Foldable Foldables

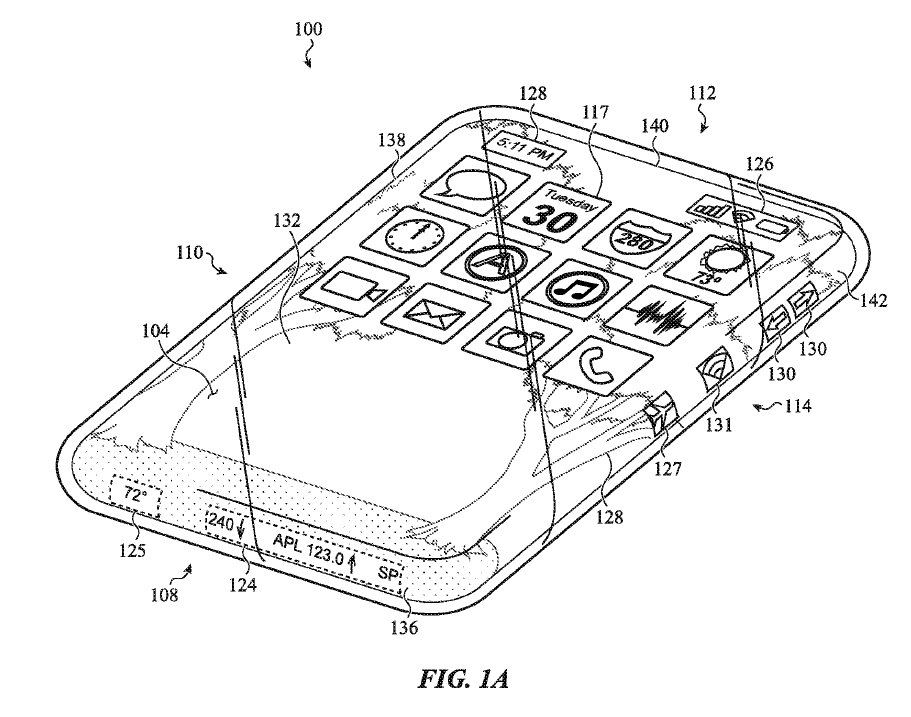

In typical use, most likely gaming, the screen is open to its full (3X) extent, which is ideal for game play or movie viewing but does not leave room for game or video controls, however embedded in the device are two projectors placed on either side of the open display, that project a keyboard or control space on the desk or table in front of the device. Since there are two projections of the same keyboard image, the placement of a finger or similar object on the virtual keyboard will cause sensors to detect that the projected image has been interrupted and will plot the location of that interruption. By calculating where on the virtual keyboard the projected image has been interrupted, the corresponding key or control movement can be determined and the system recognizes the users input.

As we have stated previously, the filing of a patent does not indicate that a company will actually produce a similar device, but it is known that Samsung has been working on a rollable smartphone that would expand to twice its normal size, so the idea of a tri-fold is just a logical expansion of that concept. More likely a 2023 product, if it ever makes it off of the drawing board, but waiting too long will give Vivo, and Oppo sub-brand OnePlus more time to refine their patent related prototypes. As the foldable leader, Samsung must push the envelope as quickly as possible without shooting itself in the foot with a device that is less than functional or has physical flaws. You’ve got to be in it to win it.

RSS Feed

RSS Feed