Resurrection

Sony (SNE) has announced a new technology that is thought to be a potential game changer for the display industry. There is a problem with that thought however as not only did Hisense (600060.CH) announce a TV with similar technology in January, but Sony itself introduced a analogous product over 20 years ago. The idea is similar to the concept behind Mini-LED TVs, which have been keeping LCD technology competitive in their race against OLED technology.

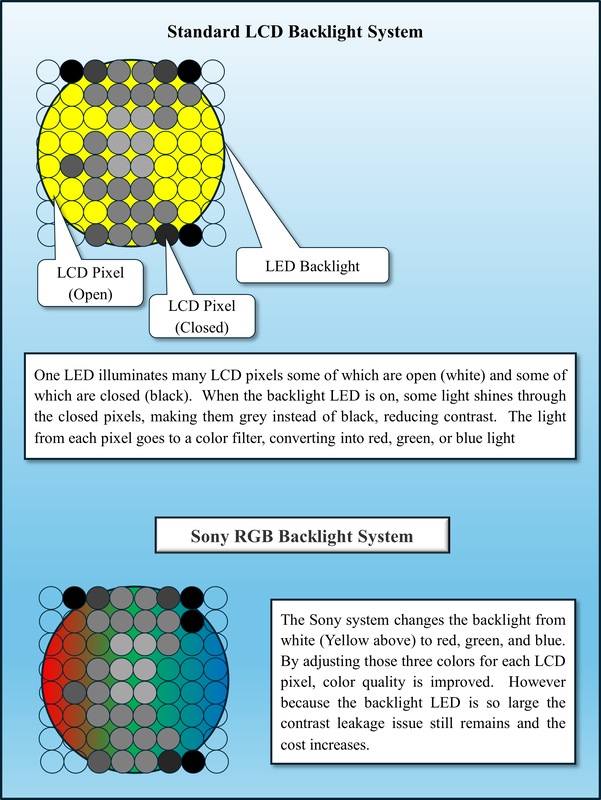

Liquid crystal, the technology behind LCD TVs, acts as a gate, allowing or blocking light from an LED backlight from reaching a color (RGB) phosphor or quantum dot converter. The brightness of the LED backlight is quite important, but because the number of pixels in a 4K TV is ~8.3 million, each LED in the backlights must illuminate a number of pixels. If some of those pixels are ‘off’ and some are ‘on’ the LED light behind the ‘off’ pixels can bleed through the liquid crystal and cause the black points (the ‘off pixels’) to be gray.

Over the years, as LED technology was refined and improved, TV set designers used smaller LEDs that helped to reduce that ‘bloom’ common to older LCD sets. Now, Mini-LED TV sets can have thousands of zones (a zone is just a small group of LEDs that act as one) which helps to reduce the gray issue, but unless there is an LED in the backlight for every pixel, those issues will still exist (it’s been tried). OLED displays are different in that they are self-emissive, meaning they directly emit light, without a backlight, so when they are off, they are black. There is some light ‘bleed between adjacent pixels in OLED displays but the contrast ratio (the difference between the blackest black and the whitest white), is almost infinite in OLED displays which sets them apart.

But what about color? In an LCD display, the LED backlight is typically white and when it passes through the liquid crystal it hits a red, green, or blue dot of phosphor and becomes one of three parts of an LCD RGB pixel. The quality of the color in an LCD display is governed by the quality of the LED backlight and the phosphors, while in an OLED display, the quality is based on the purity and efficiency of the emissive materials themselves. If one were to strip off the ‘image’ part of an LCD display, the LED backlight would look like constantly moving areas of light and dark that follow the brightness of the images, while an OLED display has no backlight.

Sony has taken things one step further. Instead of squeezing more white LEDs into the backlight (adding zones) they are using three (Red, green, and blue) LEDs and a lens instead of a white LED. This allows the backlight to control brightness (on/off) as it did in the previous example but also allows the 3 LED combination to create backlight color that reduce the burden on the phosphor by giving the backlight itself color

Conceptually this is a great idea, and one that Sony used in 2004 (46” set for $10,000) when it released the Qualia 005, the first RGB backlite TV set. However, at the time, LEDs were large and had color uniformity issues. They produced a lot of heat, and the complexity of the electronics needed to disassemble an image into ‘color zones’ and adjust 3 (RGB) LEDs instead of one white one, along with the brightness of each, was a stretch for 2004 electronics. However Sony did not forget the idea and just announced a high-density RGB LED backlight system that it expects to commercialize sometime this year.

So does this mean that Sony is going to let the idea of an RGB LED backlight TV wither on the vine again? No, we expect it will make it way toward the top of the Sony premium TV line and will compete with other OLED and potentially Micro-LED offerings. Hisense, the first to introduce a Mini-LED TV, will also showcase the technology, but at least for a while it will take its place in the ultra-high quality color world of video editing monitors and those with dollars to spend on the best of the best, while the rest of us palookas have to settle for Mini-LED, OLED, or QD/OLED sets. If we are wrong and Sony has found a way to produce RGB LED backlight systems for a reasonable price, we will be in line to try one, but with so many potential display technologies on the horizon, time is of the essence.

RSS Feed

RSS Feed