Is Apple Getting Ready for Mini-LEDs?, It Doesn’t Matter…

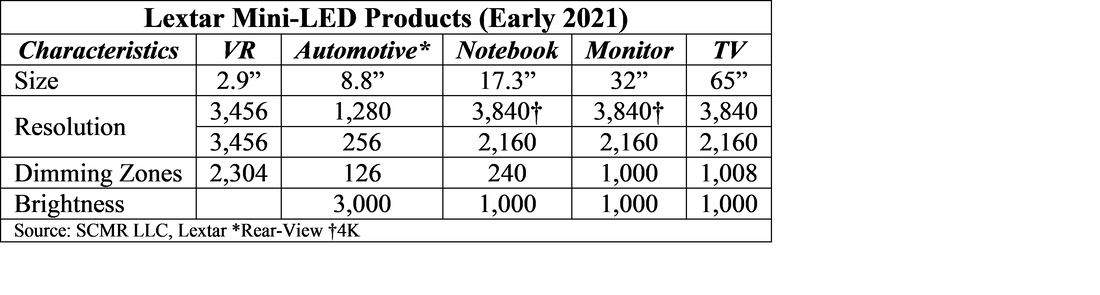

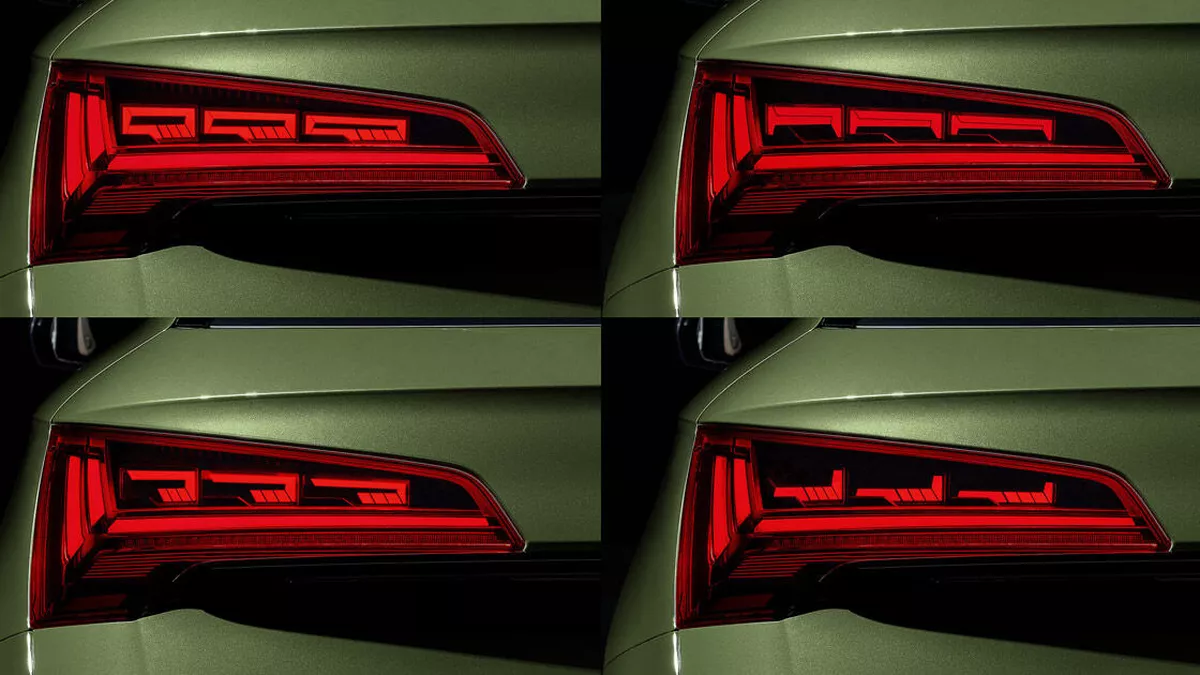

The ‘secret laboratory’ as it is called, houses the mini/micro development efforts of Apple, Ennostar (3714.TT), and AU Optronics (AUOTY), all of whom are working toward the commercialization of mini/micro-LED products for Apple (and themselves), particularly Ennostar, a holding company recently formed by the combination of Epistar (2448.TT) and Lextar (3698.TT), two of Taiwan’s LED producers and packagers, for the express purpose of building a mini-/micro-LED business that would supplement the compound semiconductor business. Lextar had already been producing mini-LED products for a number of applications before the merger, so, aside from the direct development project with Apple, the combined entity was already up and running in the mini-LED space.

While speculation continues about Apple’s mini/micro-LED plans, we believe Apple’s decision to migrate at least some products to mini-LEDs fall into three categories. First, “Does it enhance the product as it stands now?” That’s the easy one, as in any LCD based display having more granular control over the backlight system would improve the contrast of the entire system, reducing halos and adjacent segment light leakage that causes blacks to become grays. Second, “Does the cost of the enhancement justify the improvement? This is a bit trickier because estimates as to whether the improvements will justify a higher price from the consumer perspective have to be made, and we find consumer surveys and similar test marketing to be far more biased toward the product than actual consumers whose money is on the line.

Third, ”If the current cost of the enhancement is higher than justified, is there a path to a lower cost?” Here is where Apple shines, as the company has the vision and resources to look down the road to see if that justification is financially feasible in the future. In fact, Apple has been working on the development of mini/micro LEDs for years and while they will rarely be the first out of the gate with new technology, when they see the development process progressing, they will adopt the technology, slowly at first, but with increasing speed as the benefits to the Apple base are recognized.

As an example, Apple first tested commercial OLED displays in 2015, two years before it released the first iPhone using an OLED display. The 2015 OLED product was the Apple watch 1st Edition series, taking Apple until the November 2017 release of the iPhone X to move the technology into the iPhone line, and even then leaving the iPhone 8, released at the same time, with LCD screens. In 2018 two of the three new iPhone models were OLED and it took until last year for Apple to transition all models of the iPhone (exception was the iPhone SE which remained an LCD display) to OLED.

There is one more question that Apple has to answer before it can really set a true timeline for mini/micro-LED products, “Is micro-LED a viable technology?” Note we say ‘micro-LED’ here because mini-LED technology is based on existing LCD displays while micro-LEDs are not, which makes mini-LEDs an enhancement to LCD technology, giving it a more finite lifetime, while micro-LEDs are self-emissive and would represent a new technology (and infrastructure) that would compete with OLED, which is also a self-emissive technology. Of course, Apple will spend money on the development of mini-LEDs, micro-LED, and OLED in order to make sure it does not mis an opportunity, but at some point Apple will have to decide whether micro-LEDs offer a real challenge to OLED (in a cost effective manner) and if so, channel more specific product development down that road.

We do expect Apple to release a mini-LED product this year, whether it is a new iMac or a monitor (XDR series) is immaterial, as the question to ask is really how Apple views micro-LEDs. Mini-LEDs are a logical step, essentially taking existing LCD, LED-based backlight technology and continuing the path of shrinking and adding LEDs for better contrast, but micro-LEDs could represent another path for the display space as LCD technology improvement become progressively harder to make. IF Apple sees a path for micro-LEDs it will go a long way toward legitimizing the technology, even in these early stages, and as noted Apple has been spending money to that end, but Apple’s mini-LED products have little to do with Apple’s eventual decision toward micro-LEDs, so it is important for investors not to lump both together or assume that mini-LED adoption has anything to do with micro-LED adoption. They are as opposite as the sun and the moon.

RSS Feed

RSS Feed