Samsung Converting LCD to OLED

Korean construction company YMC (155650.KS) signed a contract for the dismantlement of LCD equipment with Samsung Construction & Trading (028260.KS), a major affiliate of the Samsung Group (pvt). The contract was signed on April 1 and was to extend through July 31, although it was recently shortened to July 20, but increased in size from $15.7m to $18.5m. On 5/11/21 we noted that Samsung was taking bids on the equipment in L7-2, and possibly L8-2-1, which certainly seems the case given the relatively short length of the removal contract.

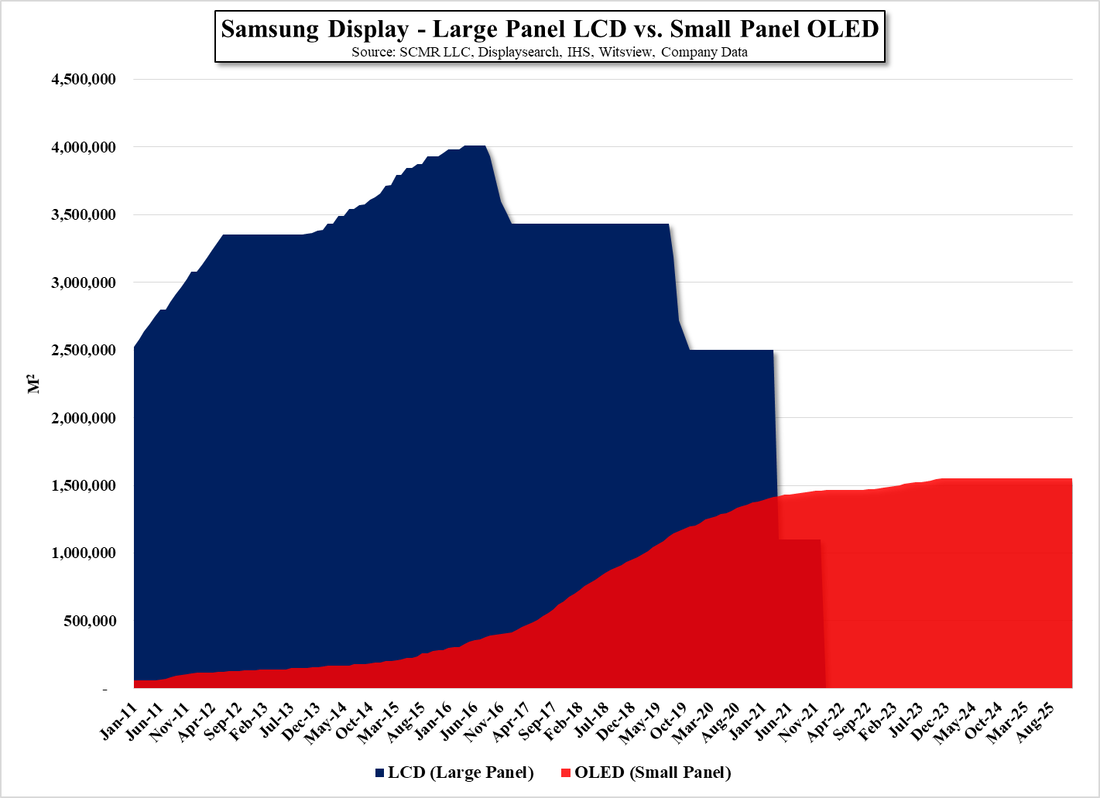

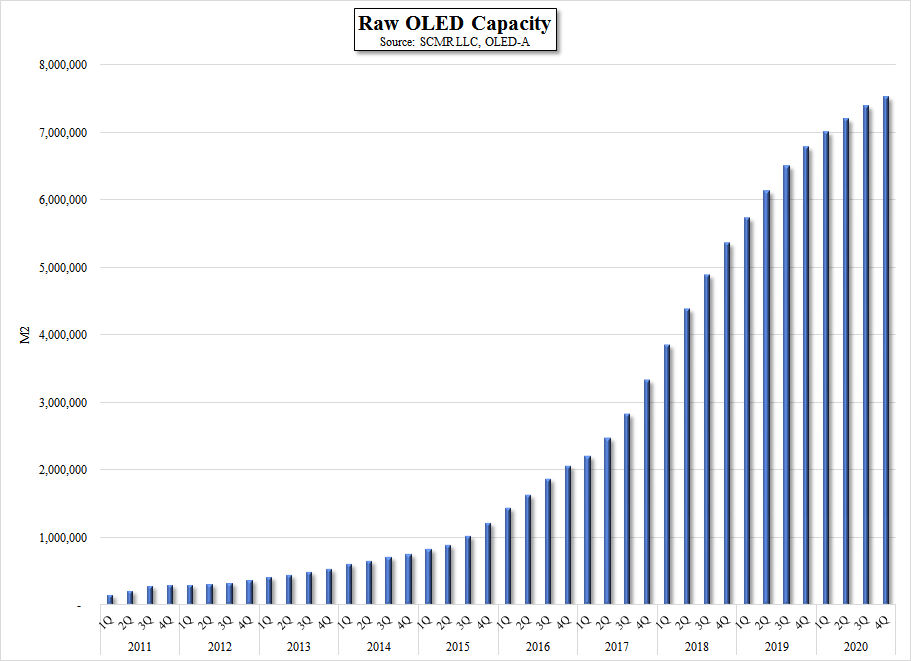

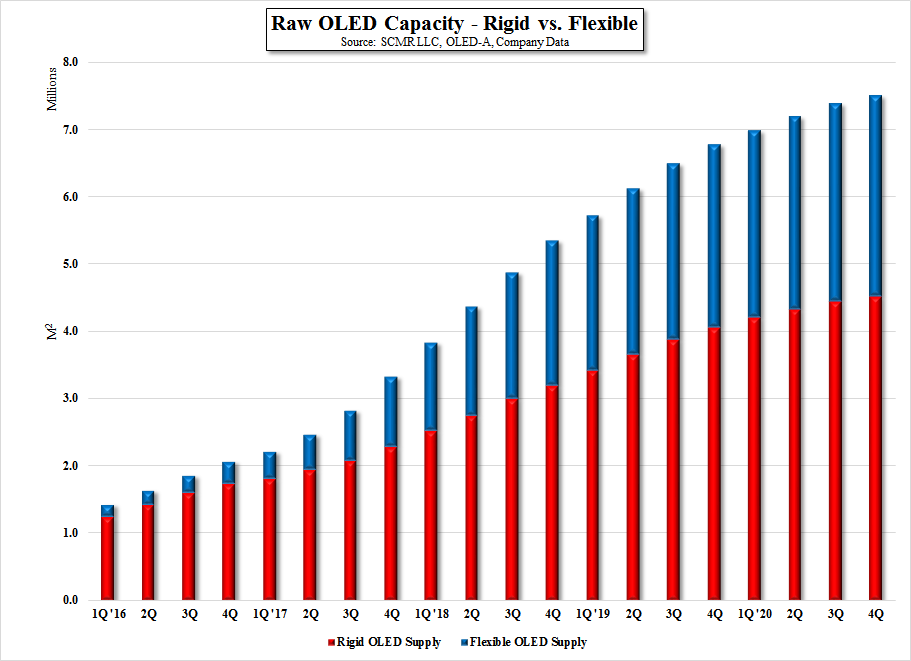

The L7-2 line has been in production since 2008 and had a peak stated capacity of 180,000 Gen 7 sheets/month will be converted into a Gen 6 OLED fab for what is expected to be ~$2.7b US, similar to the conversion cost of L7-1 line that was converted from LCD to OLED in 2017. The new fab is expected to add 30,000 sheets/month to SDC’s small panel OLED capacity when completed, although we believe there will be room for additional capacity that could be added at a later date if necessary, as SDC has ample backplane capacity at other fabs and will not need to add to that at A4E.

As we had planned for the L7-2 closing at year-end, this will reduce SDC’s large panel output by 1.08m 65” units this year, although we expect Samsung Electronics has been sourcing from alternative suppliers and will see little change to their supply chain. What this does do is move up the road map for SDC’s A4E fab which we had projected to begin operation in March 2023. We move that up to September of 2022 (Phase 1) and phase 2 completion from 9/23 to 3/23, giving Samsung Display additional capacity for flexible and foldable OLED production. We make the assumption that SDC will continue to produce large panel displays at the L8 fab until the end of this year

RSS Feed

RSS Feed