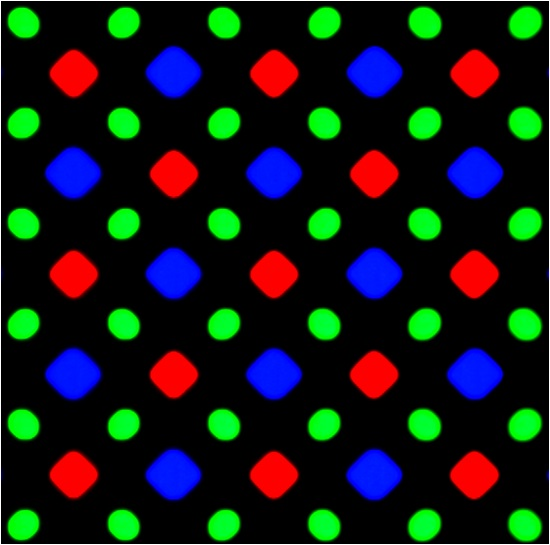

Samsung addresses ‘red tint In yesterday’s note we indicated the issues surrounding the ‘red tint’ some users have seen on the new Samsung (005930.KS) Galaxy S8 smartphone. Samsung Electronics has decided to upgrade the software for the new phone at the end of this month, heading off any chance of the type of negative publicity that the company faced with the recall of the Note 7 smartphone. The software chance will allow users to reduce the display’s red component further than is currently possible for those phones that showed the tint, with the assumption being that the problem is based on software and not hardware. As also noted, pre-delivery orders, particularly in South Korea, are running far ahead of previous Galaxy smartphone models, with expectations for S8/+ sales to reach 50m units this year.

0 Comments

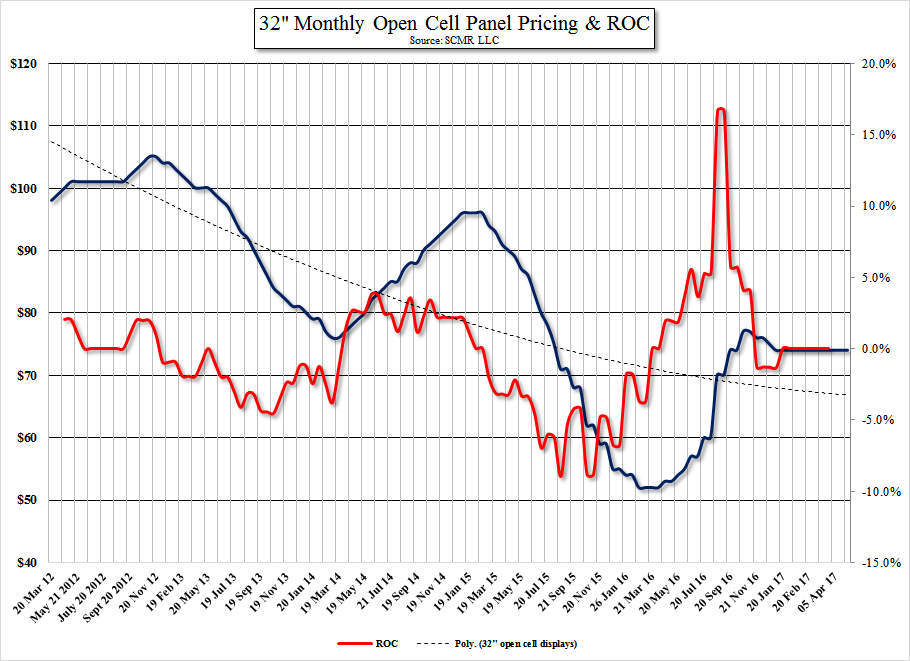

Panel Prices – Quick & Dirty |

AuthorWe publish daily notes to clients. We archive selected notes here, please contact us at: [email protected] for detail or subscription information. Archives

May 2025

|

RSS Feed

RSS Feed