Fun With Data – Playing the Odds

The real work for component buyers comes before assemblers have any idea of what they will be producing as brands must also make sure either they or the supplier can access the number of components needed for each variant, and that those supplies meet brand unit volume goals. Taking the example of Samsung’s (005930.KS) Galaxy S line, which is the company’s most visible flagship smartphone product, the current (S21) series has three basic models, the S21, the S21+, and the S21 Ultra. All three have different displays, case sizes, cameras, batteries, and many, many differences in internal components, so not only must suppliers get an order specifying the total number of units overall, but it must be broken down into every potential variant. If those orders, based on both the brand’s estimated unit volumes and estimated component and labor costs are wrong, in either direction, the profitability of that line will suffer. At an estimated $415 BOM for the Galaxy S21, incorrect estimates leading to delivery issues or excess inventory add up quickly.

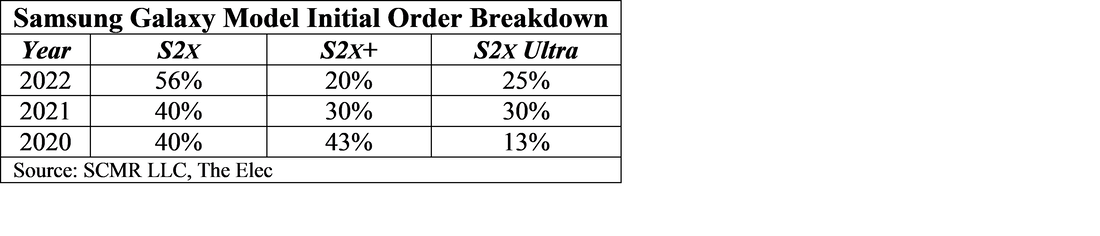

On a broad basis the table below shows what Samsung has, and is expected to order for the three Galaxy S2x variants in terms of percentage of total (Note – Where ranges are given we take the center point which means the totals do not always add up to 100%). The upcoming S22 will be the first time Samsung has ever allocated more than half of total production to a single model, which we take to indicate some concern for both the differences between the models and the price of the more expensive plus and ultra versions, and while Samsung had placed early orders for 30m units this year (S21), it is expected to be ordering only 20m initial units for the 2022 series. We do note that Samsung’s initial expectations for the Galaxy S21 series was 26m units, the company upped that to 30m around the January release date.

Last year Samsung was surprised at the initial popularity of the Galaxy S20 Ultra and found that they had not ordered enough of that model to fill orders leading to shipment delays and cancellations. It is easy to see that they expected a similar circumstance with the S21 series, more than doubling the previous year’s order, while some of that expected enthusiasm is reflected in the order breakdown for the S22 series, but the total number of S2x Ultra units declines from 9m this year to 5m next year, even with what we expect will be a flat or slightly lower BOM, which indicates Samsung’s lower risk profile for smartphones going into 2022.

RSS Feed

RSS Feed