Tracking Taylor

One of Samsung’s OSAT partners, Amkor (AMKR), is building what will be the largest advanced packing facility in the US in Peoria, AZ but that facility will not be in mass production until late 2027 or early 2028, and we doubt Samsung could build out its own advanced packaging lines much earlier than that, so for the time being, even if Samsung does commit to an advanced packaging line, we expect the chip packaging for 2026 products will take place in Korea.

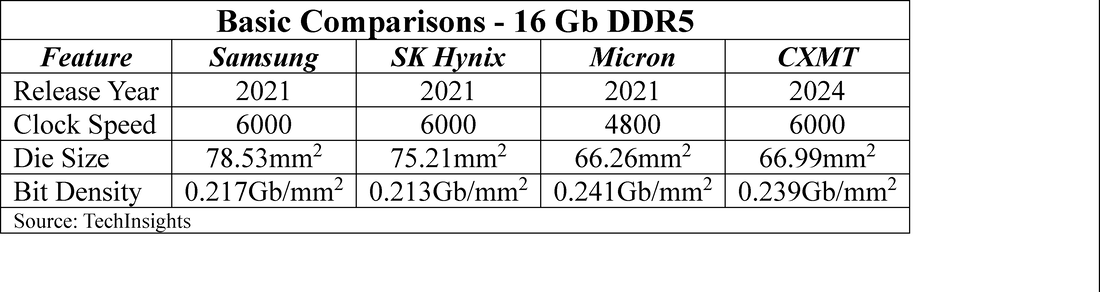

It has been thought that the Tesla deal gained traction as Samsung was able to bring its 2nm/3nm yields over 30%, which had been a stumbling block for Samsung in the past. Progress on that front continues with some estimating near 40% currently, although Samsung has not officially confirmed any yield information. Samsung seems to be more focused on improving 2nm yields than 3nm, likely to better compete with Taiwan Semi (TSM), whose N2 node (2nm) yields are thought to be in the range of 65%. TSM is expected to be in mass production at the N2 node in the 2nd half of this year as is Samsung.

Still up for grabs is the Qualcomm (QCOM) Snapdragon 8 Gen 5 chipset order expected next year. While Samsung was the producer of the Qualcomm Snapdragon 8 Gen 1 back in 2022, Samsung’s yield issues pushed Qualcomm to shift production to TSM for the Gen 2 (2023), the Gen 3 (2024), and the current Gen 4 (2025), although it looks that there is potential for Samsung to participate in the Gen 5 as a co-supplier with TSM. While shared, if such a deal were signed, it would be a major step toward Samsung’s foundry being able to directly compete with TSM and to regain much of the cache that it has lost over the last few years. Both foundries have produced 2nm prototypes for Qualcomm’s evaluation, who has been hinting that they are considering a dual-sourcing strategy for the Gen 5.

RSS Feed

RSS Feed