LG Display – 2Q Notes on LCD & OLED

In that same vein, inventory levels increased in 2Q by 11.6%, which is concerning considering the company is forecasting continued soft demand at both TV set manufacturers and retailers as a result of excessive inventory levels at those points in the supply chain. The rational, despite the company’s expected further reductions in utilization were based on new model introductions and the potential need for higher inventory levels heading into the holiday build period, although Figure 4 would indicate that such levels are out of line with historic norms, with the company indicating it expects to return to more normal inventory levels by the end of the year. We expect some of the inventory build in 3Q is related to the company’s display supply contracts with Apple (AAPL) for the upcoming iPhone, but no specifics were given.

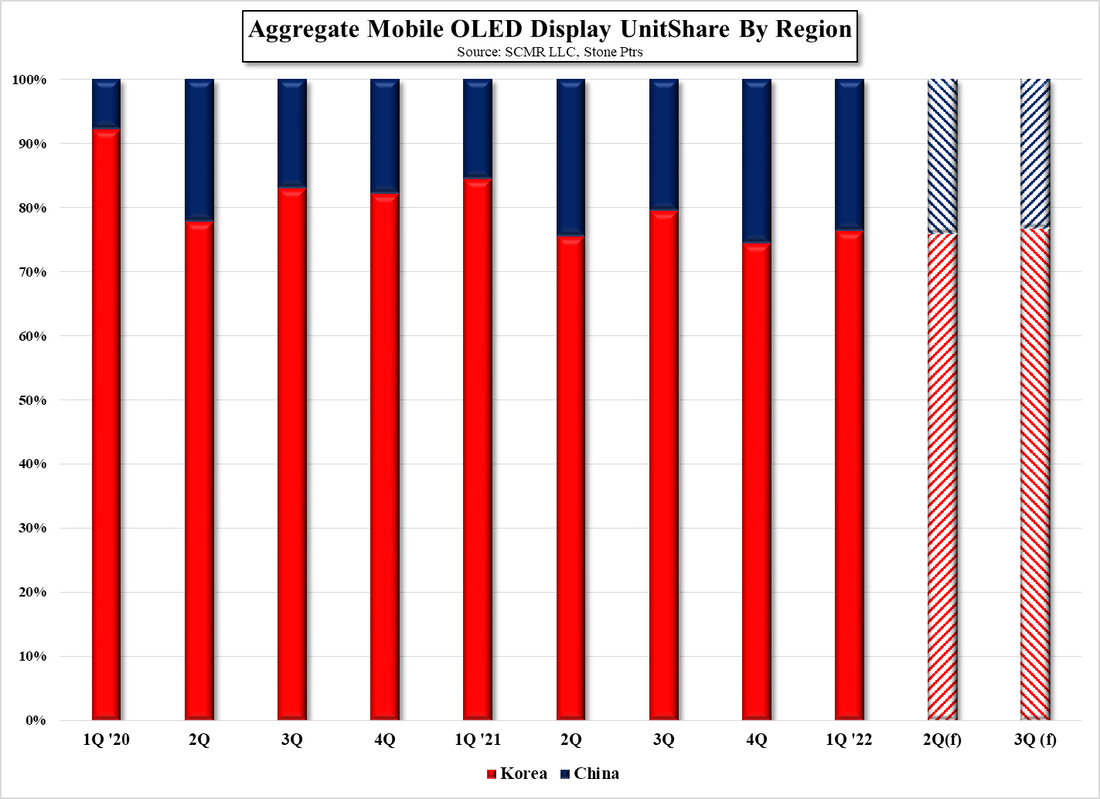

Guidance for 3Q was a bit more specific, with area shipments projected to be up between 4% and 6% q/q as IT and OLED shipments recover, and ASPs (Area basis) increase as the share of smartphones and wearables, which carry higher profitability on an area basis, increase in 3Q, but at the same time the company was forecasting IT panel prices to continue to decline and TV panel prices to also continue to decline, but at a more gradual rate as other LCD panel producers continue to lower utilization rates.

Much of this is the same corporate speak that appears when the macro environment begins to sour, and should be addressed more closely when things are going well, but LG Display, along with Samsung Display (pvt) has been in the camp of winding down its large panel LCD production for the last few years, although at a much slower pace than their rival. This brought up the question of the company’s plans for that process, with LGD being a bit more open about plans for their LCD large panel business. The company’s largest production line known as P7 is a Gen 7.5 a-Si LCD line that was built to produce 225,000 sheets/month. The company has already brought capacity down to 150,000 sheets and plans to reduce that by another 60,000 during 2H and another 30,000 in the 1st half of next year. The original plan was to end all production by the end of next year but the company has indicated that they will likely accelerate that process now that large panel prices have been declining.

While we understand that LGD has supply contracts with customers that it must fulfill, and certainly does not want to maintain fabs that run at a small portion of stated capacity, we have been surprised as to how long it took for the company to make the decision to accelerate the wind-down process, with the company stating that the fab had been running at high utilization rates, but as of last July (2021) large panel prices began to decline at a rapid pace and it seemed inevitable that the high utilization rates of 1H 2020 were not sustainable, at which point the push to cut large panel exposure should have been made. The company did indicate that its Gen 8 fab in Guangzhou China will not be closed but will be converted to the production of smaller IT panels, rather than larger TV panels, for which 10% - 15% has already been completed, with the remainder by the end of 2H next year, which will reduce the company’s exposure to large panel production by 40% (their number). Other company fabs in Korea, which are Gen 5 and Gen 6 are already oriented toward IT panel production. The company indicated that the profitability of its IT panel production declined in 2Q but saw less impact than the overall market due to its focus on high-end products.

While the question was asked about plans for expansion of the company’s OLED TV capacity, no answer was given other than the general reference to the development of new OLED oriented products (including automotive), but more importantly when asked about the on-again off-again negotiations with Samsung Electronics (005930.KS) concerning that company’s purchase of multiple millions of OLED TV panels, management indicated that such negotiations had taken place but there was nothing in progress, followed by the more general comment that the company would negotiate with any major customer ‘as long as they recognized value’, which would seem to indicate that price negotiations between the two did not end well.

The circumstances under which panel producers such as LG Display had to operate in 2Q were difficult, but not unexpected and we are always surprised at how slowly pane producers react to what seemed an inevitable conclusion as to panel prices, both TV and IT, and now that the inevitable has occurred panel producers seem a bit surprised at how rapidly things deteriorated, although few were complaining when pane prices were rising rapidly and hitting unprecedented heights. Now it seems everyone, LGD included, have gained ‘religion’ and are looking at a more conservative approach to production and longer-term plans. Of course it is easy to me an arm-chair quarterback but there is one consistency in the CE space and that is history repeats itself, so when things like prices get far out of line with historic norms, the elastic band always snaps back, so we wonder if those being ‘snapped’ really thought things were really at ‘a new normal’ or they just did not want to think about anything other than near-term prospects. Its actually not that hard to answer.

RSS Feed

RSS Feed