Micro-LED Leap of Faith

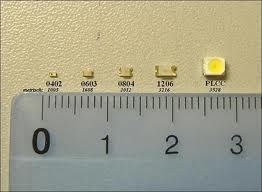

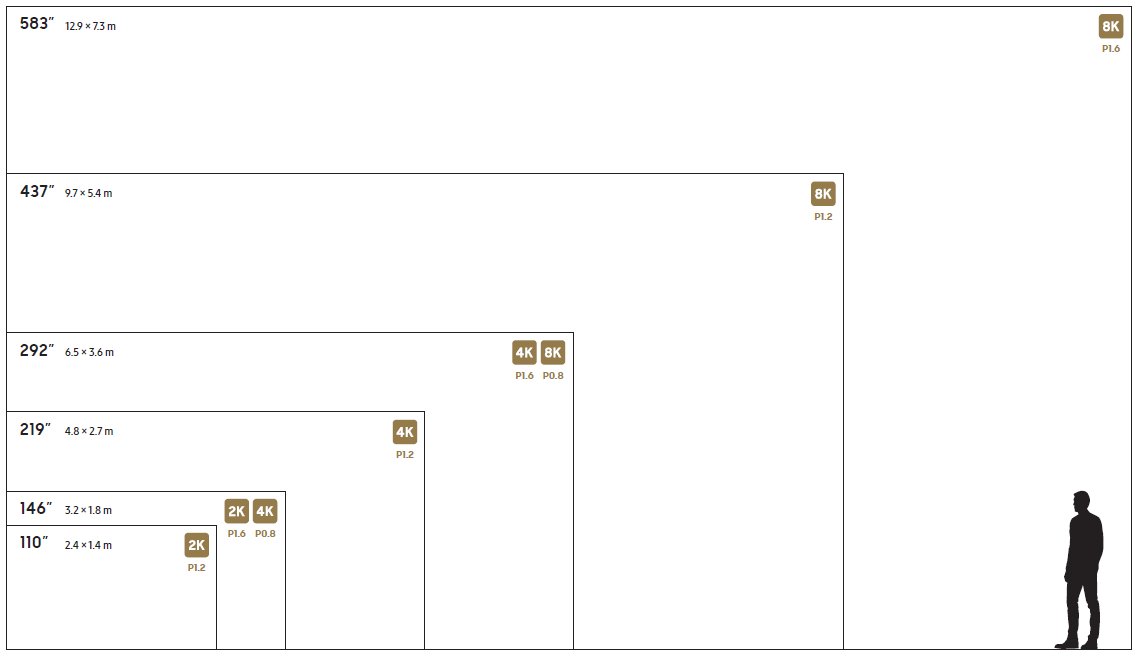

As noted, companies like Samsung (005930.KS), LG Electronics (066570.KS), Sony (SNE), and Chinese brand Konka (200016.CH), all have micro-LED ‘product’, along with a few smaller one-off producers, but in most cases that product is sold B2B, with a secondary focus on a ‘;residential’ type product. The cost for these products is staggering for a number of reasons, the least of which is the number of LEDs that are needed in such retail products, which ranges from 24.89m micro-LEDs for a 4K TV display to 99.53m for an 8K TV display. As these chips are usually smaller than 100um they are considerably harder to produce and manipulate than typical backlight LEDs and can be as small as red blood cells.

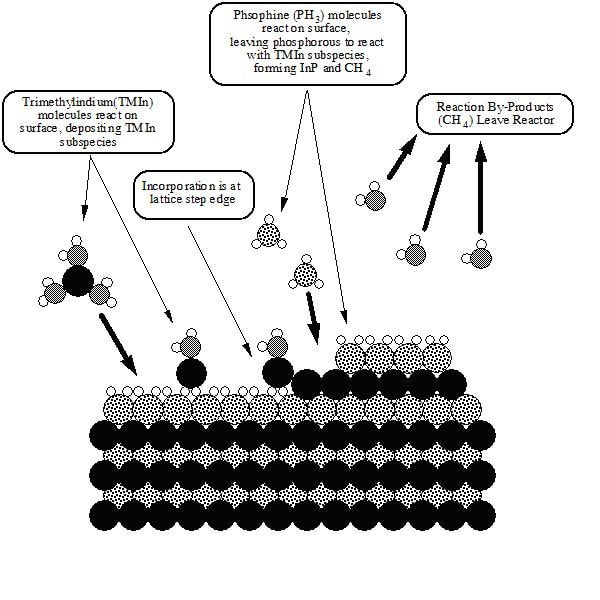

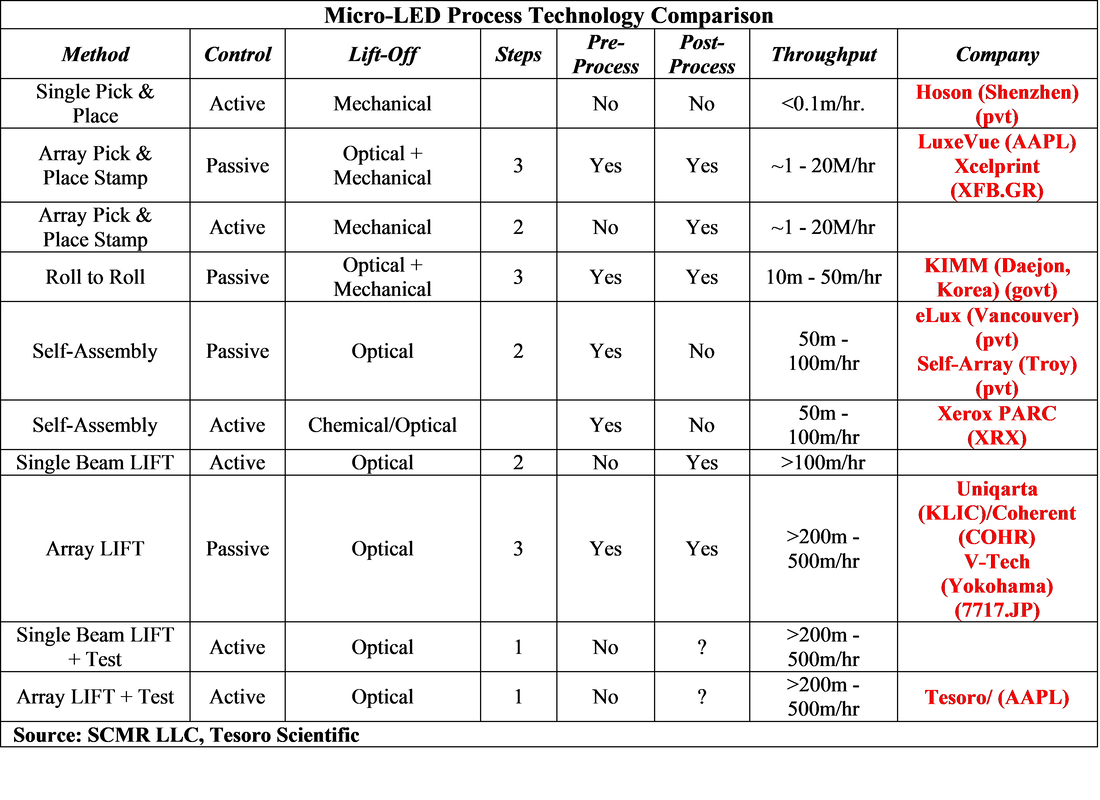

This presents a number of challenges to those looking to develop realistically priced micro-LED consumer products, especially as there is a necessity for zero defects in such products, quite a challenge when working with that many LEDs and at such small sizes. Transfer technology is certainly a question, as moving such vast numbers of such small devices falls outside of typical pick and place technology, with a number of transfer processes being researched to bring transfer times to cost effective levels. But even if that technology is developed and standardized, the inherent defect level, even in the best of micro-LED production and transfer systems would be unacceptable[1]. Each of those defective micro-LEDs would need to be removed and replaced, adding to the time to produce and the cost of such displays.

But that is some of the easy stuff that is already being worked on by both producers and equipment suppliers, while micro-LED producers are trying to find ways to manufacture such small LEDs with uniformity to wavelength (color) and luminance (brightness), which are essential to a retail product. Having variations in such metrics would make such displays unusable, but that belies a bigger question as to how those metrics are measured as typical equipment used for measuring same does not scale down to the micro-LED level. That means testing equipment would have to be designed to measure (non-destructively) every micro-LED on a display and some way to compensate for the inevitable variations that would occur must also be designed.

Even the mounting of such small LEDs becomes an issue as typical PCBs do not have the capability for such small connecting points and connection lines. Even with mini-LEDs, micro-LEDs larger cousins, PCBs are being replaced by processes that deposit the LEDs on a metalized glass substrate, again with new equipment and challenges for mass production. There are many other issues that face the production and commercialization of micro-LEDs and while we expect the display industry will eventually solve or find workarounds for most or all of such challenges, we find headlines that feature huge CAGRs for Micro-LEDs a bit self-serving. They probably do help to sell such expensive research reports but they do little to help lay investors to understand the complexities of creating a viable supply chain that can produce Micro-LED products profitably and add to the confusion that some have as to the longevity of existing display modalities.

[1] For a 4K device with a five 9’s yield, there would be 249 defective micro-LEDs on average. That would increase to 996 in an 8K display

RSS Feed

RSS Feed