Black Friday/Cyber Monday

Final price points grew 13.9% on Cyber Monday and 19% for the season, and while Adobe says it indicates that some are buying bigger ticket items (certainly possible), e-commerce prices have been up for 17 consecutive months according to the data. As we expected, discounting was modest at -12% against last year’s -27%, with TVs at -13% vs. last year’s -18% and appliances at -8% vs. last year’s -20%. For computers, Adobe expects 12/1 would have been the day with the deepest discounts (-26%) but expects those discounts to decrease as shipping costs continue to increase. Out-of-stock messages were up 8% week/week on Cyber Monday, but were up 169% y/y and 258% from 2019 for the period between November 1 and November 29. 39.7% of Cyber Monday purchases were made on smartphones, up 8.4% y/y but the y/y increases have slowed as stay-at-home shoppers are more inclined to use desktop of laptop computers, while they use their phones for browsing (57% of web visits).

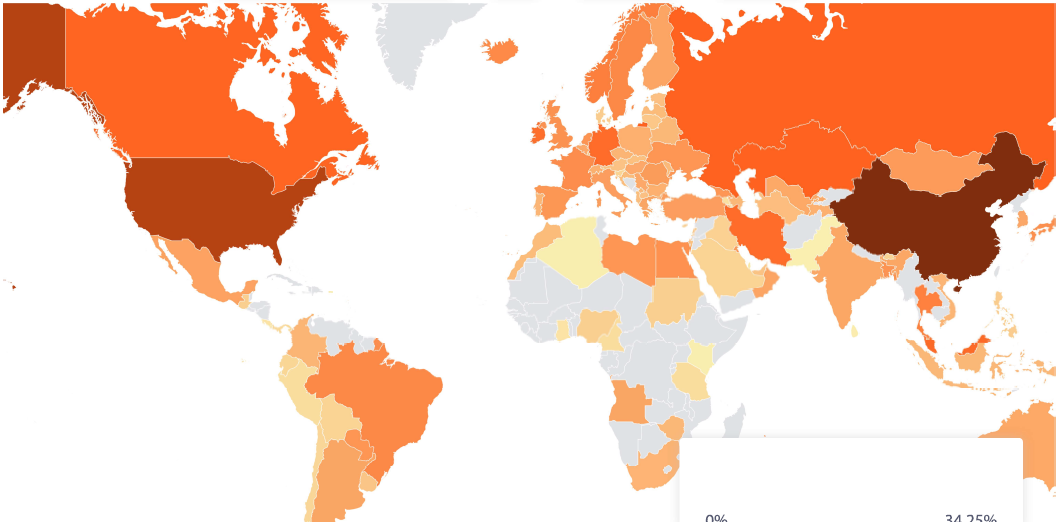

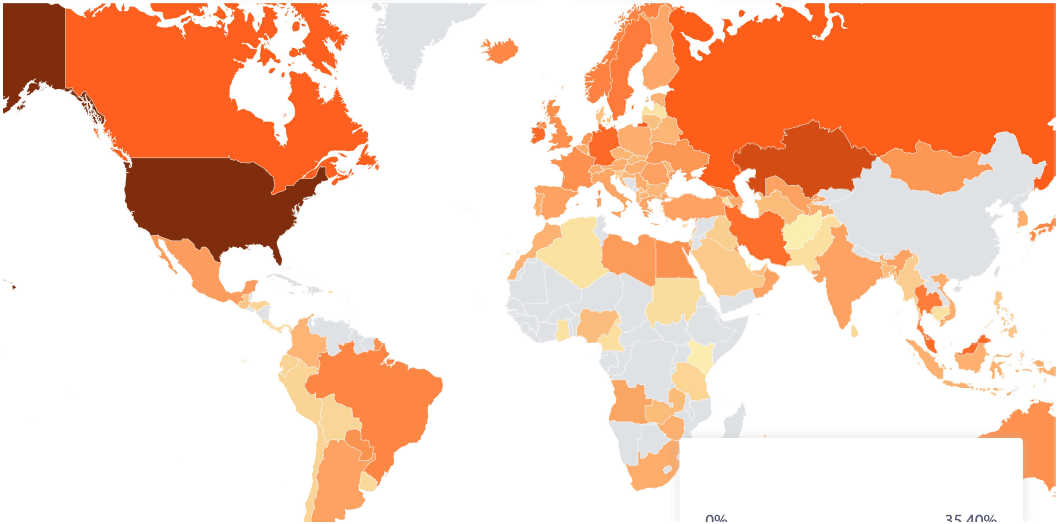

There will be more data about Black Friday and Cyber Monday over the next few weeks, some of which comes from retail trade associations that have a particular bias toward a more positive view of holiday sales, so we will continue to monitor new data and (hopefully) average the sets, but the two charts that stood out in the Adobe report seen below, tell much of the story.

RSS Feed

RSS Feed