May Final Panel Stuff

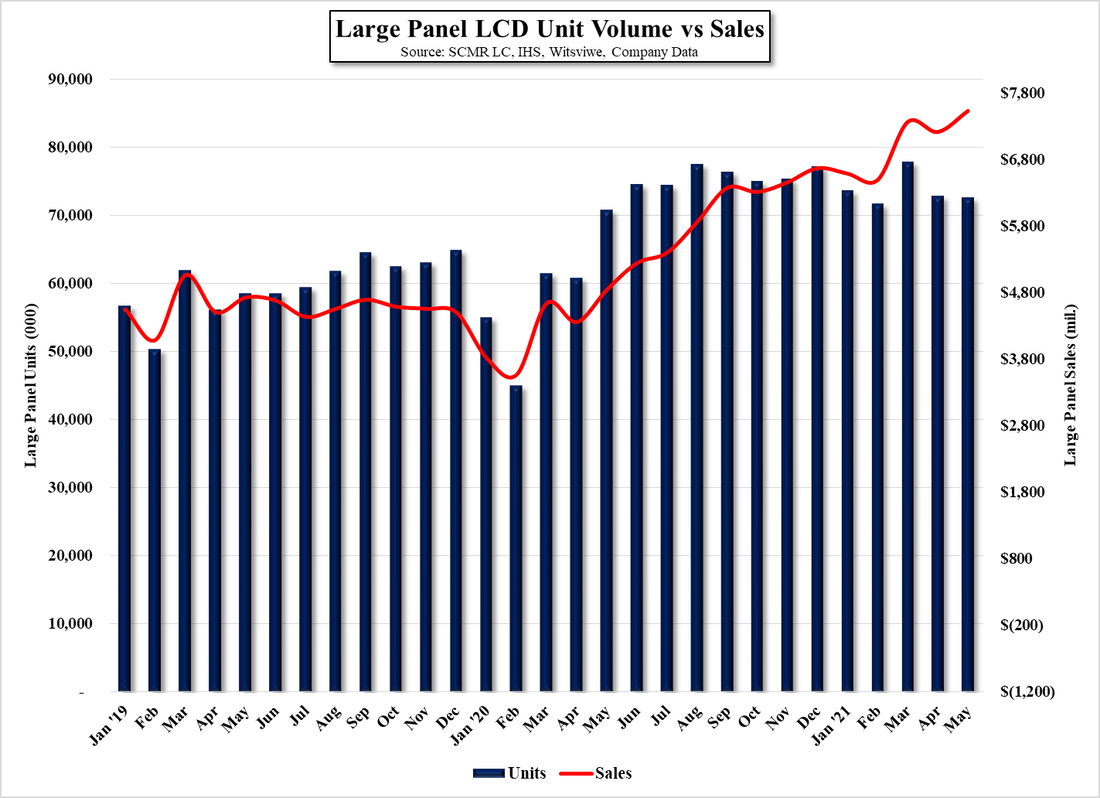

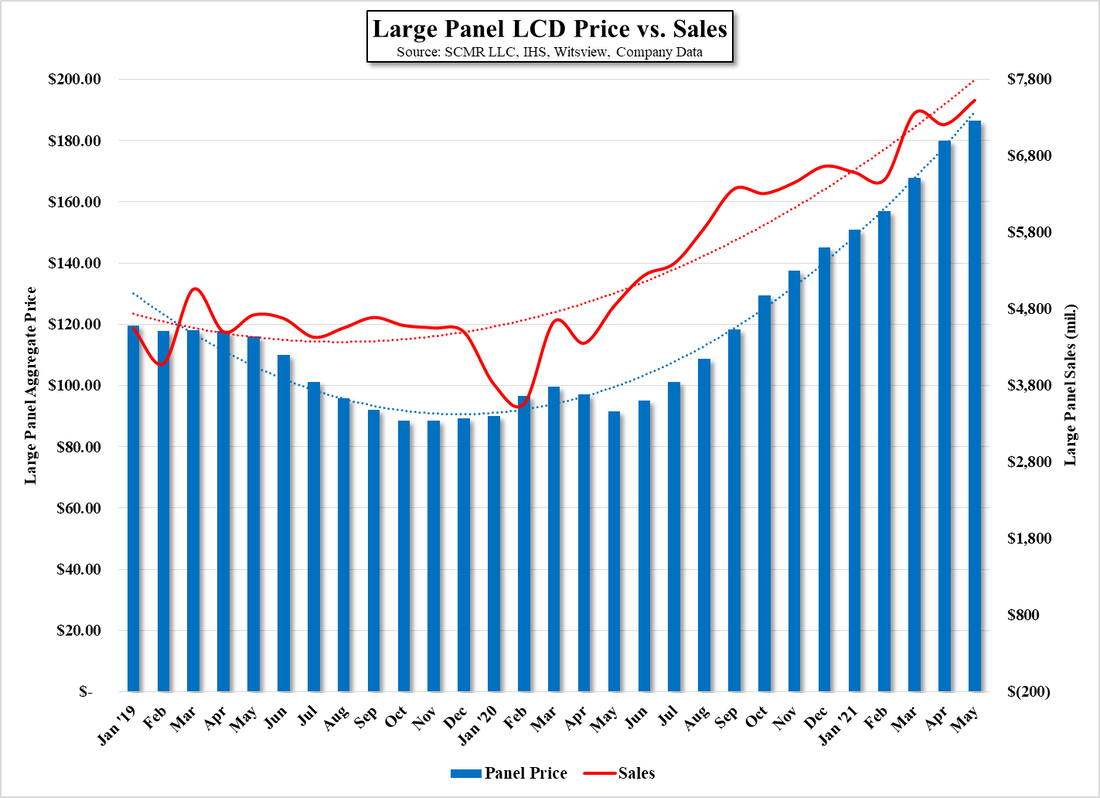

Large panel unit volumes have been relatively flat this year, with only a 2.6% spread between high and low, excluding the one month unit volume spike in March, which increased the spread to 8.5%, however sales have increased 12.9% across the industry, with rising panel prices accounting for much of the sales outperformance. In Fig. 1 we show large panel unit shipments, and while the scales are not the same for both, it does illustrate that sales are becoming increasingly dependent on price increases this year, which is further illustrated in Fig. 2 which shows that price and sales trend lines are converging.

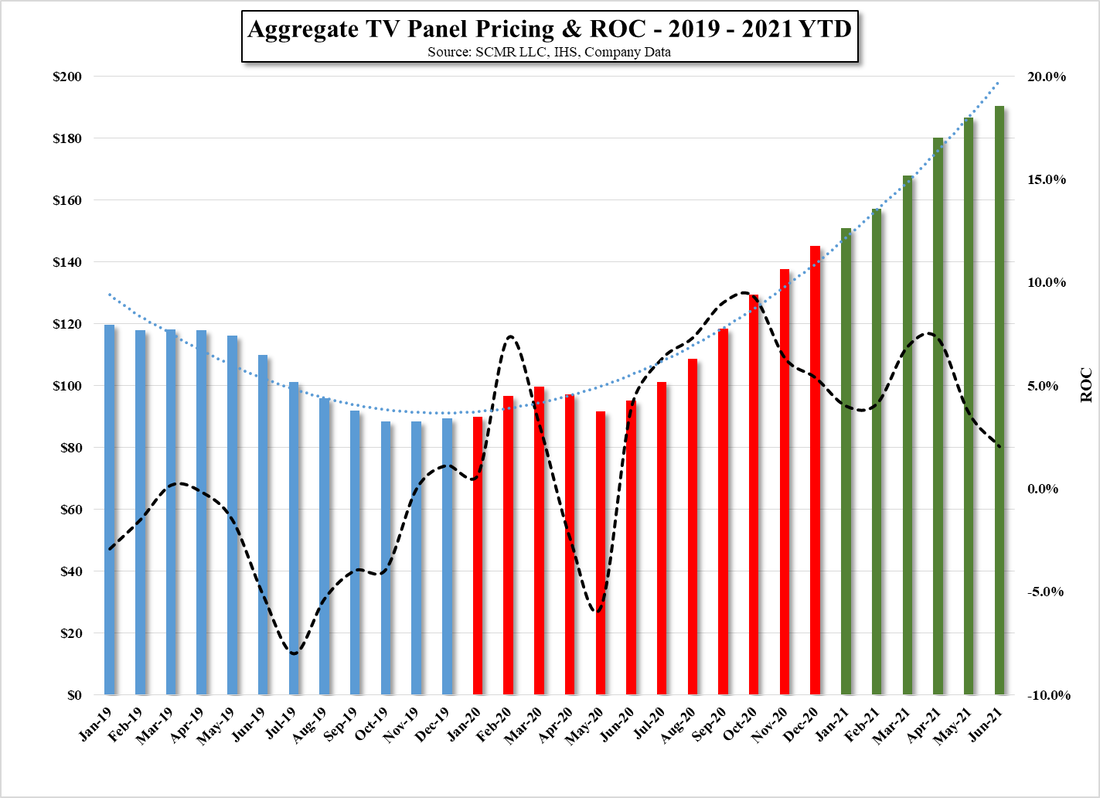

We note that 2H shipments are typically 13.0% (5 yr. avg.) higher than 1H, although removing 2020 (COVID-19) brings the average down to 10.2%, so one would assume that large panel sales will increase in 2H by considerably more than that amount, making the assumption that large panel prices continue to rise. While we do expect large panel prices to continue to rise into 3Q, we believe the rate of increase is slowing as demand, particularly for TV slows in North America and China. Fig. 3 shows TV panel pricing and ROC, with the ROC trending down and actual aggregate pricing falling below the trend line. We expect that lower panel pricing ROC trend to continue in 3Q as demand for TV slows and demand for IT products levels off. While there will be short-term anomalies, we expect that trend to continue through the end of the year.

RSS Feed

RSS Feed