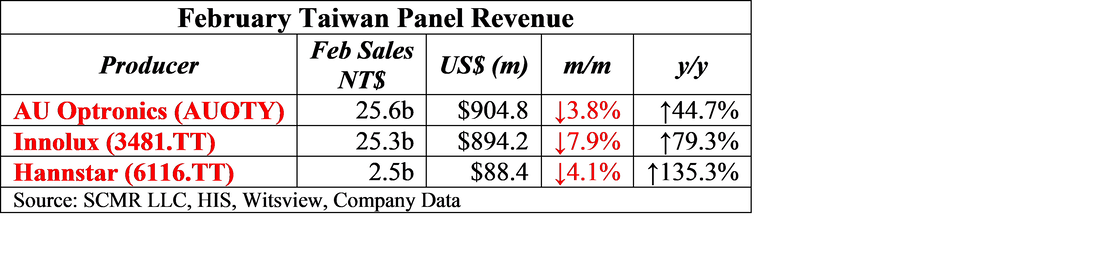

February Panel Sales in Taiwan

As we have noted previously, component shortages have been cited as a mitigating factor as to LCD fab utilization, although thus far we have seen little indication that such shortages have made a discernable difference to most panel producers, who have been shifting production to the most profitable panel applications which currently are IT products. Much has been said about shortages at the silicon level however, with stories that foundries are allocating resources to the highest bidder on an almost daily basis. While this will eventually stymie some panel production given that display drivers and similar components are not always the most profitable for foundries, we could see some production delays as older inventory is worked down.

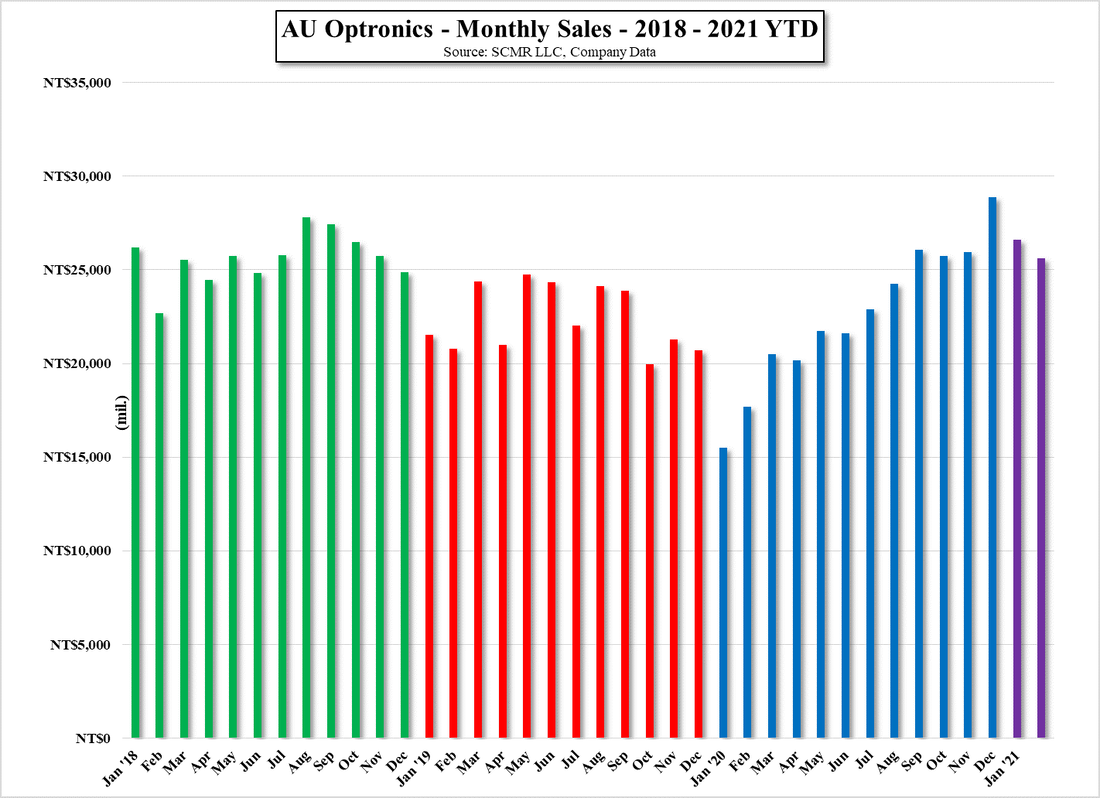

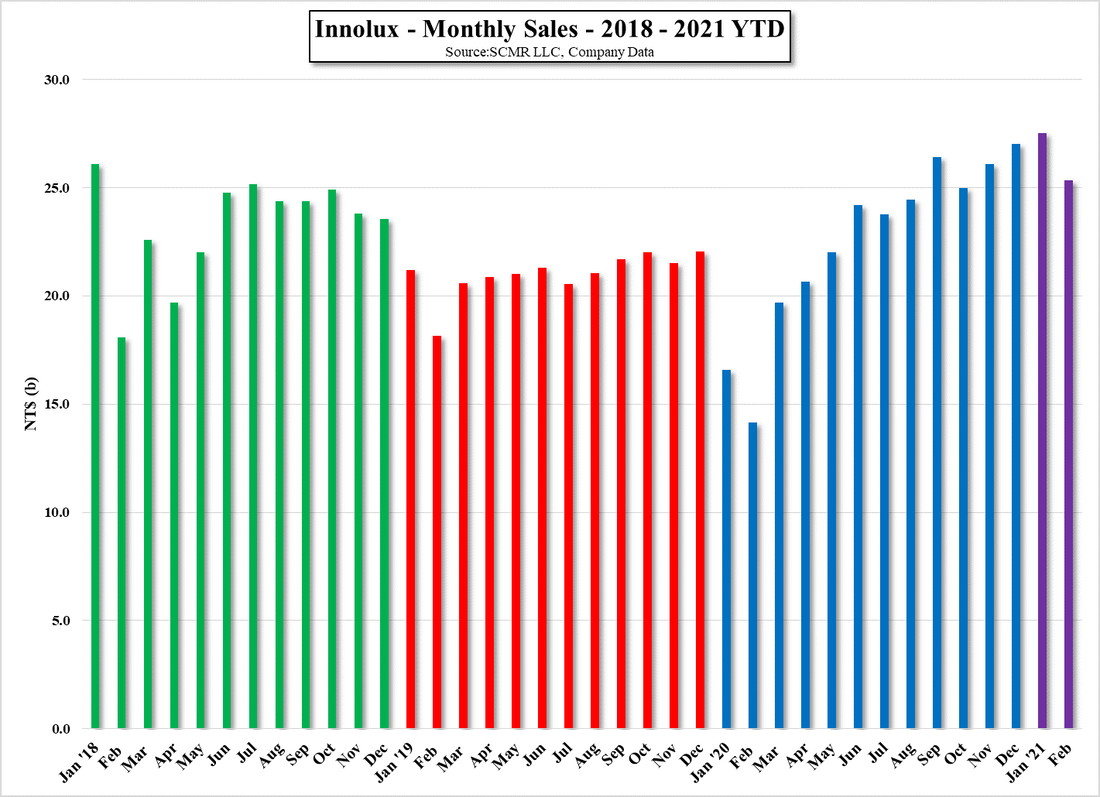

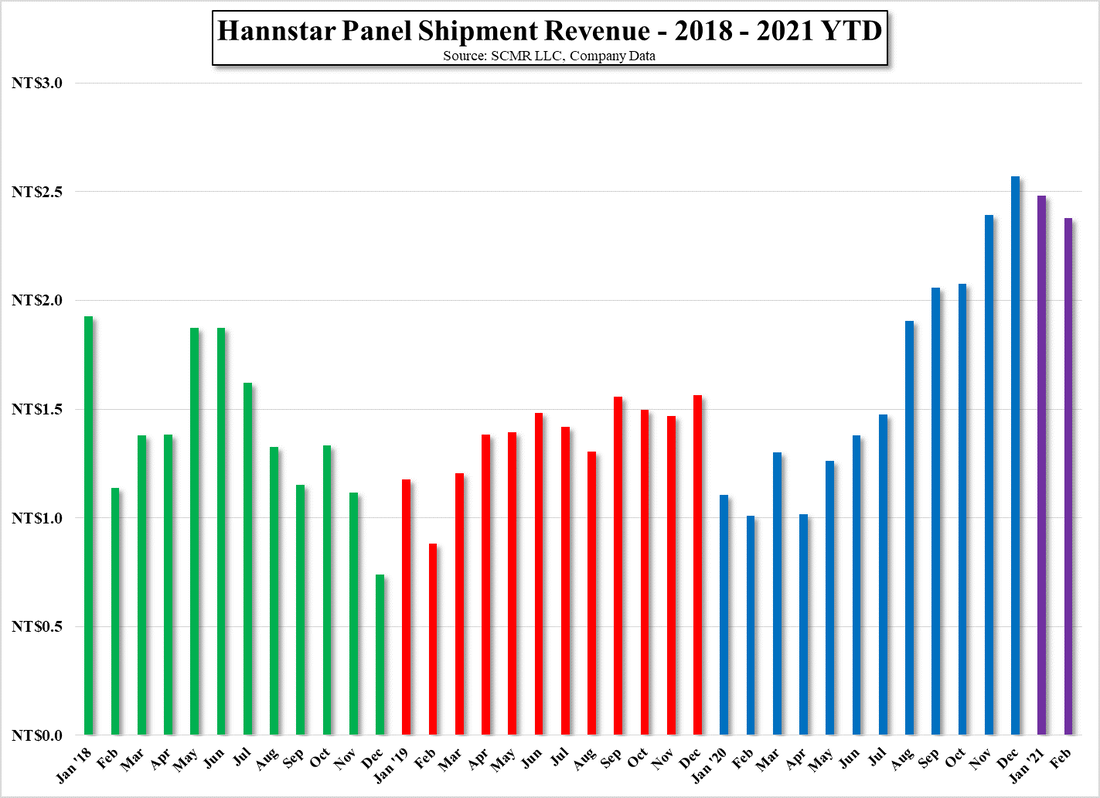

All in, February panel sales are looking to be a continuation of the strength seen over the last 9 or 10 months, and that strength seems to be keeping panel sales above seasonal norms. We do question the elasticity of display product pricing and how these continuing panel price increases will affect device production costs and the ultimate price to the consumer. High cost display inventory continues to filter through the CE supply chain and brands must deal with the higher BOM, which leads them to higher prices or lower margins. Some have the ability to share the rapid price changes with suppliers and in some cases with retailers, but the longer panel price increases continue, the less room there is for those kinds of negotiations and the specter of CE price inflation will be the result, a hard sell to consumers who are used to the opposite.

RSS Feed

RSS Feed