Mini-LED Monitors – More, More, More

The downside to this is the fact that the premiums associated with this ’new’ technology will not last for an extended period, and the competitive nature of the product will make it difficult for brands to maintain the unusually high premiums that exist on some Mini-LED products currently. Aside from TVs, Mini-LEDs are used for monitor backlights, particularly those designed for gaming and image processing, where parameter control is of great importance. In terms of overall performance, as Mini-LED based monitors are LCD based, they tend to be brighter than most OLED display based monitors, and the increased number of LEDs used can add a bit to overall brightness. Unfortunately not all brands specify brightness in terms of averages, with many only giving peak values, but any brightness value over 500 is better than most TVs.

Most high performance monitors are either 27” or 32”, at least currently, with ASUS (2357.TT) being the monitor producer with the most Mini-LED models, but there’s a new kid in town, HKC (pvt) who has released its own 27” Mini-LED monitor that is going to put some price pressure on those that charge premium prices for Mini-LED monitors. HKC produces its own LCD displays and its self-developed Mini-LED backlights have now been qualified by OEMs, assemblers, TV brands, and other panel producers including Samsung, Foxconn (2354.TT), and Konka (000016.CH). The company is expected to expand its Mini-LED production by building out enough capacity to give it the #3 share in the market (still waiting for details), but with its first offering, it has set a new price point that will make comparisons against even the top Mini-LED models more difficult as to price.

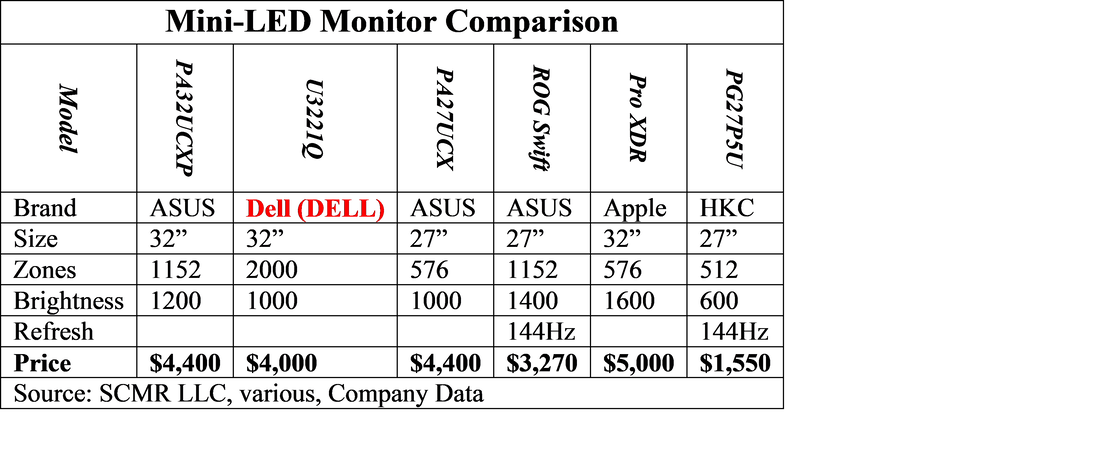

The table below shows some of the top Mini-LED Monitors and the specs that highlight each device. Some have lots of LEDs, some have lots of ‘zones’ for more exacting control, and some have high brightness or color coverage, but while the HKC Mini-LED monitor gets good marks for its comparable specs, it is considerably less expensive than most, and will open the Mini-LED market to a broader group of users who might have passed on alternative brands due to cost. The HKC units will become available in Hong Kong next month and are expected to expand to other cities by the end of the year. We note that there are other metrics that are involved in deciding absolute value of monitors, but all monitors included in the list below are considered the top or among the top few Mini-LED monitors currently available.

RSS Feed

RSS Feed