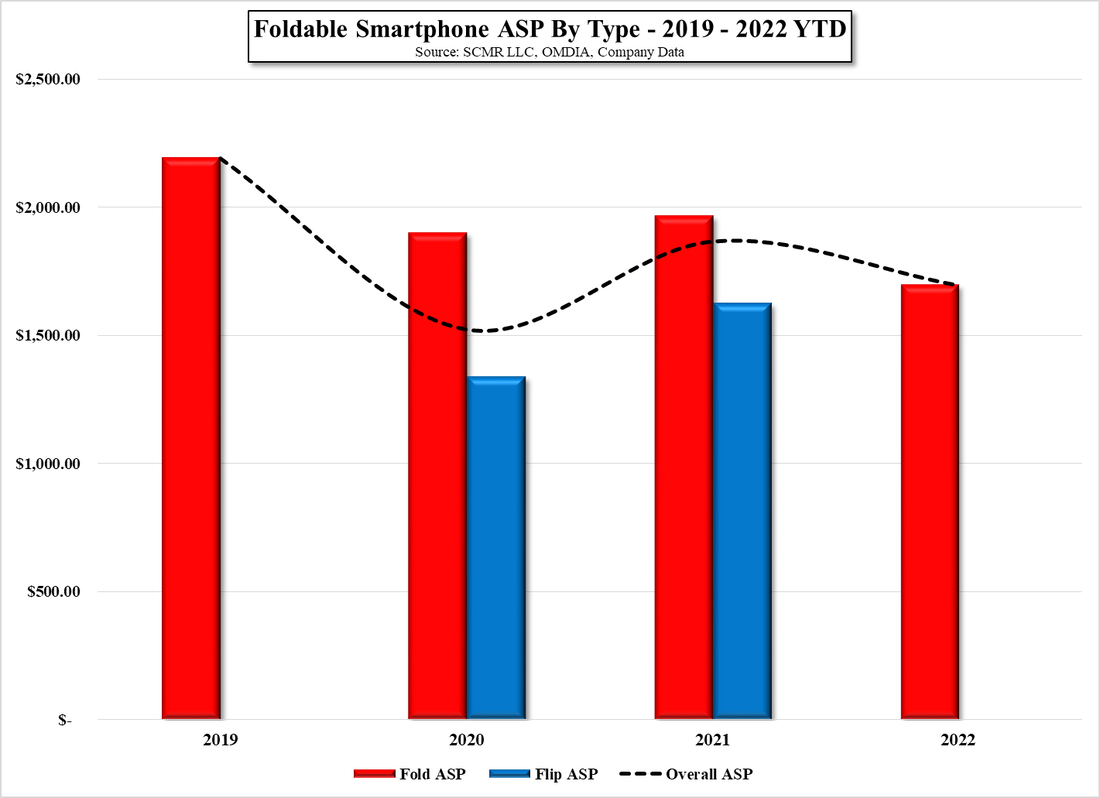

Tentative Foldable Pricing

Most recently we received pricing data from Korea that indicated that Samsung had reached a tentative price agreement for the new models with a mobile carrier (domestic) that would hold the price of the Galaxy Z Fold (256GB) at the same price as last year, while the Galaxy Z Flip (256GB) would increase by 3.6% and the 512GB models would remain at last year’s price. Given the strength of the dollar there is some play here relative to what will be US pricing, but it seems that Samsung has, at least for now, kept new model pricing relatively intact if the Korean pricing is any indication, which we would see as a positive for foldable sales given the recent rumors, and if you pre-order (Korea) they will throw in a pair of Galaxy Buds 2, a case and a 1 year phone care package.

While blogs have been chattering about the miniscule changes in bezel size, notch shape, or camera specs, most consumers at least start evaluating new smartphones based on price, so a small or no change should keep the foldable playing field relatively level heading into the 2nd half. It’s now up to Chinese rivals to see if they are able to cut prices for new foldable models in the current inflationary environment in order to gain share against Samsung, whose share of the foldable market was between 85% and 90% last year.

RSS Feed

RSS Feed