AU Optronics buys tools from Nikon worth $86m

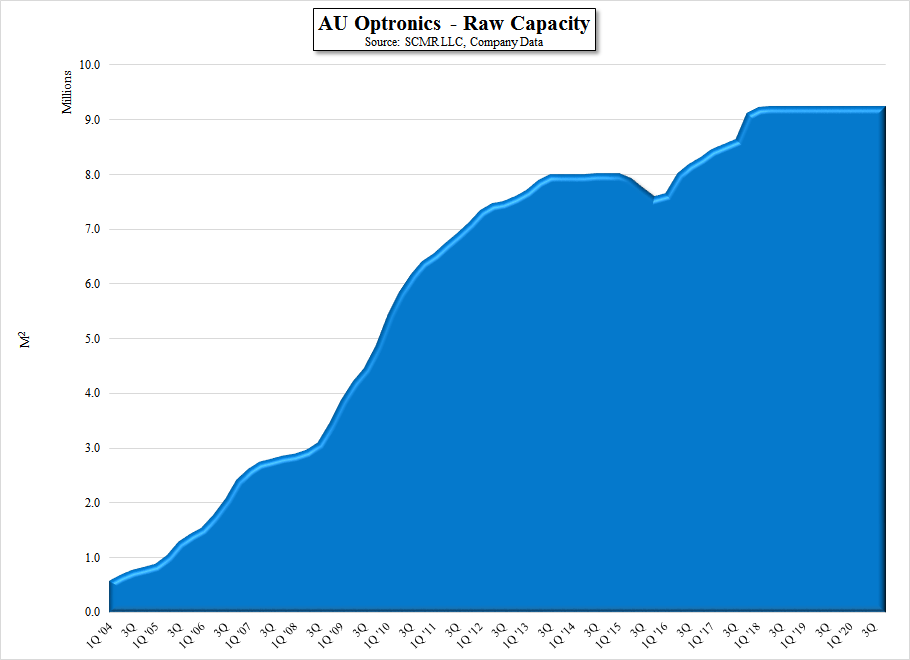

AU Optronics has gained traction in the large panel (TV) market with an early entry into 4K panels a few years back, and has continued to focus on the premium TV display segment and has moved from a swing producer[ii] to one with a reasonably diverse customer base, supplying Sony (SNE), Vestel (VSQ.GR), and a number of OEMs including Wistron (3231.TT). AUO has been somewhat conservative over the years as to adding capacity, with financial constraints being an issue during the last display down cycle, but has recently expanded their L8B fab as noted above, and is expanding its LTPS based Gen 6 fab in Kunshan, China. AUO is also considering a Gen 11 fab, but plans have yet to be finalized.

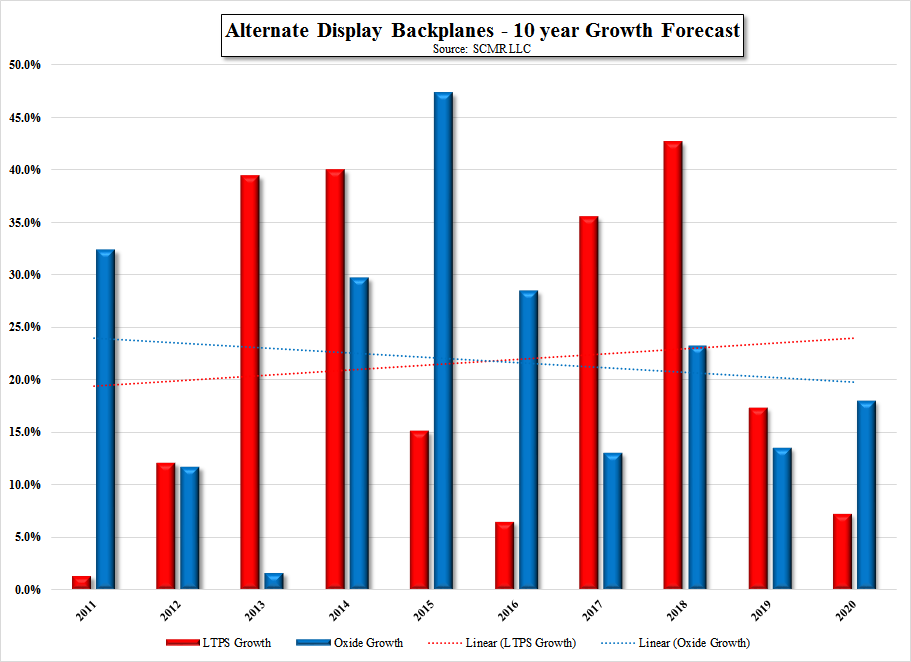

[i] Indium Gallium Zinc Oxide aka ‘Oxide’

[ii] When large panel producers such as Samsung Display are unable to meet customer demand, they buy from ‘swing’ producers on a relatively short-term basis. Good for swing producers when demand is high, but they are the 1st to be cut out when demand weakens.

RSS Feed

RSS Feed