OLED Laptops

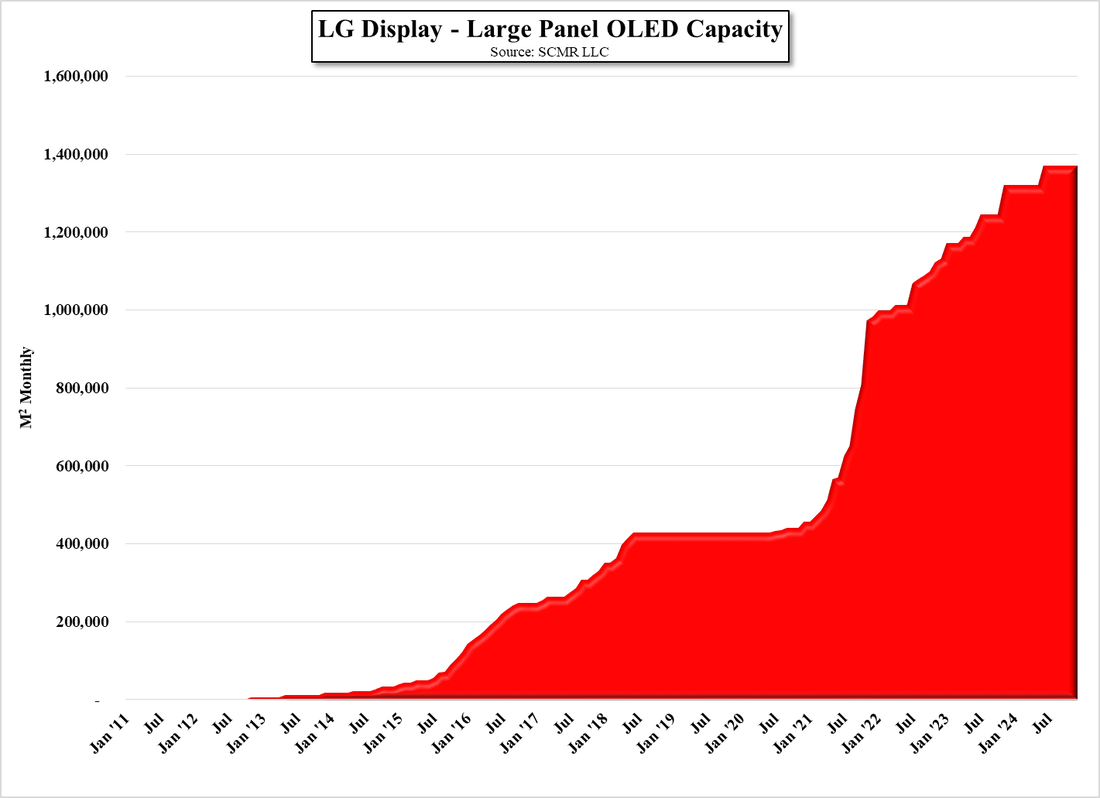

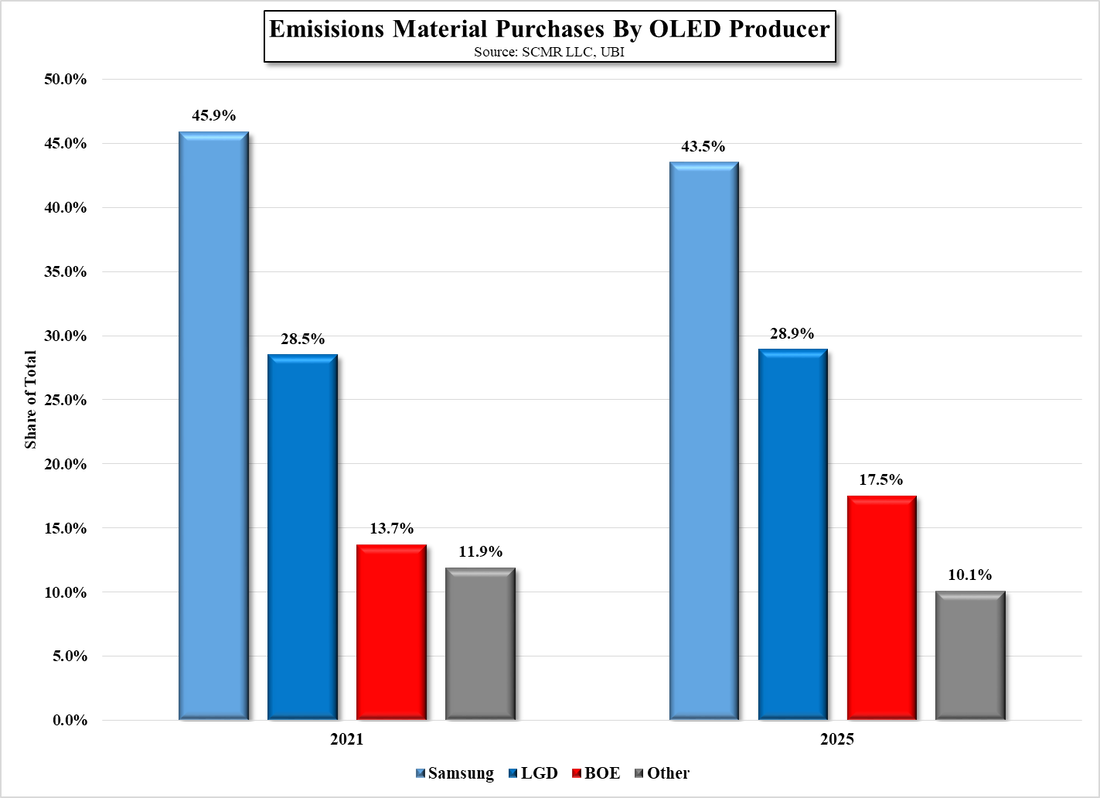

There are some limiting factors, particularly on the supply side as this relatively new segment must compete for capacity against high volume OLED smartphones, tablets, and smartwatches, all of which have well-established customers and justifiable pricing. Large scale small panel OLED producers, such as Samsung Display (pvt), LG Display (LPL) and BOE (200725.CH), are careful to keep supply closely matched to demand, and even with smaller Chinese OLED producers nipping at their heels, are careful not to over-expand and crater small panel OLED pricing. However, if even the least aggressive estimates are calling for rapid expansion in the OLED notebook space, small panel OLED display producers will have to begin to dedicate more RGB OLED production to what are considerably larger notebook panel sizes, and with Apple (AAPL) looking to join the OLED tablet/laptop fray next year after converting its entire smartphone line, it is a topic close to the hearts of all small panel OLED suppliers.

Right now, OLED laptops come in two sizes almost exclusively, ~13.3” and 15.6”. There are exceptions, but those two sizes are the current norm. If we compare those two sizes against a typical 6.8” 9:16 smartphone display, the 13.3” notebook will take up 3.9 times the substrate space of the smartphone, while the 15.6” notebook would take up 5.3 times the substrate space, simply meaning that in a static capacity model if the mix between laptop sizes were even, the 2.6m OLED laptop estimate for this year would reduce the number of smartphones produced by over 12m units, creating a 2.1% shortfall in small panel OLED smartphone capacity. While these numbers do match exactly to absolute fab production rates, they give a better understanding as to how the competition for small panel OLED capacity will fare as the OLED notebook market develops.

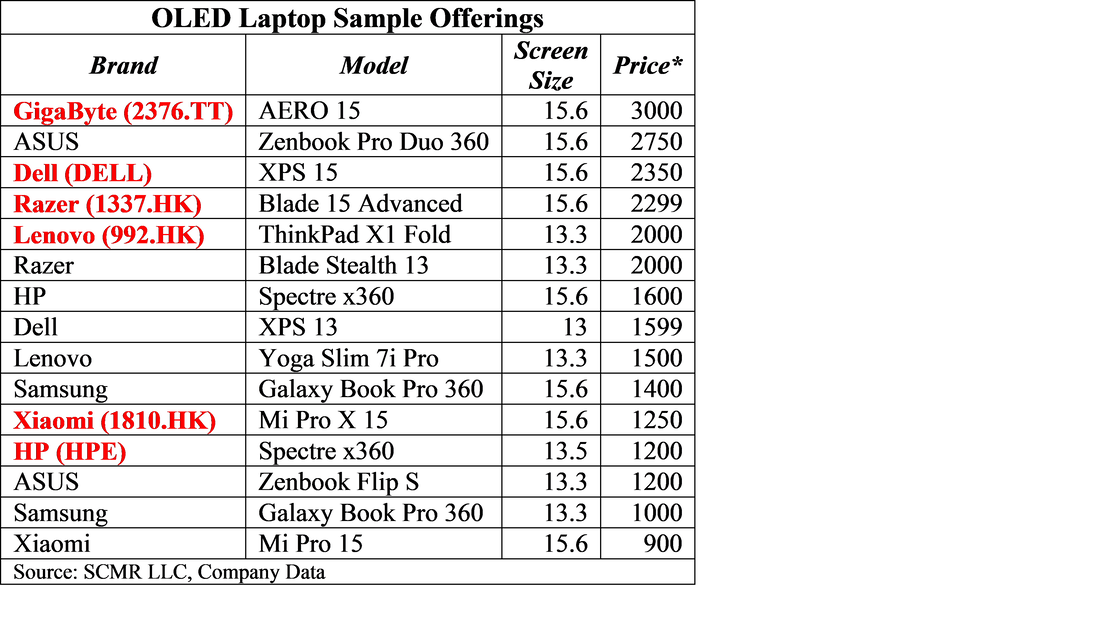

The number of OLED based notebooks varies on a daily basis as newer versions of models are added and older models are sold out, and not all models are available in the US, but the table below gives a sampling of some of those that have been announced and (hopefully) are available currently. We note also that while some models show up on Amazon (AMZN) or Best Buy (BBY) sites, they are out of stock due to component shortages, and pricing, which we show only for reference, varies considerably with processor, memory, and drive configuration. The pricing range is what we consider the most important.

RSS Feed

RSS Feed