BOE Bits

In the case of BOE (200725.CH), China’s largest display producer and at times the largest in the world (units), is an influential company in the display space with a wide variety of display and other assets. On occasion we can get answers to questions but the company is as skilled in ‘corporate speak’ and many US companies. That said, since the beginning of the year we have been able to get a few questions answered which we list below with the question, the company response, and our comment (red).

- Has the shortage of display drivers affected your business?

- No, there have been no material shortages that have affected production – ‘material’ is key but we take it at face value as of early March. Glass and driver ICs are the primary concerns but BOE is large enough to be able to pull glass from a number of suppliers. Corning (GLW) produces Gen 10.5 glass at BOE’s plant in Hefei (B9) and is the likely supplier for Wuhan, so a pull-in for Wuhan would also mean increasing production for GLW through mid-year at least.

- What is the status of the Gen 6 OLED fabs in Chengdu and Mianyang?

- Both are in production and are growing with ‘climbing progress’ – We expect this means capacity is available and now looking for customers to fill capacity

- Flexible OLED yield is >80% for ‘mature products’ – Mianyang would likely not be producing ‘mature products exclusively so overall OLED company yield Is likely lower. Chengdu is likely above 80%.

- Did you meet your flexible OLED targets last year?

- Due to COVID-19, we produced about 36m flexible OLED panels in 2020. Still double 2019. – A 10% miss is just low enough to be acceptable under COVID but no target for 2021.

- What is the status of the Gen 5.5 (B6) fab in Ordos?

- Currently focused on mid to high-end smartphones but able to produce wearables, etc.

- Unit volume grew ~8% last year – Unit volume relatively unimportant without size breakdown. No info on area production.

- What is the status of the Wuhan Gen 10.5 LCD fab?

- With a design capacity of 120,000 sheets/month the fab was able to run 90,000 sheets earlier this quarter and is in ramp mode, with full production expected by the end of June. Focus on 32” panels at the onset. – We pull in our production model for Wuhan G10.5 which is a bit ahead of our model.

- What is the status of your automotive display business?

- #2 worldwide in 8” or over automotive displays (Jingdian subsidiary) with 12.3” dashboard, a-pillar, and OLED taillight.

- What is the status of the Fuzhou OLED fab (B15)?

- Under planning – We push out our ramp up date to 6/22 with a very tentative notation.

- Do you expect to have any in-cell products this year?

- In-cell pen technology ready by end of 2Q – No mention of in-cell touch offerings.

- Have you begun mini-LED production?

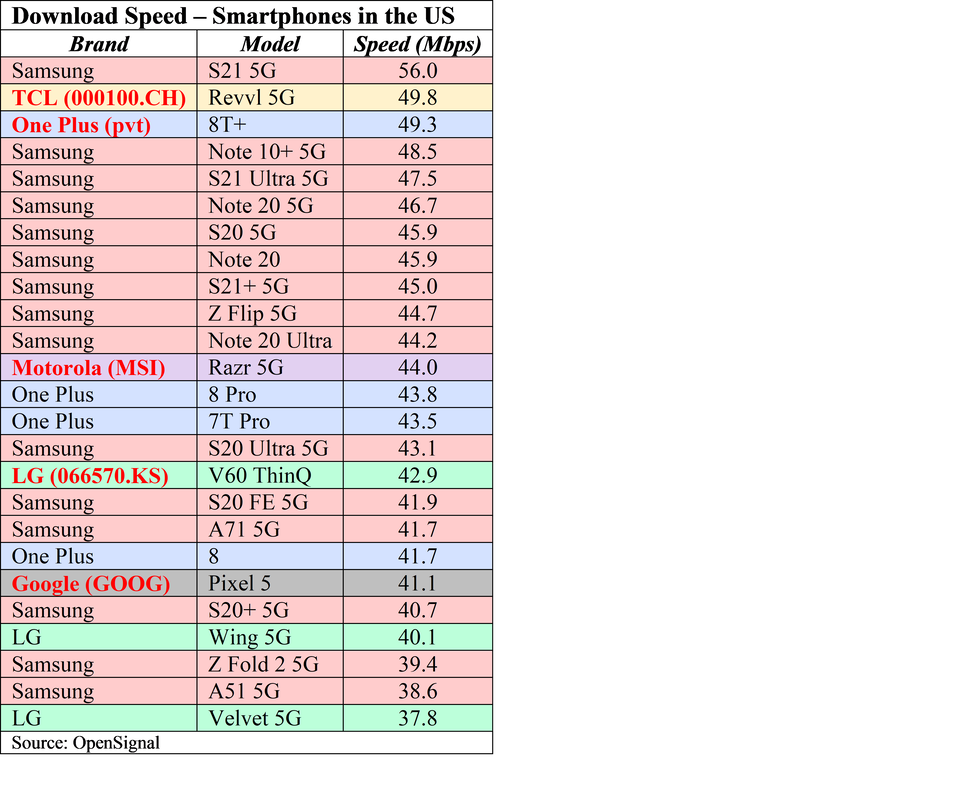

- We have delivered mini-LED product to customers – both 65” and 75” – No mention of commercial production to date but TCL’s (000100.CH) 65” and 75” QD Mini-LED TVs sound strangely similar to the BOE mini-LED backlight models, without BOE actually saying so.

RSS Feed

RSS Feed