Further, switching that same 60W traditional bulb to LED could save as much as $6,000 over the life of the bulbs, or enough energy to binge watch 200 episodes of a one hour TV show, microwave 3 two-minute meals every day for a year, or not have to replace the bulb from the time your first baby was born to the time you send him/her off to college…

|

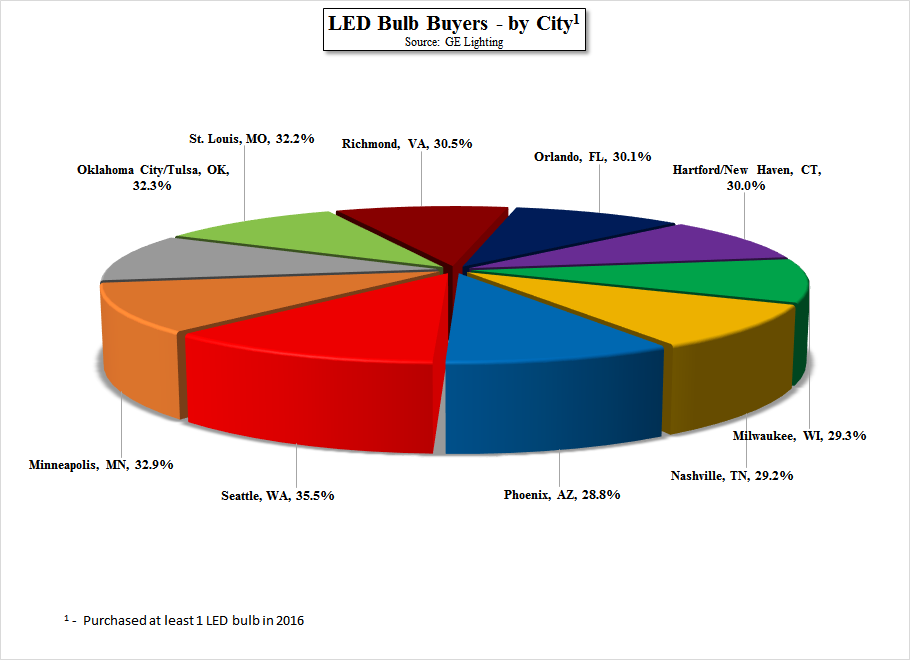

According to GE Lighting (GE), residents of Seattle, WA were the biggest buyers of LED lighting bulbs last year, with 35.5% of residents buying at least 1 LED bulb during the year. With the efficiency of LED bulbs between 70% and 90% better than traditional light sources, if every American replaced one 60W traditional bulb with an LED equivalent, we would eliminate 7 billion pounds of greenhouse gas emissions, or the equivalent of 648,000 cars, and the US would save $566m in energy costs, or the amount of energy needed to light 2.6m homes each year.

Further, switching that same 60W traditional bulb to LED could save as much as $6,000 over the life of the bulbs, or enough energy to binge watch 200 episodes of a one hour TV show, microwave 3 two-minute meals every day for a year, or not have to replace the bulb from the time your first baby was born to the time you send him/her off to college…

0 Comments

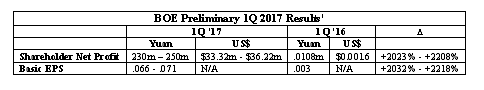

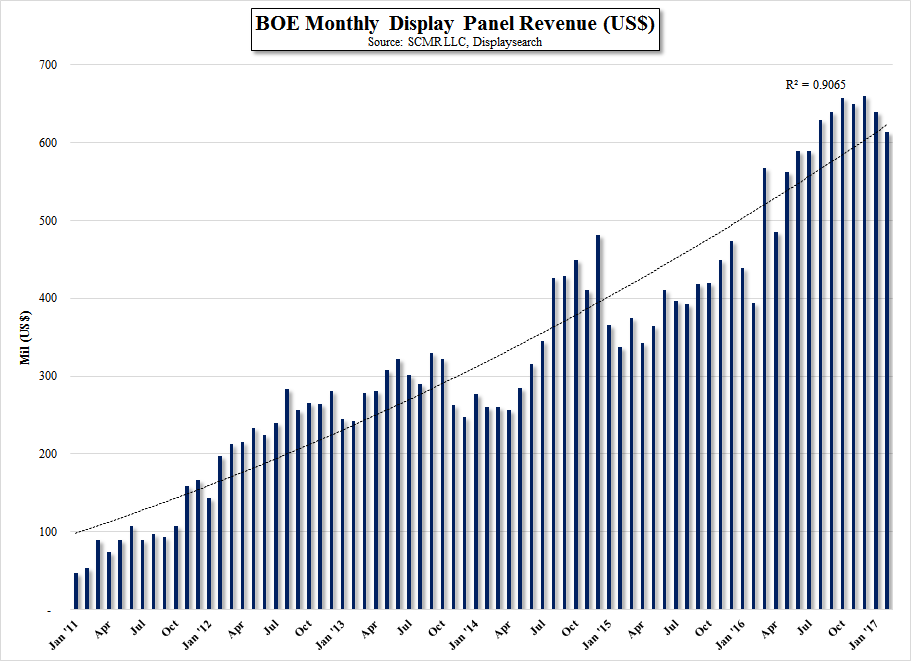

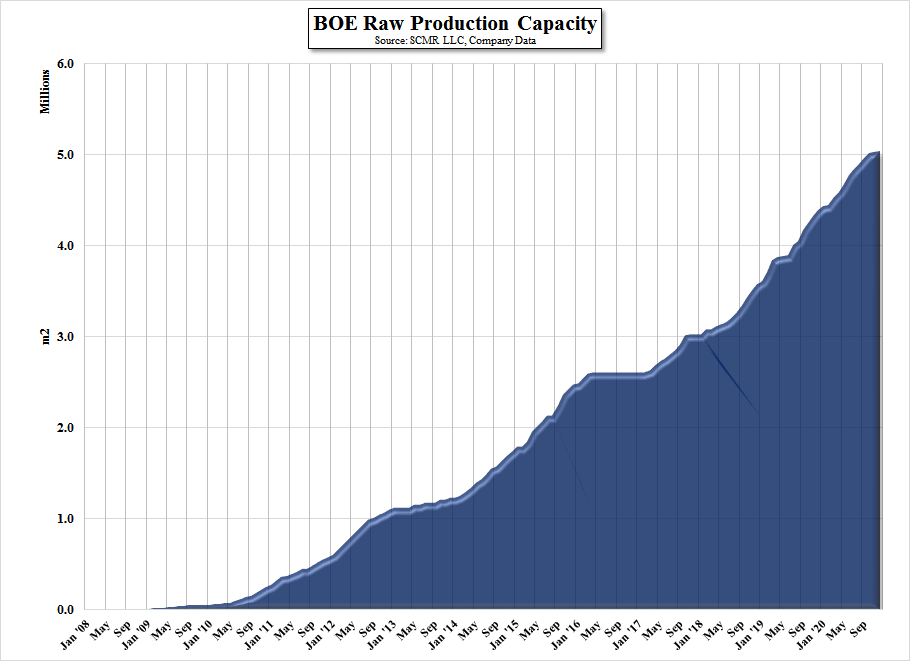

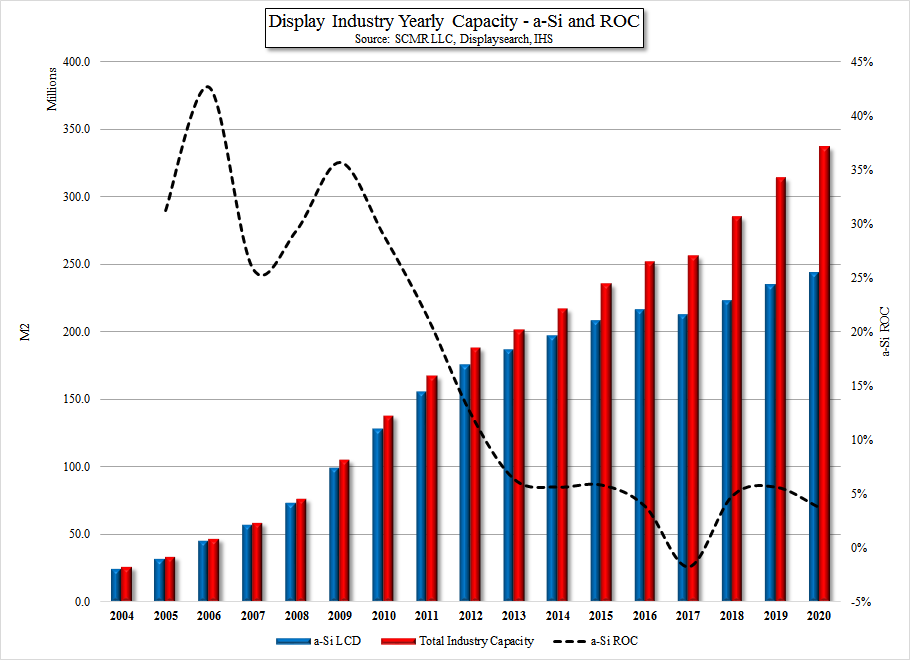

BOE gives preliminary 1Q guidanceBeijing based BOE, the largest Chinese panel producer, gave preliminary 1Q net profit and EPS results for 1Q as follows: BOE (000725.CH) is following in the footsteps of other panel producers, although as we have noted, the comparisons against 1Q 2016’s rapid panel price declines are quite easy. Profitability is up as panel pricing has improved since mid-year 2016 and remains somewhat stable currently and BOE’s vast panel producing capabilities are running at high utilization rates. We would expect y/y comparisons to become more realistic in 2H 2017.

LeEco & Vizio merger officially cancelled |

AuthorWe publish daily notes to clients. We archive selected notes here, please contact us at: [email protected] for detail or subscription information. Archives

May 2025

|

RSS Feed

RSS Feed