Is AU Optronics back in the OLED biz?

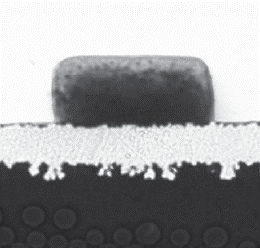

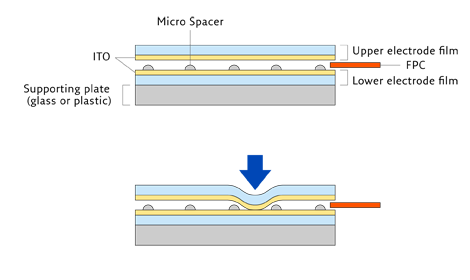

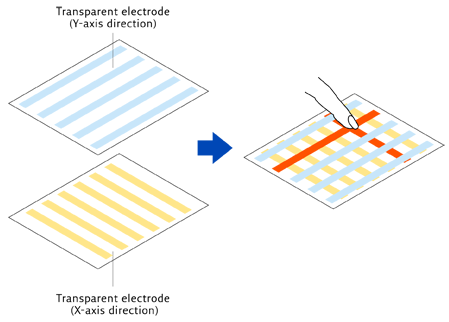

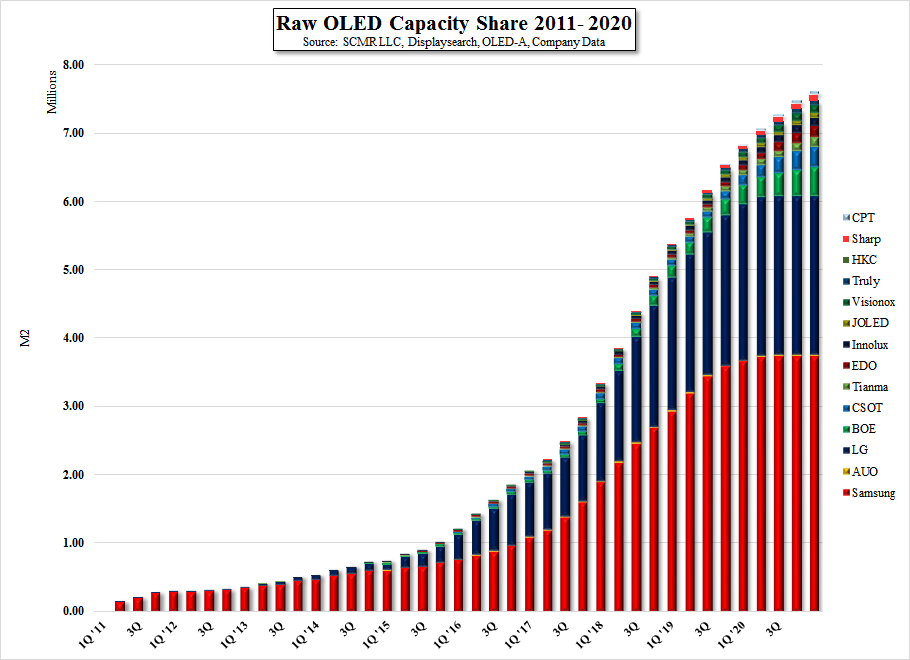

Recent reports that AUO has improved product yields implies that they are refocusing some OLED production assets on smartphone sized displays, particularly 5” and 5.5” models which have become available on a number of 3rd party vendor sites with capacitive on-cell touch. AUO was an early producer of circular OLED displays for wearables (see below) but has seen mixed results in the smartphone space, announcing a 5.7” 2560x1440 pixel OLED display in 2014 (very high resolution for the time) but seemed to be unable to reach manufacturing yields above 50%, keeping the firm from entering mass production.

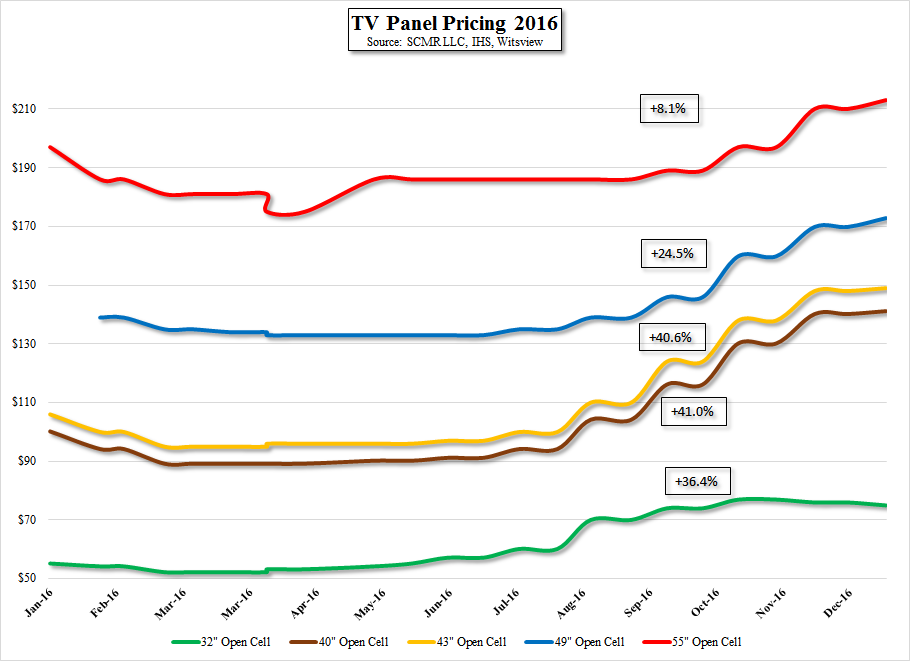

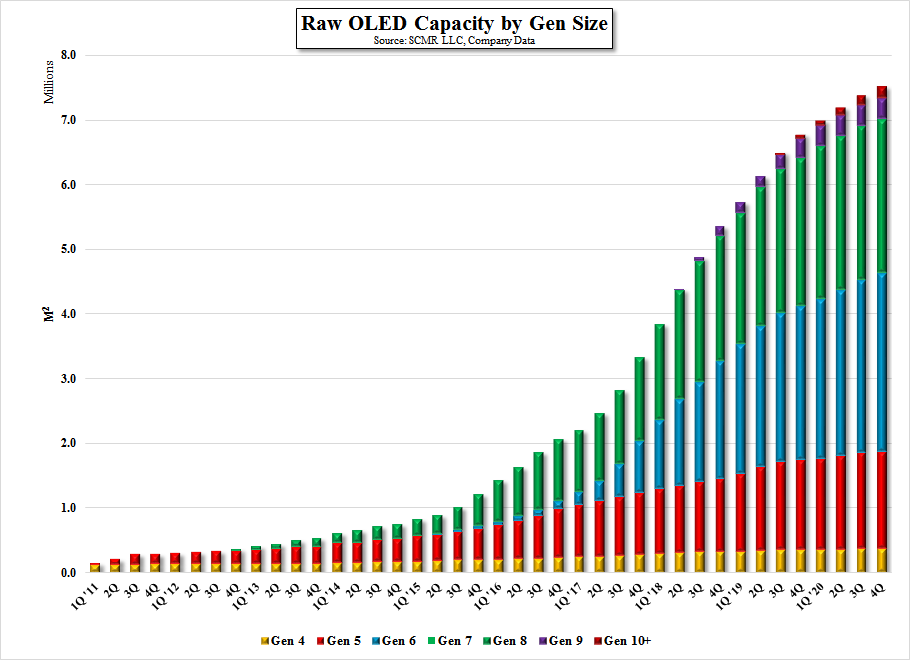

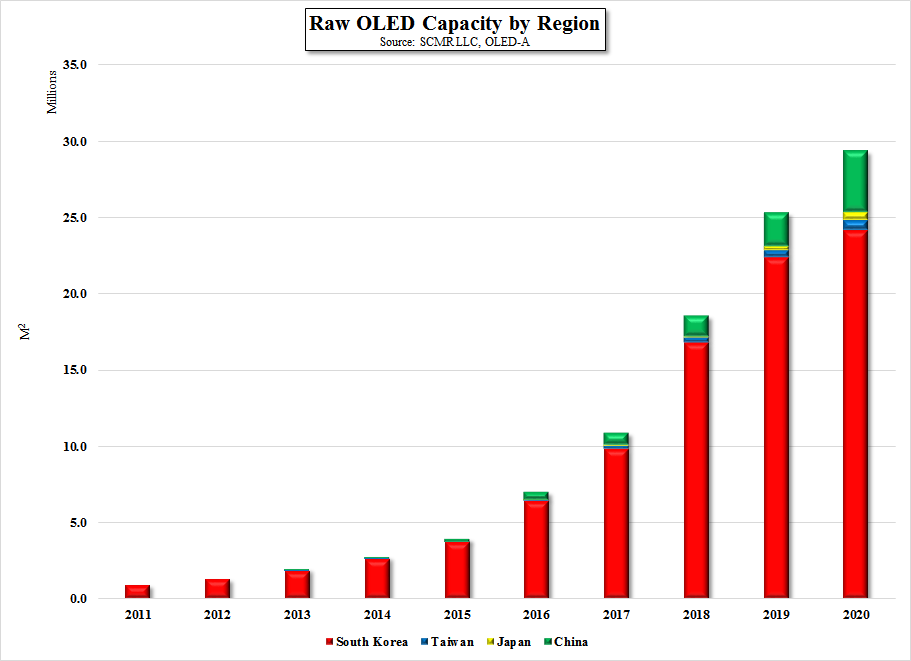

Hopefully AUO has reached production yields that will allow them to be profitable in their OLED efforts in the near-term, but we believe they need to expand capacity if they are to compete in the OLED space in anything other than niche products. The company is currently expanding its Gen 8 LCD lines in Taichung, Taiwan and its Kunshan fab in China, which has an OLED R&D line as noted above. The company has also mentioned the potential for a Gen 10+ fab, but has no specific plans for such a large format fab currently.

RSS Feed

RSS Feed