Tianma to buy its US JV

Now the company is expected to buy a 78.1% stake in what we believe is a JV between Tianma and NLT Technologies, formerly known as NEC LCD, a division of NEC Corp (6701.JP) and AVIC. The transaction for the US JV stake is expected to be priced at $5.268m, valuing the JV at $6.7m, and making the entity a wholly-owned subsidiary of Tianma, which the company believes will allow it to improve the existing assets and reduce layers of management, the same statement made concerning the AVIC purchase.

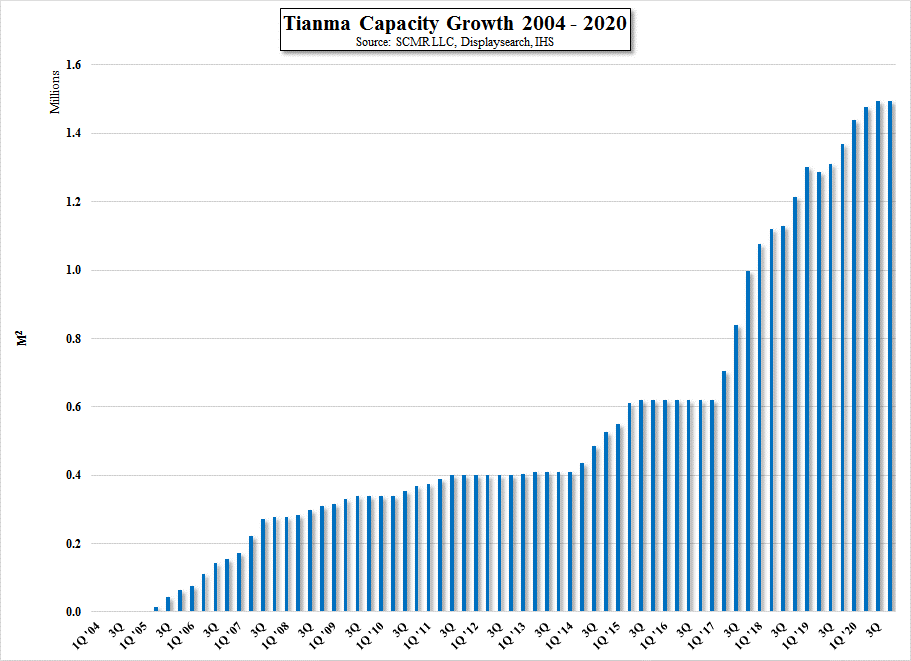

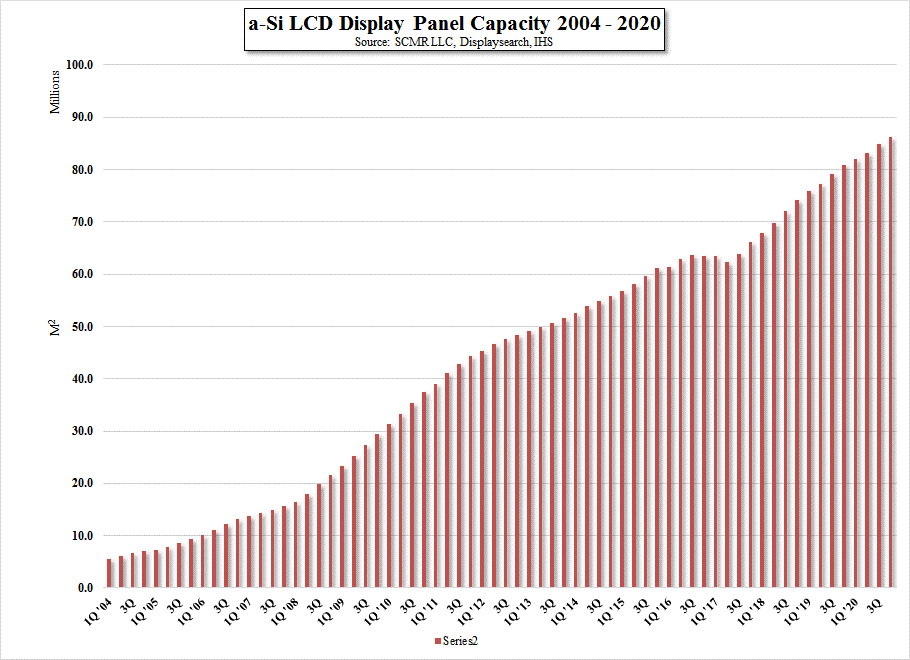

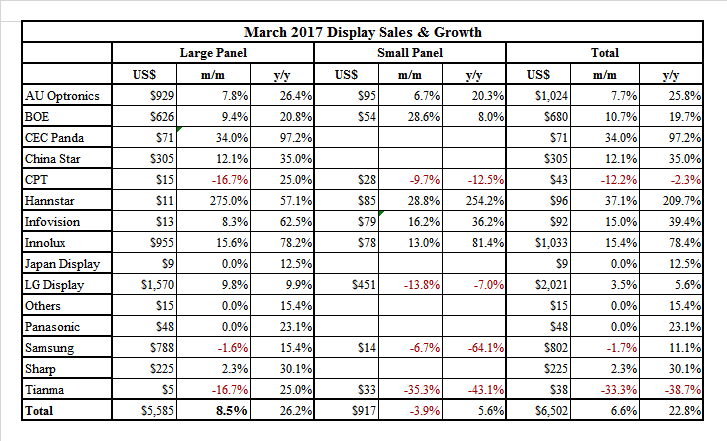

Tianma’s current share of the display market by capacity is ~1%, with a focus on small panel display production. Tianma has restructured a number of times over the last few years under the same basic mantra of ‘increased efficiency, faster time to market, and flexible customer support’ but has been unable to grow significantly over the last three years. As can be seen in Fig. 2, the company is currently adding significant Gen 6 capacity with both LTPS backplane and flexible OLED lines for which it is raising capital as noted above, but even with the fulfillment of its timeline goals, Tianma will remain under 2% of the total gross industry capacity by 2020. Earlier this week we noted that Tianma began production at its Wuhan, China OLED fab. The company generates ~87% of its revenue from small panel production and is the smallest of the three Chinese small panel LCD display producers (BOE – (200725.CH), Infovision (pvt) & Tianma), with a 19.8% share of Chinese small panel monthly revenue, but holds an 8% share of worldwide LTPS capacity.

RSS Feed

RSS Feed