Fun With Data – The Semiconductor market

In particular the optoelectronics segment is of particular interest as it includes imaging devices, LEDs, OLEDs, and lasers, all of which play a significant part in CE devices, although that is not to say that other components are less necessary, as semiconductor sensors are the basis for the development of IoT and will see increasing applications in both mobile devices and static equipment. However optoelectronic semiconductors, which convert electrical energy to optical energy (LEDs, OLEDs) or optical energy to electrical energy (image sensors) are key to devices with displays, which many consumer oriented devices use as the basis for communication to and from users.

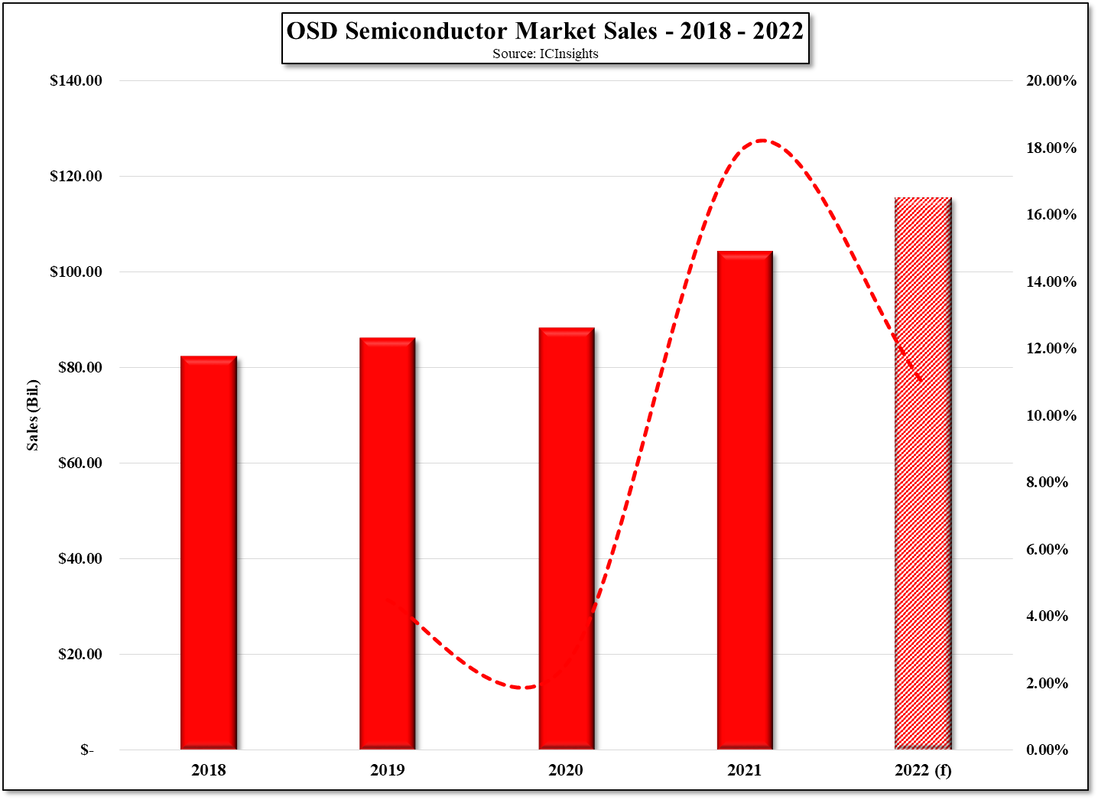

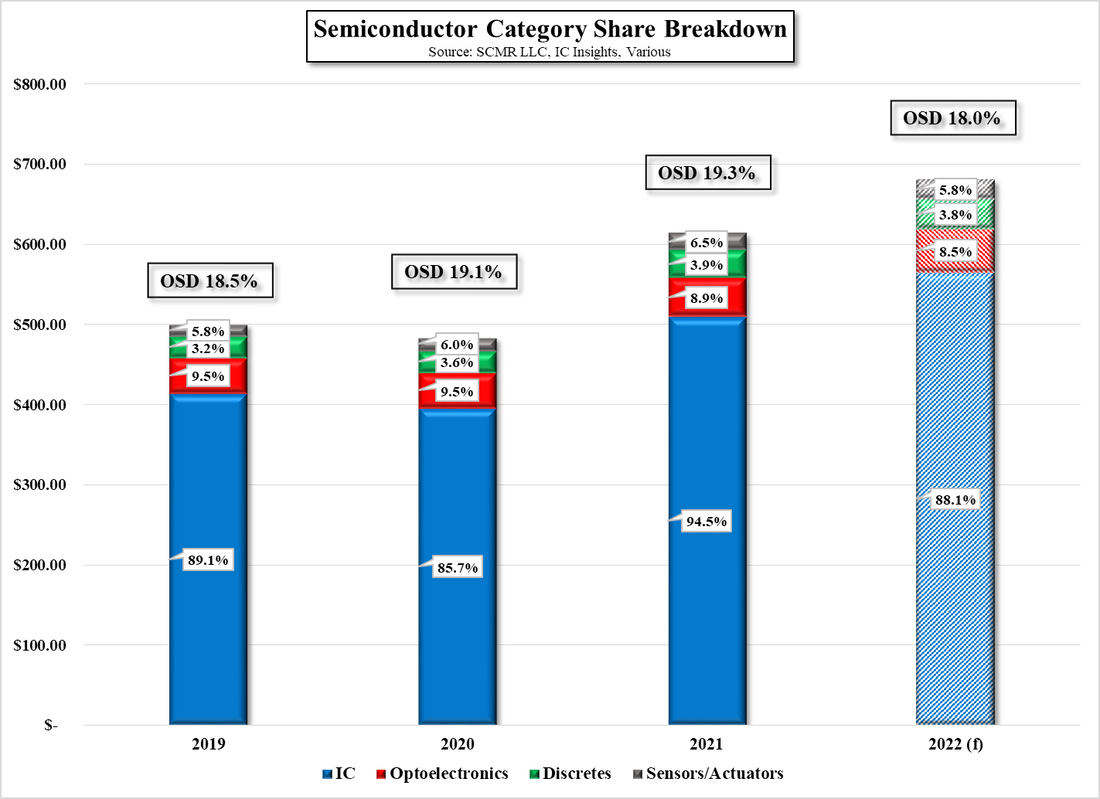

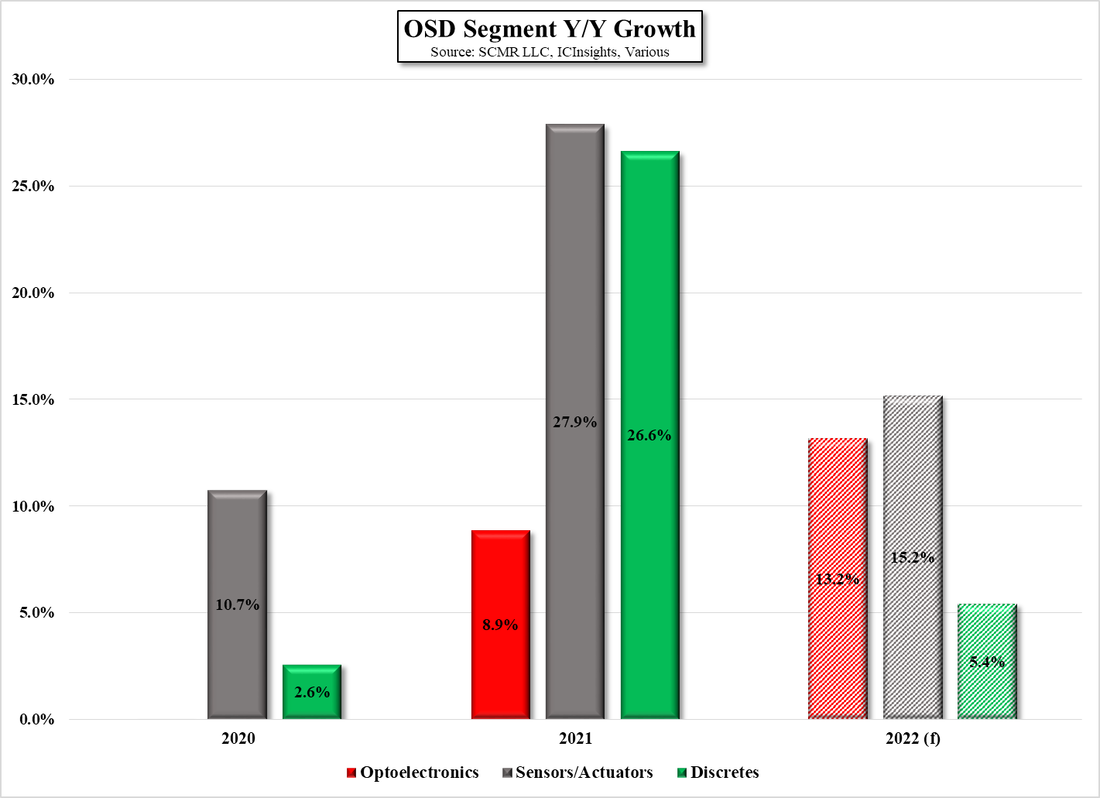

2021 was a good year for the OSD segment, growing sales 18.0% y/y, while shipments grew 20%, far above the 10 year CAGR of 4.7%. That said OSD grew less than the IC segment, which saw 28.8% growth in sales y/y and 22% in shipments (also above the 10 year CAGR of 7.4%). While all three OSD segment components grew in 2021, optoelectronics was the underperformer, growing only 8.9% y/y, while sensors/actuators grew 27.9% and discretes, 26.6%. We believe there were two factors that held back growth in the optoelectronics segment, the first being trade issues with China trade that caused brand share changes and lower overall mobile unit growth, and the second being the lower than expected demand for image sensors, which we detailed in our 01/14/22 note, with silicon based shortages adding to the slower growth.

Expectations for the OSD segment this year are less optimistic, calling for 10.9% y/y growth after 2021’s 18.0%, but in that composite, the optoelectronics segment is expected to grow 13.2% y/y, above last year’s 8.9% as mobile device demand increases and silicon shortages are reduced. That said, we expect those expectations might still be a bit high, given that camera sales growth (image sensors) is less likely to be driven by an increase in the number of cameras/phone and more by the size and value of the image sensors used, but not outside of a range we see as possible.

In passing, just to be transparent, we note that the sales values we use for the overall semiconductor market are averages based on published data from a number of sources, and as averages, share values do not always add up to 100%. That said, we also note that this year’s forecasted semiconductor market sales numbers vary by 13.5% from low to high, and while that might seem a wide range, it is far smaller than the 2021 variance of 35.8%, the 2020 variance of 18.1%, and the 2019 variance of 21.3%, which is indicative of both the value of individual estimates and the unknown inclusions and exclusions that (hopefully) account for the variances, and our the reasoning behind our use of averages for market values.

RSS Feed

RSS Feed