Semi Scenarios

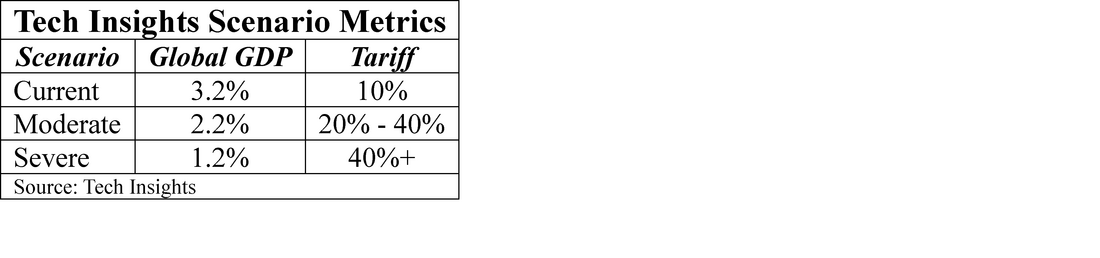

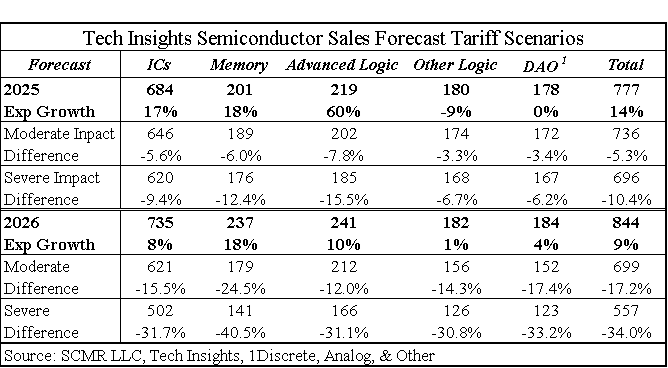

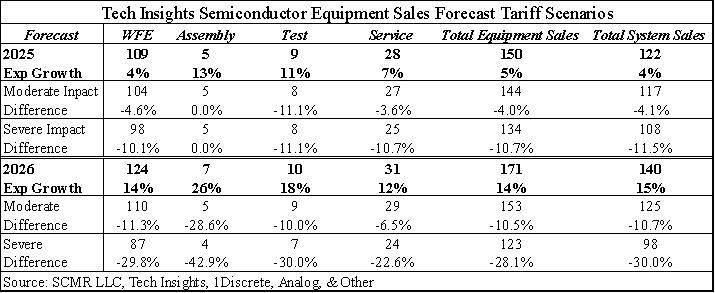

Tech Insights current expectations are now between the April forecast and the moderate scenario as negotiations continue, but the more severe scenario could occur if negotiations fail before the July deadline. The current forecast and two scenarios are as follows:

RSS Feed

RSS Feed