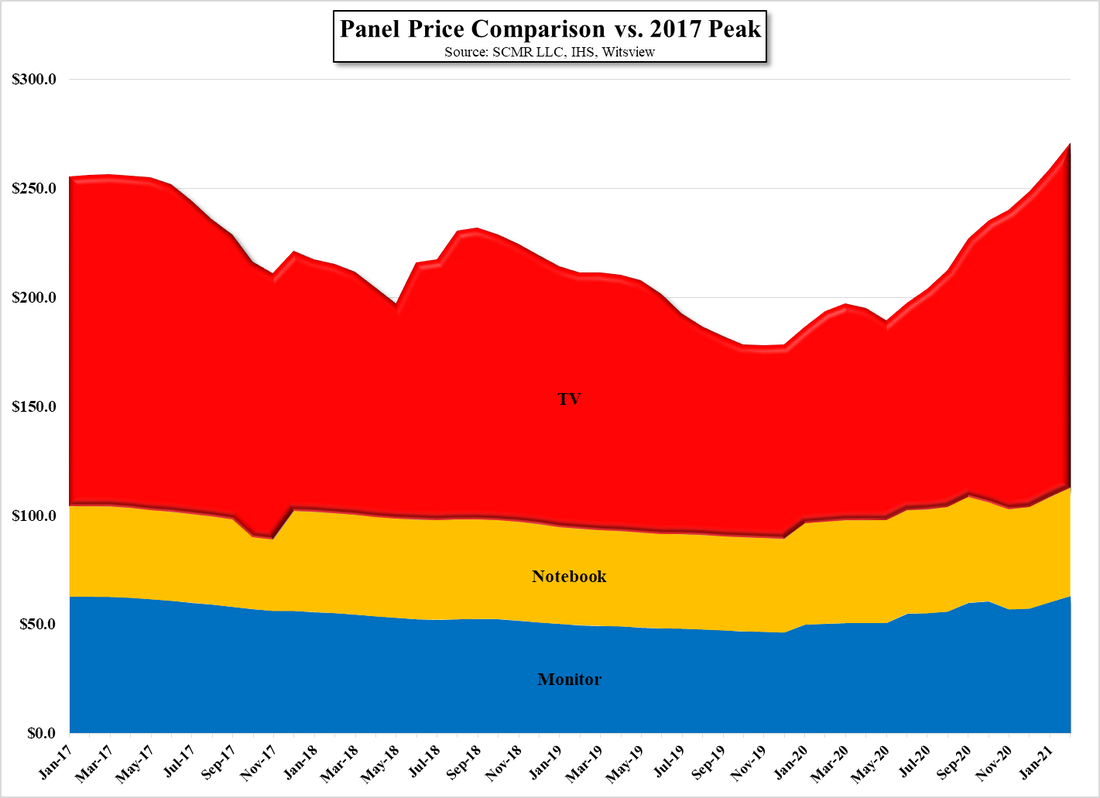

Early March Panel Prices

While we expect shortages to keep panel buyers under constraints to meet early 2021 quotas, demand is still being ‘regulated’ by the necessity for stay-at-home scenarios, a result of COVID-19, and while the virus is still at pandemic levels, vaccines and a more stringent public health requirements on a global basis, seem to be having at least some effect on hospitalizations. With plans for most educational facilities, at least in the US, to be back to in=person classes by the fall, we expect demand to soften during the summer, but we also expect a lag between when demand slows and when buyers feel they can actually negotiate with panel suppliers given the desperation buyers have faced in past months. Does that push out a slowdown until 3Q or does it happen during the summer? That is a hard question to answer, but we will present four supply/demand scenarios later this week. Without giving too much away, the four scenarios are titled, ‘slow burn’, ‘Black Diamond’, ‘New Normal’, and ‘Avalanche’.

RSS Feed

RSS Feed