Blue Again

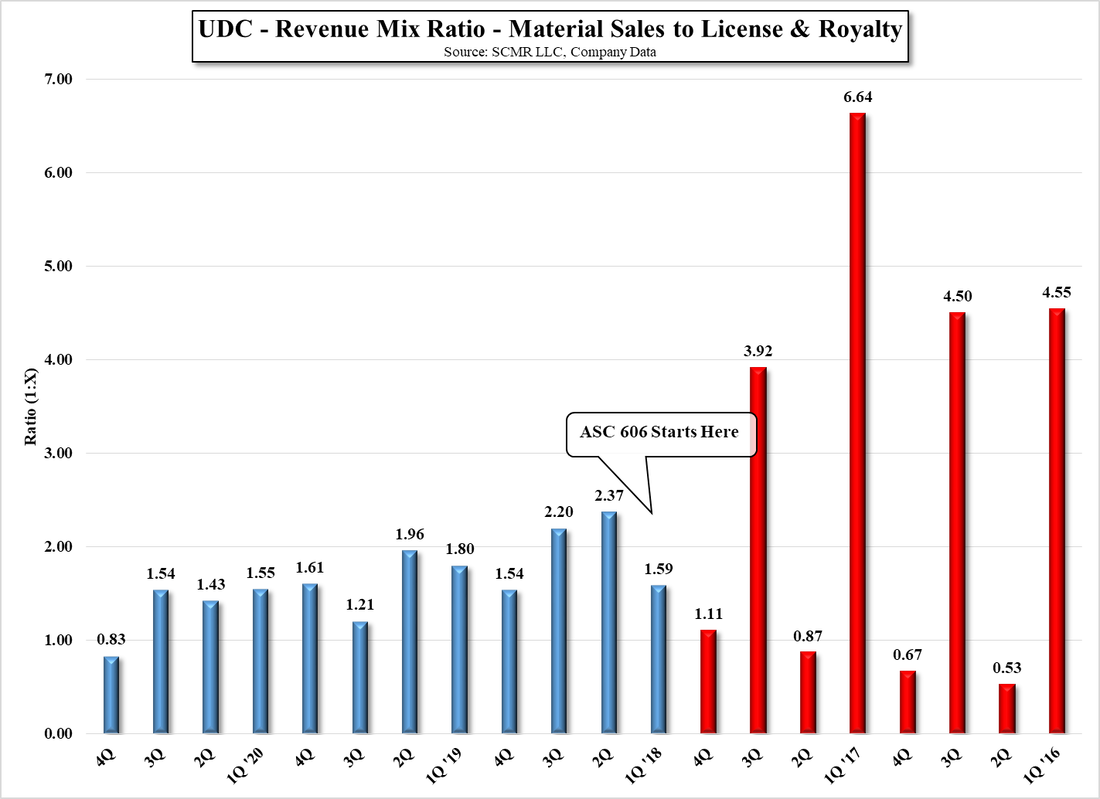

Additionally, the CEO of Samsung Display indicated that the company was working on the development of its own ‘blue’ , which was a bit unusual in that most emitter materials are developed by companies such as UDC, along with customers who tend to provide parameters and leave the actual chemistry to others who have background in material science. We are still not convinced that the statements made by SDC were quite what they seemed and more likely SDC is involved in the development of a blue emitter material with a partner, although perhaps a bit more deeply than in the past, but those statements opened the door to further questions about who will be the first to commercialize a blue emitter and how it might be licensed.

US patent law is about as complex and arcane as law can be and requires very specific knowledge that can require understanding both science and the nuances of language, but we expect Mr. Hack was referring to UDC’s ownership of Utility patents that cover the use of heavy metals in organic phosphorescent materials and their use in a light-emitting device. The metals involved are Iridium, Osmium, Platinum and others, so if someone were to find another way to produce a phosphorescent emitter that did not use heavy metal ligands, they might be able to bypass the material side of the IP, but if they were to use a phosphorescent material to produce a light-emitting device, they would have to license the IP as Mr. Hack suggested and while such a new material could be produced and sold by other than UDC, its use in any device would require licensing.

We are the first to admit we are not patent attorneys or organic material scientists, but after reading hundreds of patents relating to organic materials we have some knowledge of how the system works. For reference…

There are requirements that must be met to apply for patent protection, and here is where things get fuzzy. The first requirement is it has to be ‘patentable subject matter’, which seems obvious until you ask what is patentable subject matter, and that is somewhat open to legal interpretation. Some of the things that are not patentable are natural phenomena, abstract ideas, printed matter, and business methods, however the last item is no longer part of the ‘no’ list as new rulings have allowed certain business processes. Additional requirements are the patent has to be novel, it has to have utility, it has to be non-obvious, and it has to be subject to ‘enablement’, with each of those being subject to interpretation. In terms of just ‘utility’ or the ability to garner a ‘utility patent’ the subject has to be a process, a machine, a composition of matter, a manufacturing process, and an improvement over existing process or IP. If that doesn’t prove that IP is a subject that could lend itself to an almost infinite amount of conjecture, and if the US patent courts are any indication, it does.

That said, while the specific IP relating to Mr. Hack’s comments were not given, the fact that every commercial OLED manufacturer (or at least those producing full color OLED displays with phosphorescent materials, which is most of them) licenses UDC’s device and material patents, is a good indication that the vast UDC IP portfolio covers all aspects of using phosphorescent materials in a light-emitting device and that regardless of who is the first to commercialize a blue phosphorescent emitter, license negotiations will occur with UDC.

RSS Feed

RSS Feed