SMIC – Good News Bad News

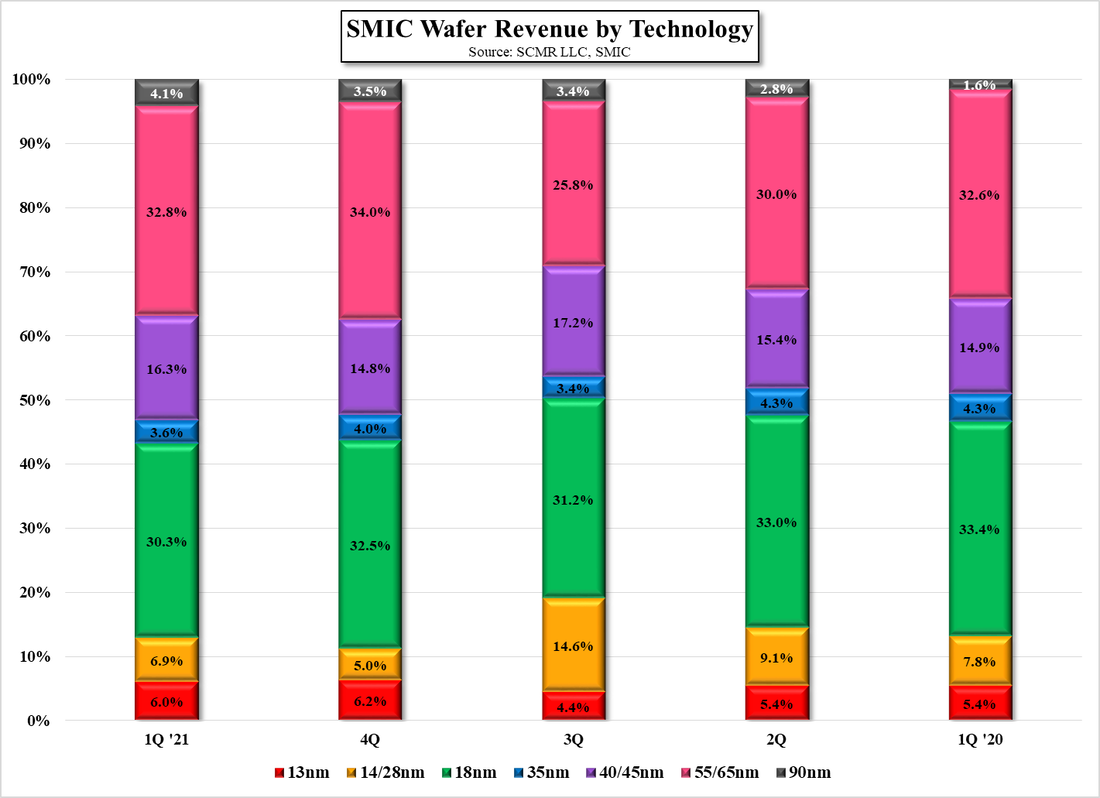

While the good news certainly was good, as this was the company’s 2nd best quarter ever, management did indicate that while negotiations were heading in the right direction, it was expecting that the US restrictions placed on the company last December by the previous administration, could delay the mass production timeline of the company’s new $2.35b 28nm/40nm foundry project in Shenzhen that was announced in March and could also delay the planned expansion of its 8” and 12” fabs, which were expected to see 45,000 wpm and 10,000 wpm increases this year. With expected delays, the expansion contribution will be pushed to the back end of 2H and will likely be less than expected for the full year because of the delays in procuring equipment. While that is certainly distressing for SMIC, they still gave 2021 guidance a boost, even under these circumstances.

Given that SMIC is the 4th largest global foundry, despite the political optics of lessening the hold the US has over equipment vendors that supply SIC, the global semiconductor shortage affects the US economy in many visible and some less visible ways. Automotive plant shutdowns, higher device prices, and potential end-user product shortages will capture more headlines than allowing SMIC to build capacity. While eventually equipment trade license grants would come to light and be promoted by anti-China trade groups, granting trade licenses, especially for 28nm equipment, would be a more subtle way of helping to alleviate the semiconductor shortages without making visible public policy changes.

RSS Feed

RSS Feed