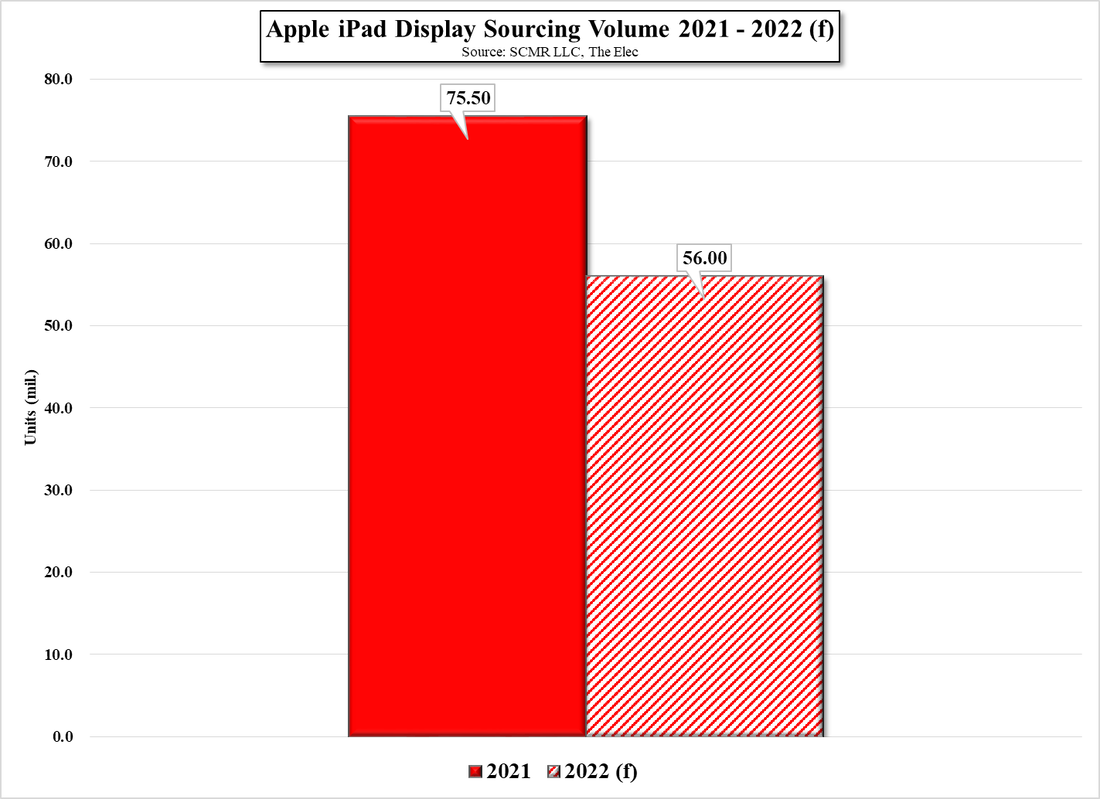

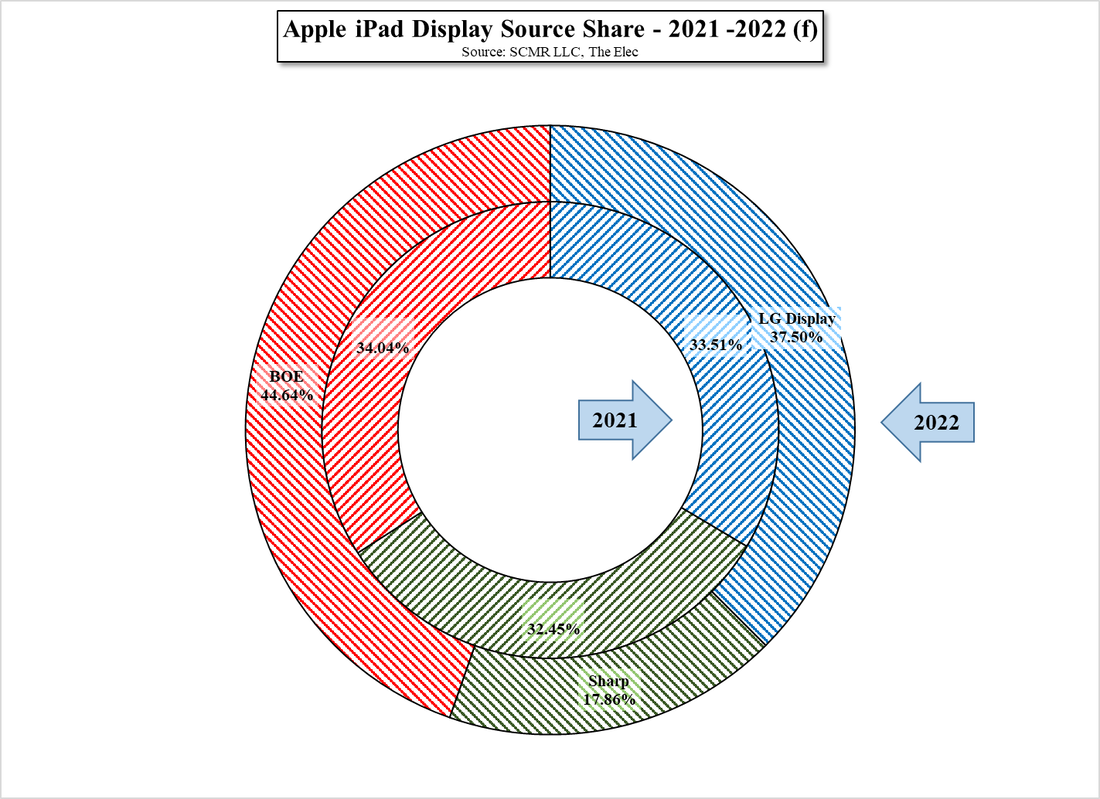

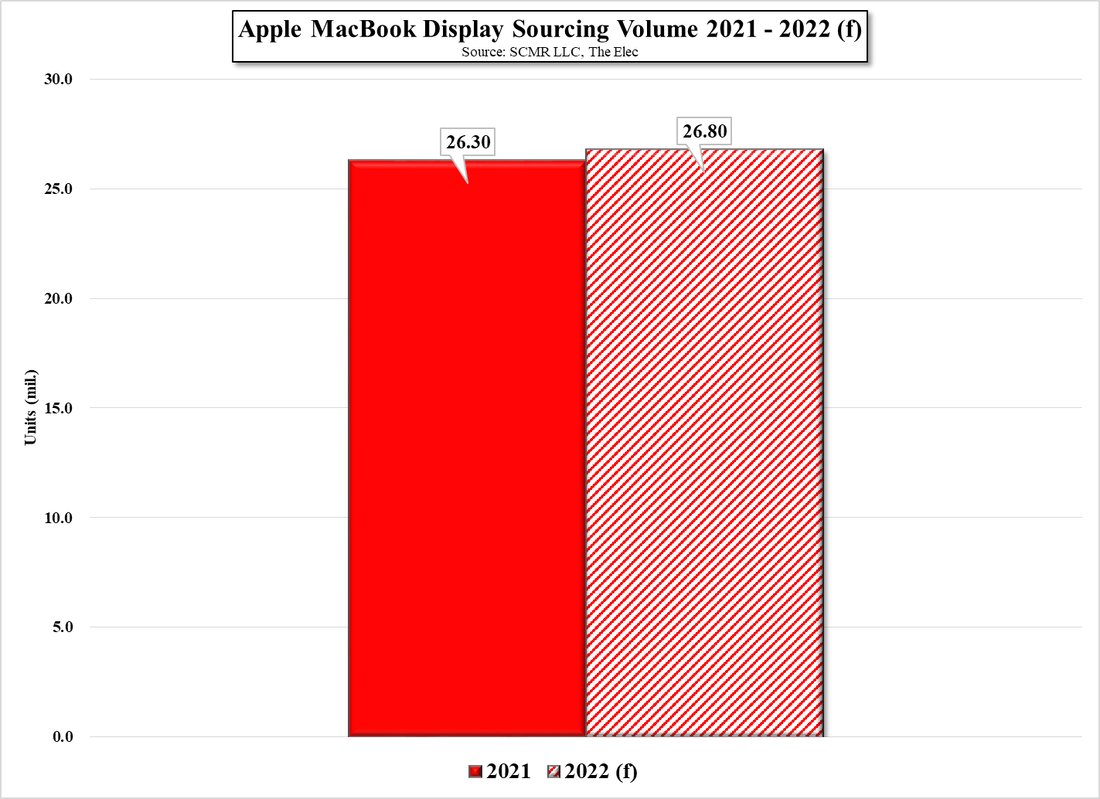

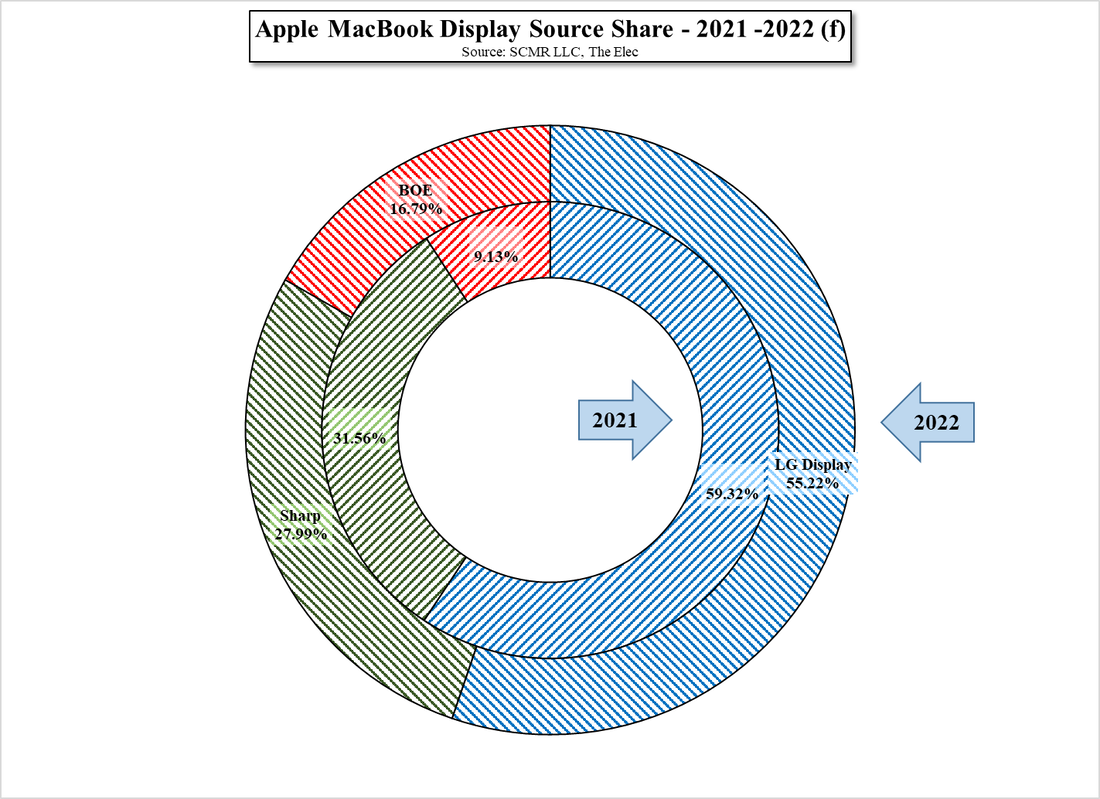

Much has been made in the Chinese trade press as to how BOE is now challenging South Korean dominance in Apple’s display supply chain, with considerable and mostly well-deserved nationalistic pride, but while the press champions BOE’s success with the iPhone, they miss the fact that BOE was the primary supplier of LCD displays to Apple’s iPad line in 2021 and is expected to remain so this year, despite reductions in Apple’s display procurement for the product., which is expected to decline by 25.8%. In fact, if estimates for LCD iPad display procurement are correct, BOE will see only a small drop in y/y units shipped (-2.7%), while LG Display will see a 17.0% reduction in units and Sharp (6753.JP) will see a 59.2% y/y unit reduction this year. MacBook shipments are expected to see a 1.9% increase this year, and while BOE will not have the dominant share, it will be the only supplier to see an increase in units (+87.5%), with both LG Display (-5.1%) and Sharp (-9.6%) seeing decreases, which points to the fact that BOE, while still facing some challenges in the OLED space, is seeing considerable success with Apple in the LCD display space.

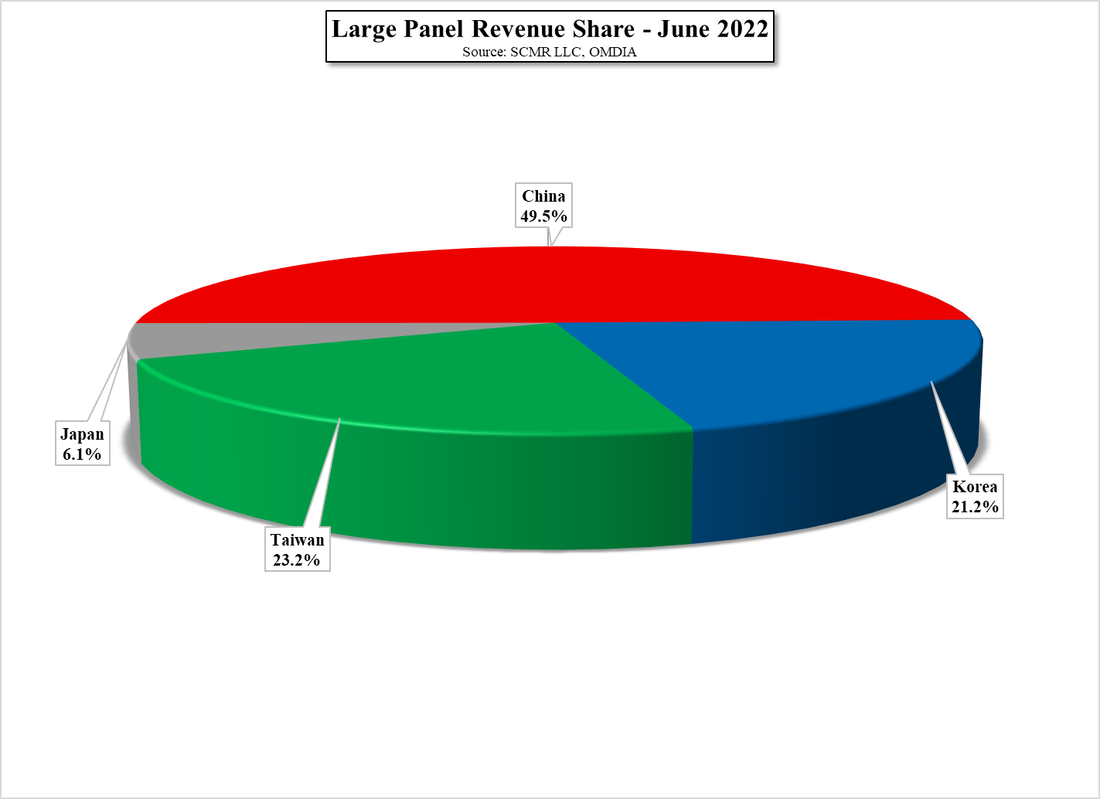

While OLED displays, particularly flexible OLED displays tend to be the focus for number crunching and press releases, there is still a vast LCD display world that gets little recognition unless it has ‘quantum dot’ or ‘mini-LED’ attached, but that world is still a very large one with ~891.2m large panel LCD units shipped last year, generating over $85b in revenue and one that Chinese display producers dominate. While the Chinese press glorifies any statistics that show Chinese supremacy in the display space, credit is due to BOE, Chinastar (pvt) and other Chinese LCD display producers, who hold the top share in the large pane LCD space. One can question whether that will be as valuable a position 5 years from now, but currently they certainly have accomplished their goal of becoming the leading source of large panel LCD displays.

RSS Feed

RSS Feed