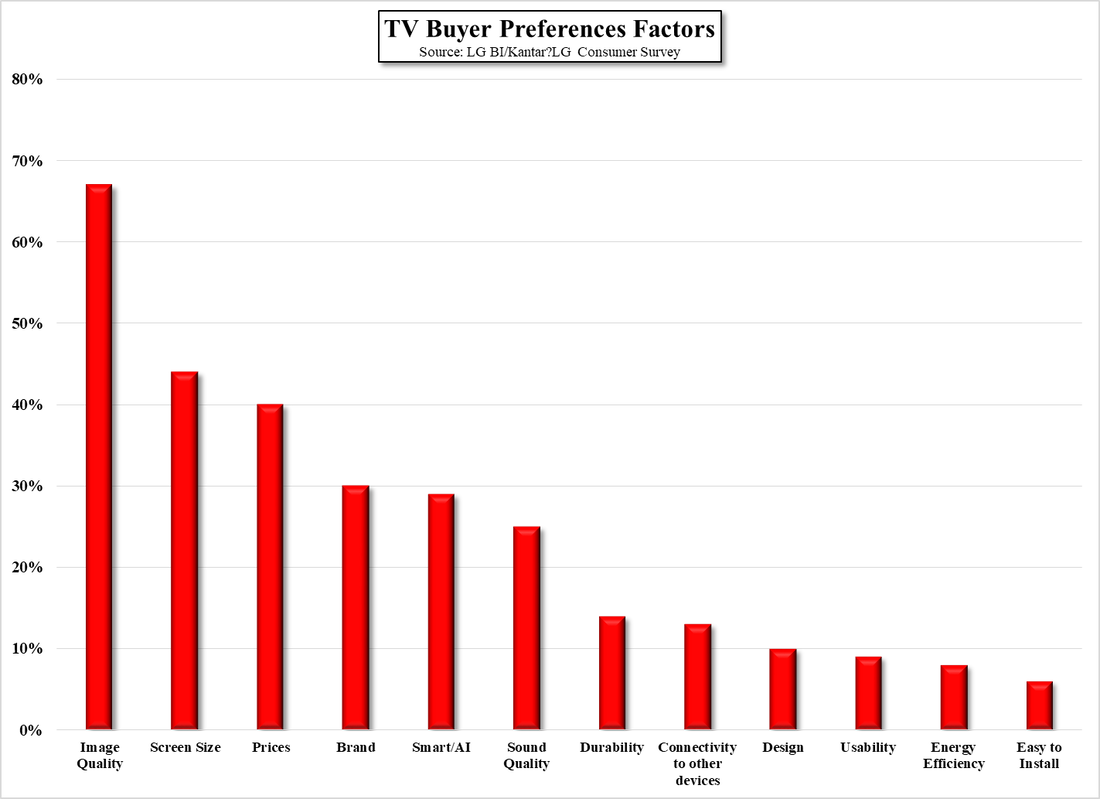

While these issues are devastating to LCD and OLED equipment manufacturers, the postponement or cancellation of potential capacity expansion projects is a positive for the industry, albeit a bit later than hoped. With little demand expansion expected for the display space over the next year, and the expansion of new product categories, such as AR/VR and Micro-LED still a few years out, there is little need for greenfield capacity, unless it is dedicated, such as has been the case with Apple (AAPL) and LG Display (LPL) in years gone by. But with a number of OLED panel producers chasing the same potential future Apple business, and the thought that the automotive display business cannot be supported by existing capacity, has pushed some to set capacity goals a bit unrealistically.

While most expansion plans are rarely fully cancelled (it does happen), most slow considerably or change from one display modality to another as display perspective change, and delays or postponements of new capacity currently serve to tighten the supply side of what is an unbalanced equation currently. Without a return to the incremental demand seen during the height of the COVID pandemic, or a more conducive spending environment, the display and even the entire CE space must focus on supply, at least for the 1st half of 2023, so we view any delays and postponements as a positive, despite the implications for tool vendors and similar suppliers, as it seems better to take a short-term hit than to live through an extended downturn that could impact the entire industry. It’s the best of a bad situation.

RSS Feed

RSS Feed