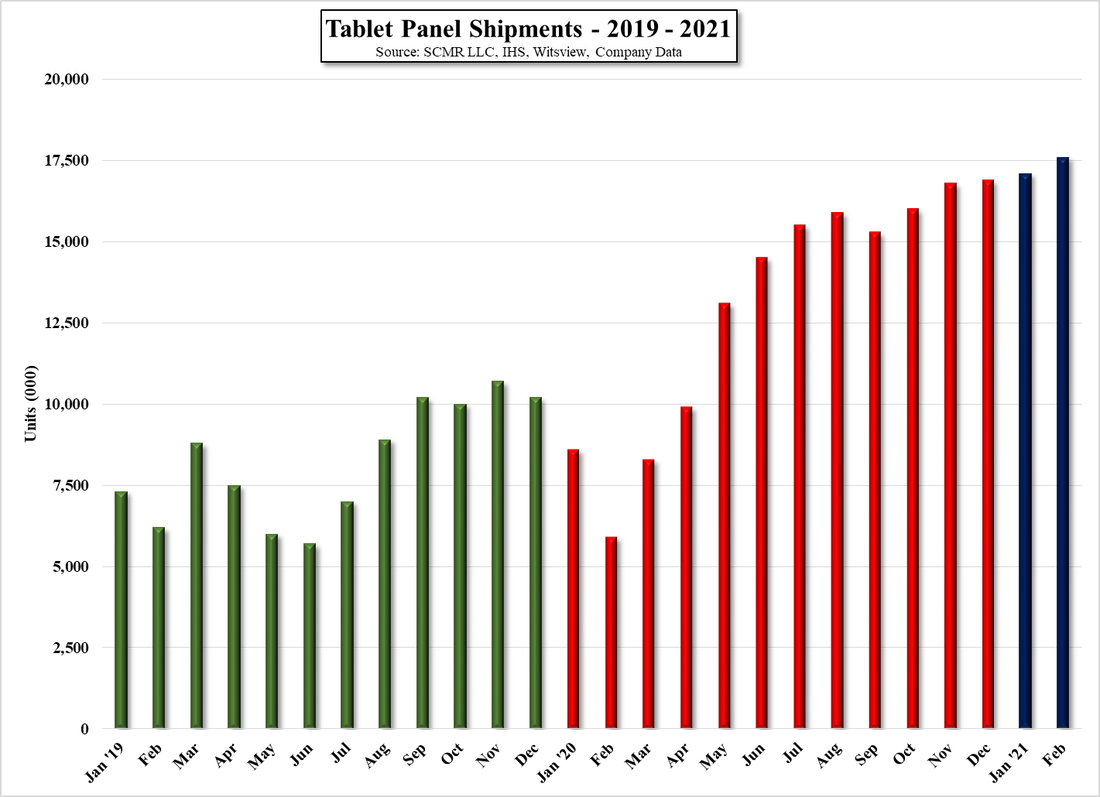

Panel Pricing & Shipments – February/March

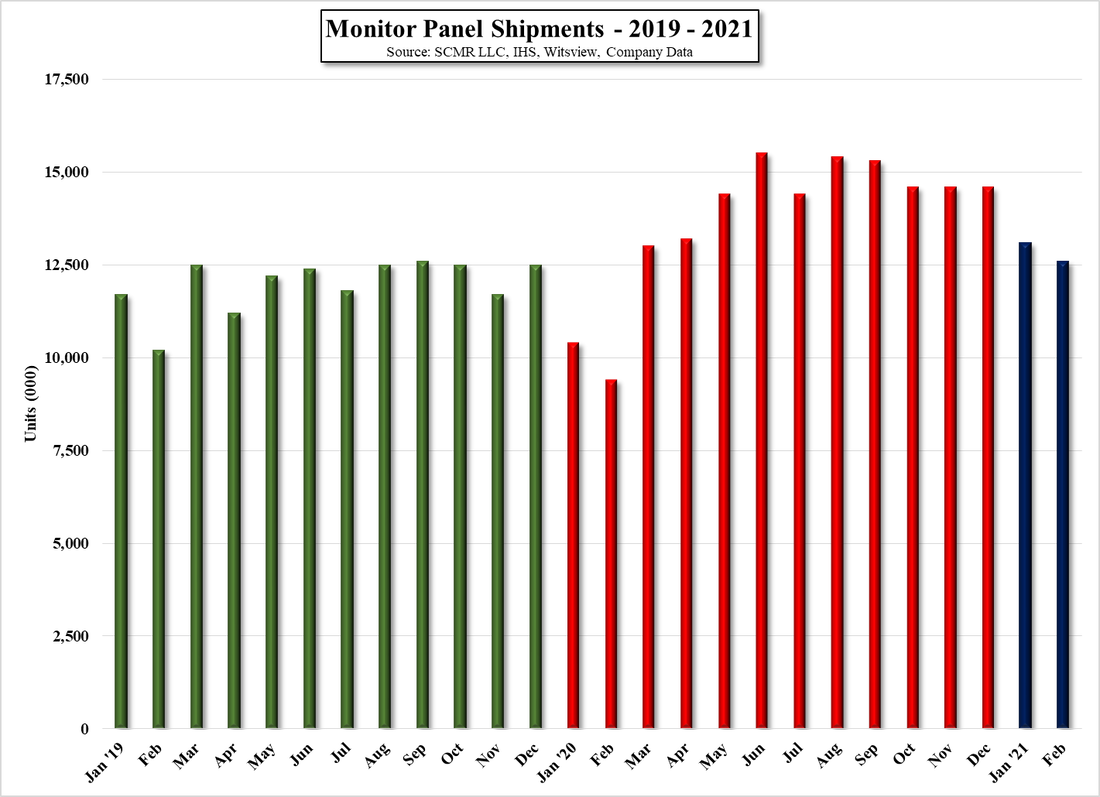

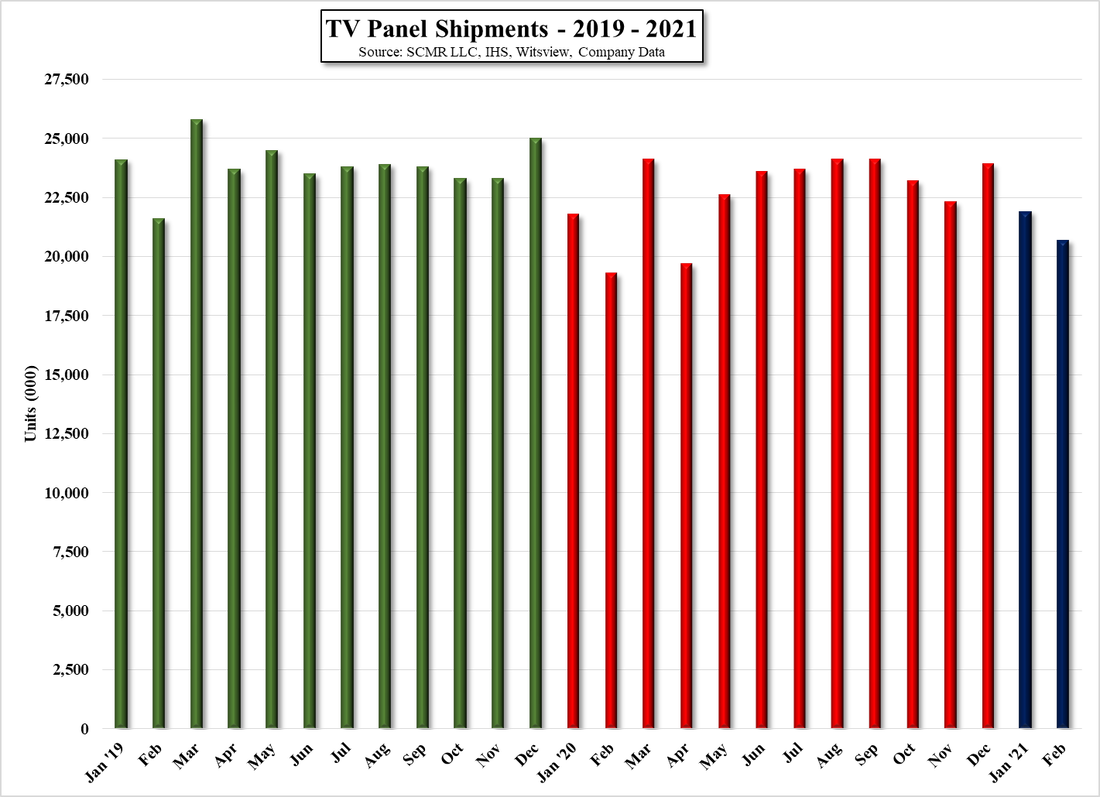

On a general basis, Chinese large panel producers saw revenue increase in February, while all others saw revenue fall, other than Sharp () as large panel LCD unit volume was down 2.7%..Total large panel LCD revenue was down 1.4% in February, with panel price increases making up a portion of the unit volume decline. We would have thought large panel sales would have been higher in February given the increasing panel prices, but that was not the case, although February in the display space is an odd month considering the Chinese New Year holiday, so we wait to see March panel sales before we can determine whether the February large panel sales decline was a one-off or a trend.

RSS Feed

RSS Feed