Fun with Data – Smartphone ODMs

Samsung, while 3rd in last year’s ODM outsourcing ranking, saw the biggest y/y increase, up 269.1%, however while LG Electronics (066570.KS) saw a 56.6% increase in ODM unit volume they will likely see a very substantial reduction this year, as they have decided to close their smartphone division. Huawei (pvt) saw a reduction in ODM orders allotted in 2020, but that was likely a result of weak smartphone sales coming from the US trade sanctions levied against the company last year. Such a reduction will likely happen again in 2021, as the company’s smartphone sales, both in China and globally, have been further limited by the same sanctions.

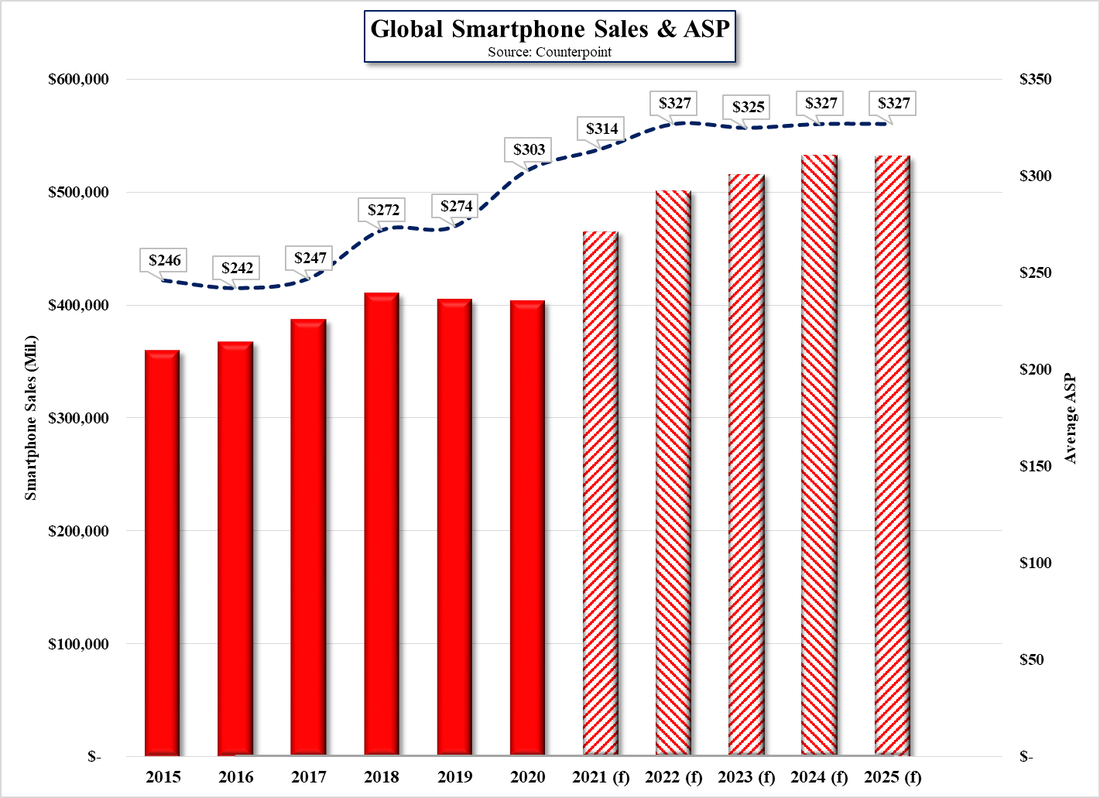

Estimates for the smartphone ODM market call for an increase from 480m units last year to 650m units in 2025, while sales value is expected to increase from $26.4b last year to 33.8b in 2025. Much of the growth is expected to come from said increased unit volume but predictions that the average price of a smartphone will continue to increase at least in the near-term, benefiting ODM sales, is also baked into forecasts for this year and next. Unfortunately component and raw material inflation is the root cause of the big boost in smartphone ASP last year (10.6%) and this year (3.6%), although we believe preduictions for another 4.1% average ASP gain in 2022 could prove optimistic. After that ASP’s for smartphones are expected to be essentially flat through 2025.

RSS Feed

RSS Feed