Samsung and LG Display to evaluate LCD to OLED conversions

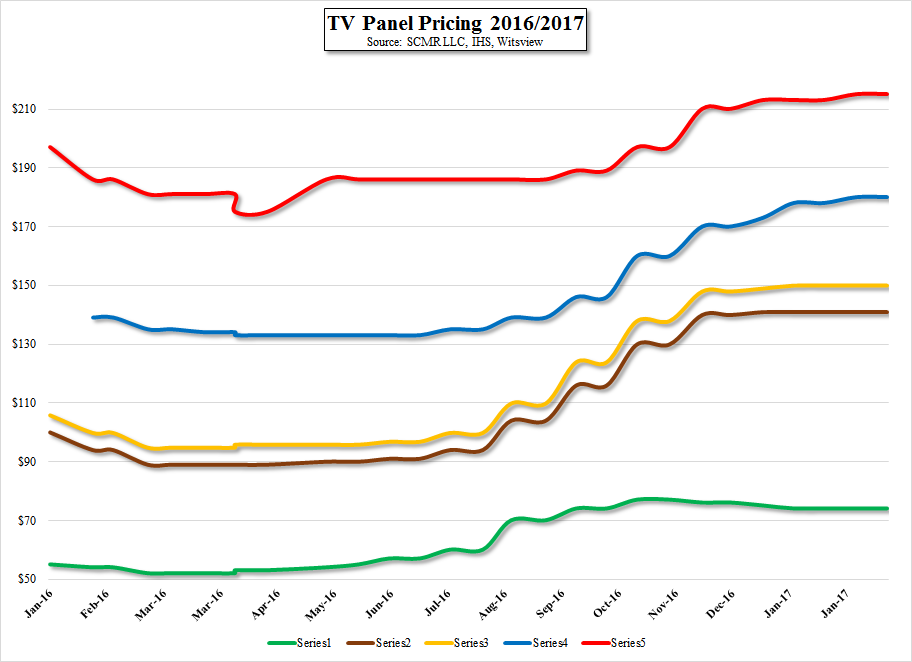

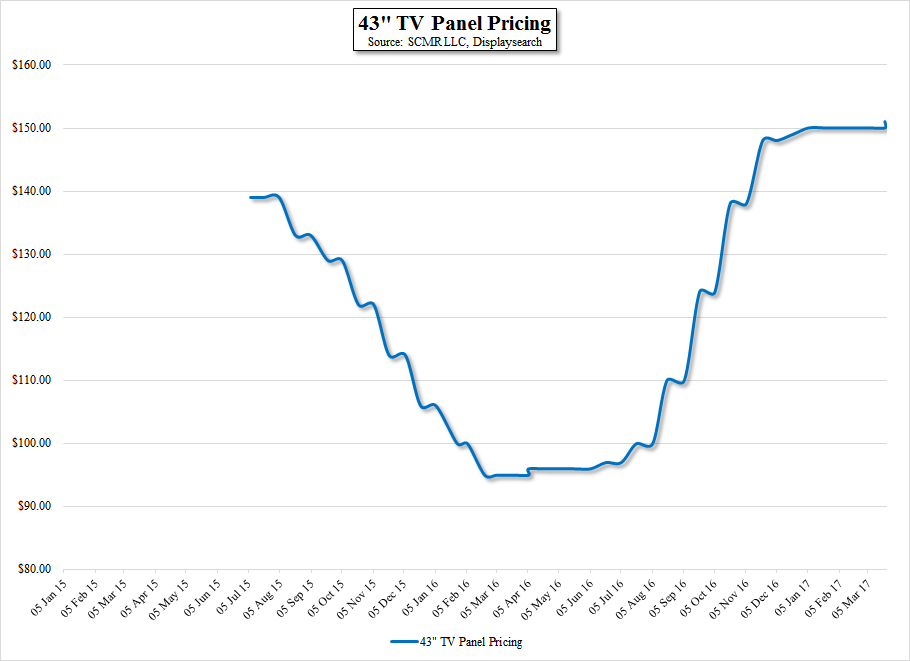

The conversion of such LCD fabs to OLED would give these producers more OLED capacity, however it also has the effect of reducing the supply of LCD display panels, and while in recent weeks the upward pressure on LCD panel pricing has moderated somewhat, the closings that have already taken place and the prospects for additional closings will keep the display industry in a relatively tight supply situation. By holding back the prospective closings, industry participants will better be able to fill demand for those panels that have seen substantial price increases, and participate in the improved pricing and margin environment.

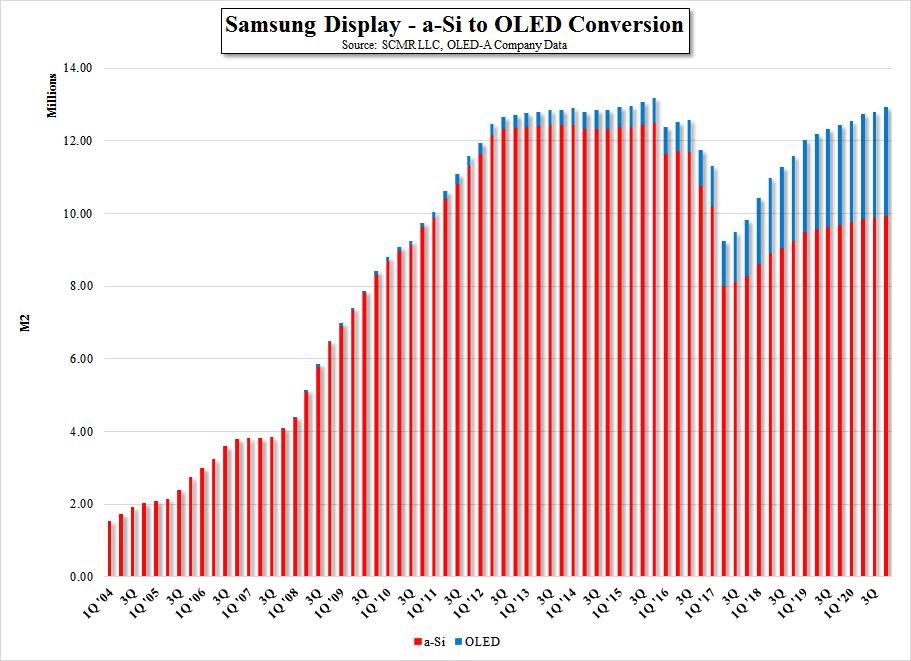

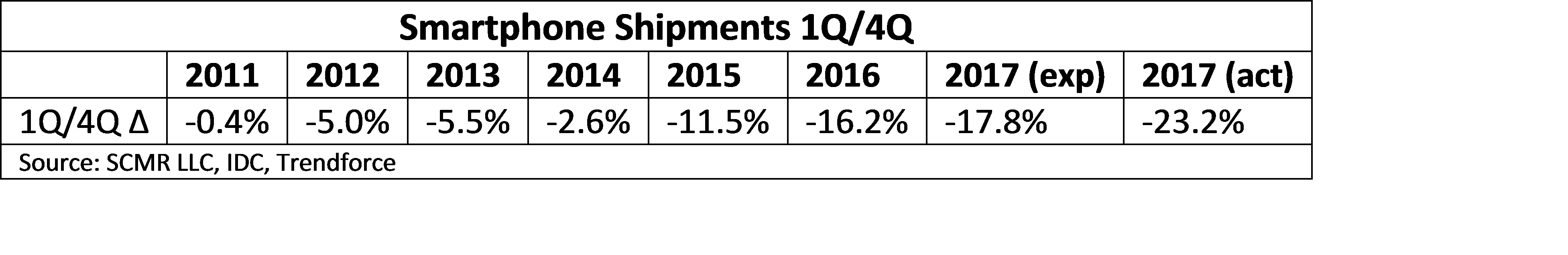

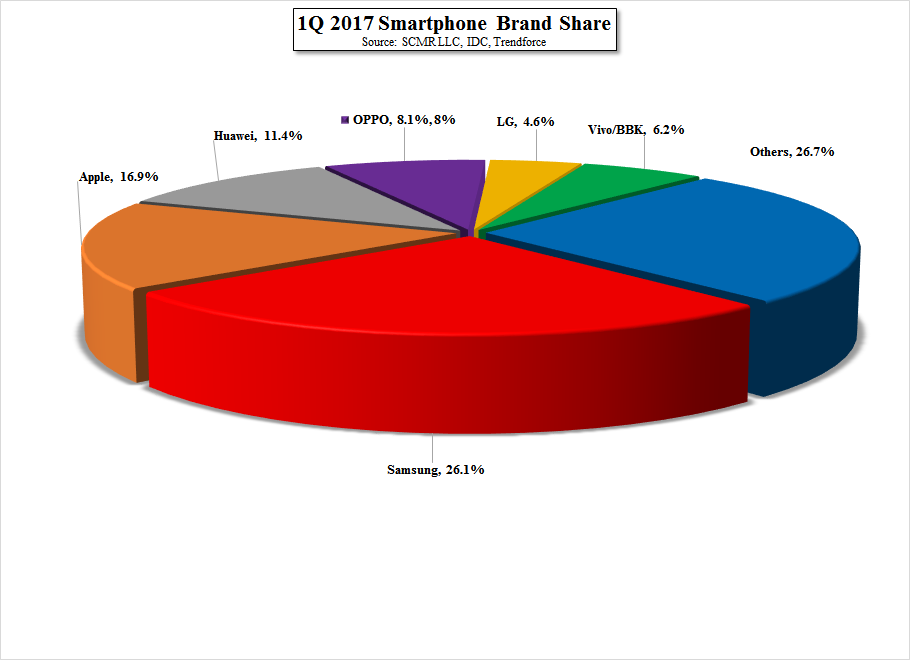

Of course altruism for the industry is not the only motivation here, as Samsung owns Samsung Electronics, which provides a significant portion of the company’s profitability, and Samsung Display is a subsidiary of Samsung Electronics, so by missing out on the ability to capitalize on the TV panel price increases seen in recent months, the overall Samsung profitability ‘chain’ becomes limited. But what about OLED? The objective for Samsung’s conversions was to take less efficient LCD plants and convert them to small panel OLED production, which has been in relatively short supply since it became a viable commercial display product. As small panel OLED becomes more popular, along with the potential for Apple to add significantly to demand with an OLED based iPhone display, Samsung Display, as the primary supplier (90%+ of small panel OLED), needed the converted capacity to supply the industry with OLED displays, another profitable product for the company.

The tradeoff is complicated, as Samsung Electronics, as a TV brand, has seen rising costs and lower TV margins over the last year due to the panel price increases. Should Samsung Display limit its plant closings and conversions, the result would likely be panel price stability, or the potential for panel price declines. This would be less desirable for Samsung Display, but very helpful to parent Samsung Electronics, who would see TV margin improvement. Samsung Display also plays into the equation, as the timing of the conversions, some of which would not be completed until 2018, would leave the company without revenue in either the LCD or OLED categories for these fabs, so the question then becomes, is it better to continue to produce what are now higher margin TV panels on the fabs in question for the near term, or lose the near-term revenue and build the potential for additional OLED capacity down the road?

Normally, Samsung takes the longer view, and tends to build for the long-term, but things are moving far more quickly in the display space than they have over the last few years, and the issues facing Samsung management are far different than in previous years. With the Samsung Electronics vice-chairman under indictment, and the dissolution of the Samsung office that controlled affiliates as a group, each affiliate has greater control over their own fate, and the affiliated division heads now in control have a far more detailed view of the issues facing the consumer electronics and display industries than the previous oligarchy. Will this mean better decisions? That depends on how well the affiliates work with each other, but we would expect the focus will be somewhat shorter-term and oriented toward near-term results in order for the ‘new’ management to prove their abilities and expertise.

We doubt the changes will be as cut and dried as the Korean press might indicate, and such decisions are more likely to postpone rather than eliminate, but will this affect Apple’s OLED project for the iPhone 8? Not likely, as we would expect that any agreement between Apple and Samsung Display would be based on a pre-payment toward ‘available volume’, giving Apple semi-dedicated production lines at Samsung Display, based on an agreed upon schedule of capacity expansion (which would be partially financed by an Apple pre-payment). Would it change Apple’s ability to release an OLED iPhone this year or was the potential decision by Samsung to slow the conversions (if true) due to Apple’s less aggressive OLED plans? We will map those rather complex scenarios in days following, but we can look at the impact of the potential Samsung and LG changes.

Samsung Display has three commercial OLED facilities named A1, A2, and A3. A1, the smallest of the three, has been producing OLED displays since 2009 and uses a gen 4.5 rigid substrate. A2 has been producing since 2011, and is a gen 5.5 fab, but has some capability for both rigid and flexible substrates. A3, which began limited production in mid-2015 is a Gen 6 fab that is designed for flexible substrates, and continues to be expanded. While Samsung has other R&D and pilot lines, including the Gen 8 lines where it originally produced OLED TVs, their OLED production is based on the three ‘A’ lines. The two major conversion projects were the conversion of L7-1, a Gen 7 LCD fab that was put into service in 2005, with a capacity for 140,000 sheets/month. The conversion to a Gen 6 OLED facility was expected to be done in two phases, with the 1st being put into ramp mode in 3Q 2017 and the 2nd roughly a year later, but the total OLED capacity would be close to 44,000 sheets/month. The 2nd conversion, a Gen 5 a-Si line going back to initial production in 2003 has the maximum capacity of ~200,000 sheets/month, with expectations for the three phase conversion producing 60,000 sheets/month of mixed rigid and flexible OLED capacity, scheduled for phase 1 ramp early in 2018, although few details as to substrate size format have been revealed.

[1] Low Temperature Poly Silicon

[2] “Oxide” – Indium Gallium Zinc Oxide

While all is still at the conjecture stage, any change in plans by Samsung Display would be considered significant, especially as to how it affects the OLED display space, the OLED supply chain, and panel pricing across the board. We will continue to evaluate these potential plan changes in days to come, with a full evaluation of the impact on Apple’s OLED plans, and will model a number of scenarios that will detail the overall impact on the display industry.

RSS Feed

RSS Feed