Jigsaw

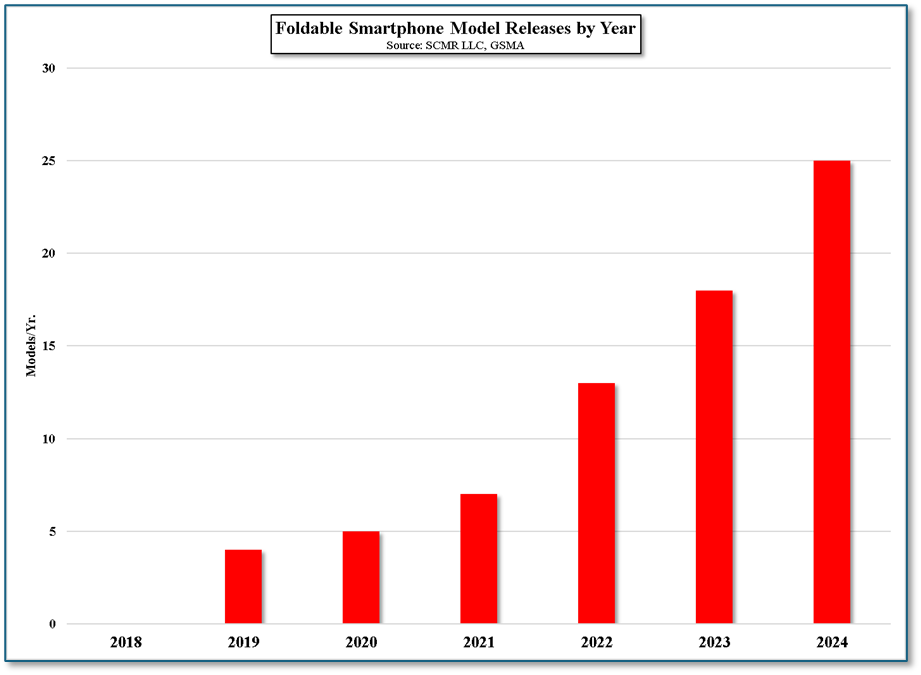

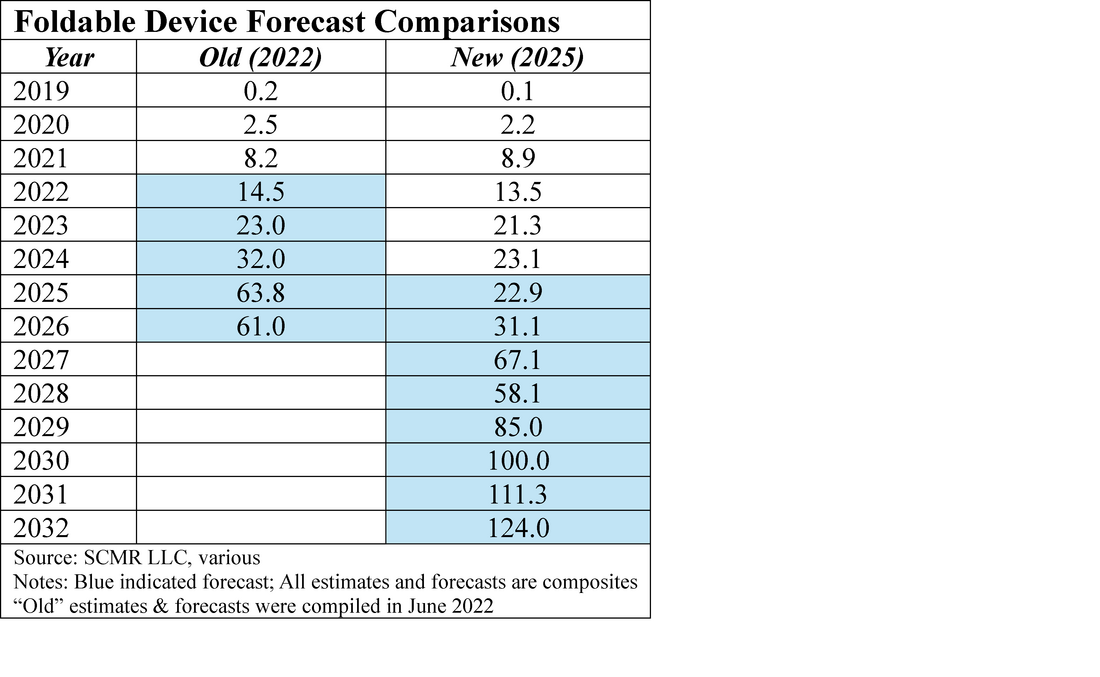

Foldables displays are a relatively new category with a commercial debut in late 2018 with the Royole (bankrupt) FlexPai, followed by Samsung’s (005930.KS) Galaxy Fold 10 months later. Since then there have been over 85 foldable smartphone models released, with over 13 brands releasing at least one foldable smartphone. Given the fact that only a few models were released in the early years of foldables, unit volume expectations were muted, especially given the crease issues that plagued early models. However by 2022 longer-term estimates began to surface, which we examine to give some clarity to the most recent foldable estimates and forecasts.

We have to assume much of that outperformance comes from Apple. This overage, if it were all Apple, would represent ~9.6% of Apple’s yearly iPhone shipments. In 2024, Samsung’s foldable smartphone shipments represented between 2% and 3% of its smartphone shipments and given that the product is not new for Samsung, this seems a reasonable base. Excluding non-smartphone foldables (laptops) we could see a 3% to 4% foldable share of Samsung’s smartphone volume this year, although our gut says closer to 2% to 3%, which makes the 9.5% assumption for Apple stand out as a bit excessive.

We do expect Apple’s foldable initial year to be a big one, as the Apple fan base has been clamoring for such a product for years. Samsung’s has a much broader customer base, inclusive of low and middle price tier customers that would not have an interest in a foldable. By comparison Apple’s base is less eclectic and more willing to pay a premium, but we see the incremental 22.5m (9.5%) Apple units as high, with a more reasonable range between 13m and 14m units, putting the 2027 estimate at 58.1m, strangely the same as the 2029 composite forecast. That said, much will depend on the timing of Apple’s release and the uptake of other foldable devices, however, while foldable displays overall have improved dramatically over the last few years, they are still quite expensive, which keeps the customer base narrow and limited to top tier consumers.

Unfortunately for foldable smartphones, much of the attention given to such devices in the early years has been usurped by AI, which has a number of use cases and potential applications. Foldables do give the user additional workable real estate, but don’t have a particular application under which they provide a proprietary solution, other than perhaps content creation, and thus far such an application has not appeared. This leads us to see foldables as a product still in development, not from a hardware perspective but from an application perspective. Perhaps gamers will adopt foldables at some point in the future and catapult the category to stardom, but for now we are still looking for an application to justify such a purchase.

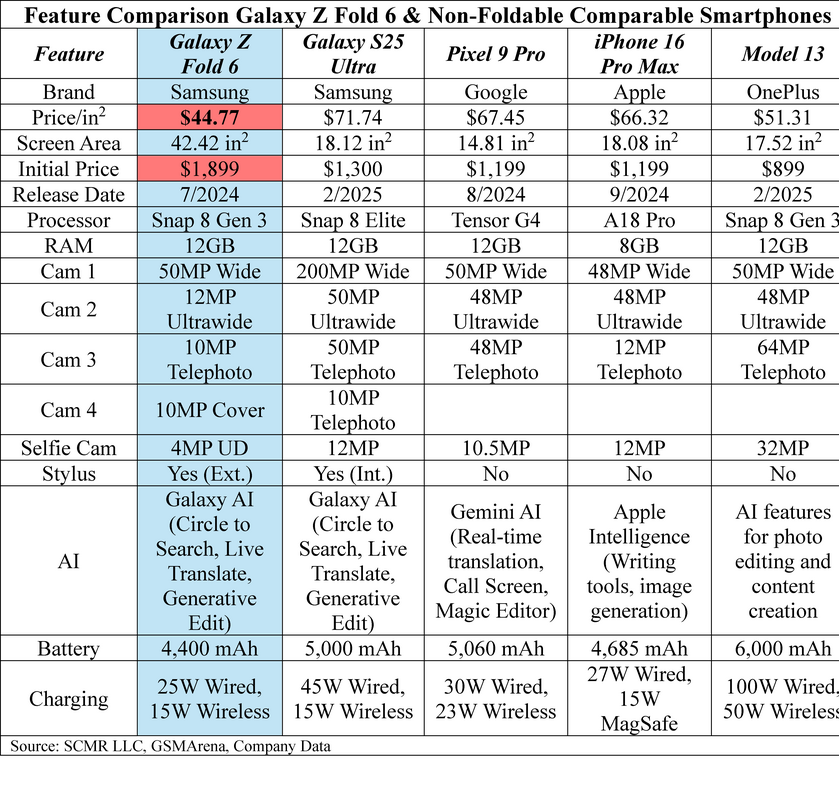

. For those that need the screen real estate, the comparison below, with 4 non-foldable upper tier smartphones with similar features, the Galaxy Z Fold (and similar foldables) are the least expensive in terms of price per square inch of incremental screen space, but the initial price is almost 47% higher than the Galaxy S25 Ultra, the next most expensive comparable non-foldable. This means foldables, at least at this juncture, need a justifiable use case to make fiscal sense. In the early days of foldables, we expect many purchases were made to show off the fact that the purchaser was a technology leader, but as foldables become more mainstream, the early adopters play out and the hard realities of the CE space and the smartphone market chime in, and with that we have to look at current forecasts with 5+ years duration with a bit of skepticism. They are certainly possible if all of the right assumptions actually take place at the prescribed time, but they rarely do in the CE space.

RSS Feed

RSS Feed