India OS – Rupees Well Spent?

If those obstacles were not enough the Indian government is planning to develop an indigenous mobile operating system to compete with Android and iOS in order to further its ‘Digital India’ plans, although we find it hard to understand exactly how an in-country OS would encourage front-end spending, particularly as Apple is the sole supporter of iOS. Perhaps the country’s investigations into Google (GOOG) and Apple relating to application payment systems makes them believe that they could provide a less expensive or more robust system on their OS, but first they would have to convince developers to adopt the new OS and either port existing applications or write new ones exclusively for the new OS.

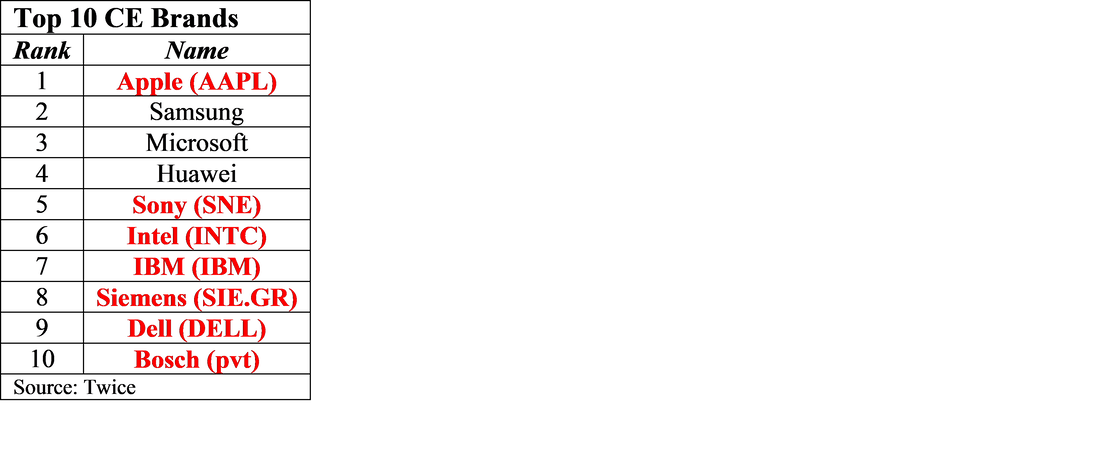

While we are usually skeptics when it comes to plans for rebuilding what has already been built, it could work, but the odds seem small when looking at the number of mobile operating systems developed by such as Microsoft (MSFT), Samsung, Blackberry (BB) all of which have been abandon, along with dozens of others that most would not recognize. Of course, a self-developed OS could be tailored to Indian social proclivities, making it more attractive to 1.4b Indian residents, but the country already has a few ‘local’ variants that operate under Android, none of which have achieved traction, and undertaking a full OS development is a much larger task.

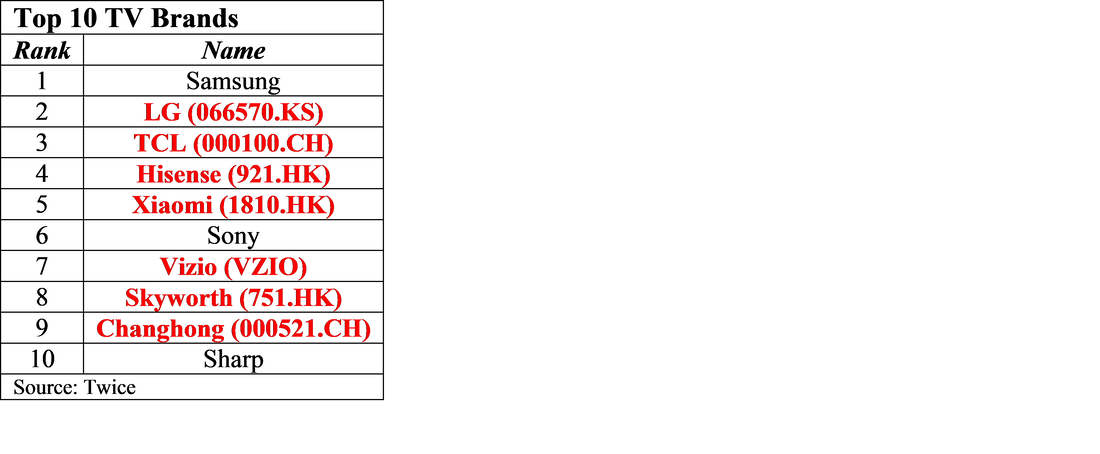

As seen in Figure 2, the dominant mobile OS is Android, along with iOS represent 99% of the Indian mobile OS market, so it might take some time to unseat such an entrenched user base if potential users could be convinced to switch, with much resting on whether other applications can be ported or new ones developed, all of which will depend on the new OS and how easily developers can make such changes, but in the long run it seems very counterintuitive to set out to spend R&D dollars building what has already been built. A company like Huawei (pvt), with vast resources and IP had little choice when it was forced out of the Android world, and the company, even if successful with its Harmony OS, would likely be limited to use in China, which means in the long-run it will probably wind up on the list of mobile operating systems that are no longer in use, like Symbian, Blackberry, Firefox, WebOS, Windows Mobile, and Windows Phone, all of which were developed by companies with considerable mobile experience and resources, some of whom had or have a very large installed base. Rupees well spent?

RSS Feed

RSS Feed