Fun With Data – 5G 2021

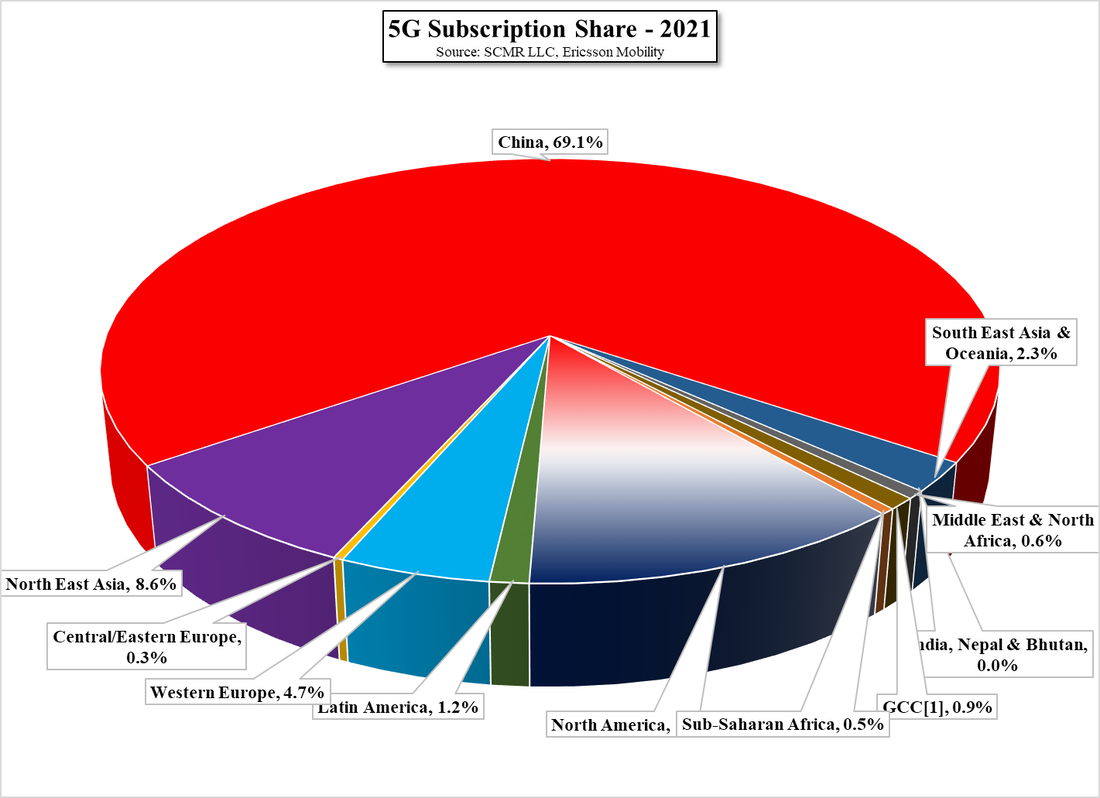

- 481 operators in 144 countries/territories have invested in 5G to date. That is up 16.7% y/y.

- Of those 481 operators, 189 in 74 countries have launched one or more 5G services, up 40% y/y.

- There are 81 operators offering residential or business 5G FWA (Fixed Wireless Access) services, up 84% y/y.

- 32% of FWA service providers offer speed-only based rates, while 36% offer volume-only based fees, with 9% offering both plans.

- FWA quoted speeds range from 50Mbps to 4.2Gbps, with just over half between 250Mbps and 1.0 Gbps.

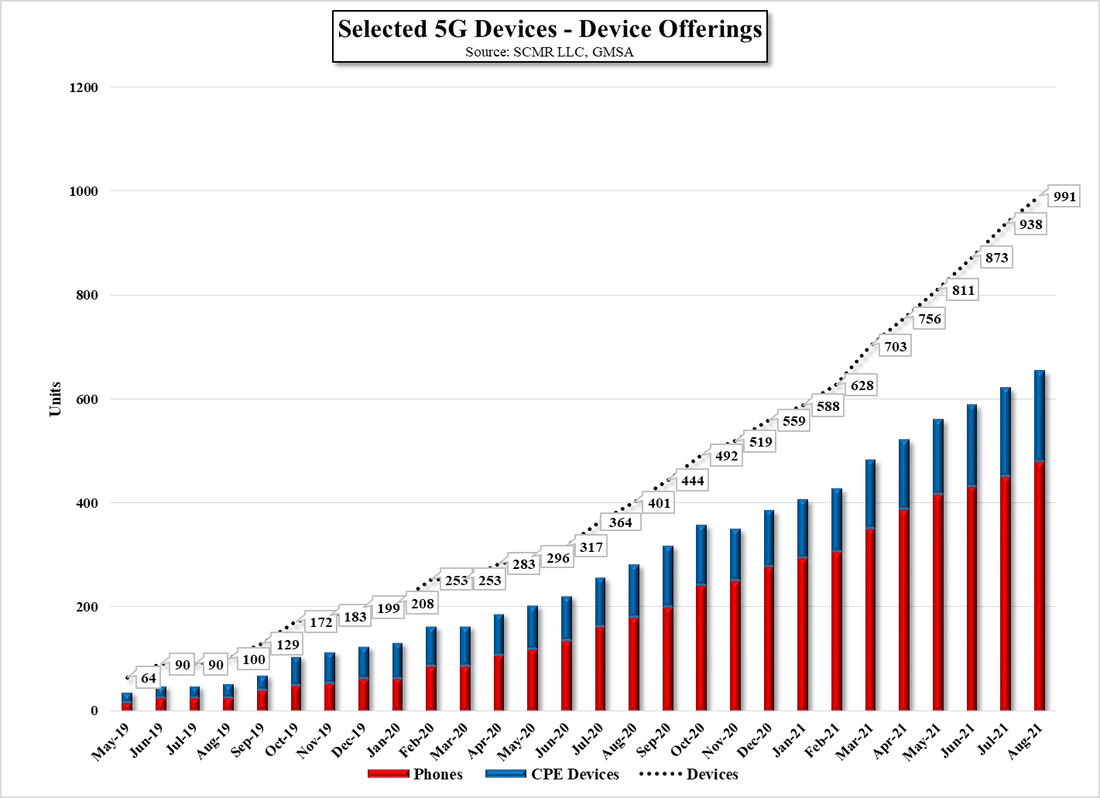

- 207 5G FWA CPE (Customer Premise Equipment) devices have been announced (up 92% y/y) with 61.8% for indoor use.

- Private network deployments (664 total) are primarily LTE, but currently 5G private networks hold a 20% share, with combined 4G/5G adding another 5%.

- The total count of announced 5G devices is now over 1,200 with 832 commercial devices

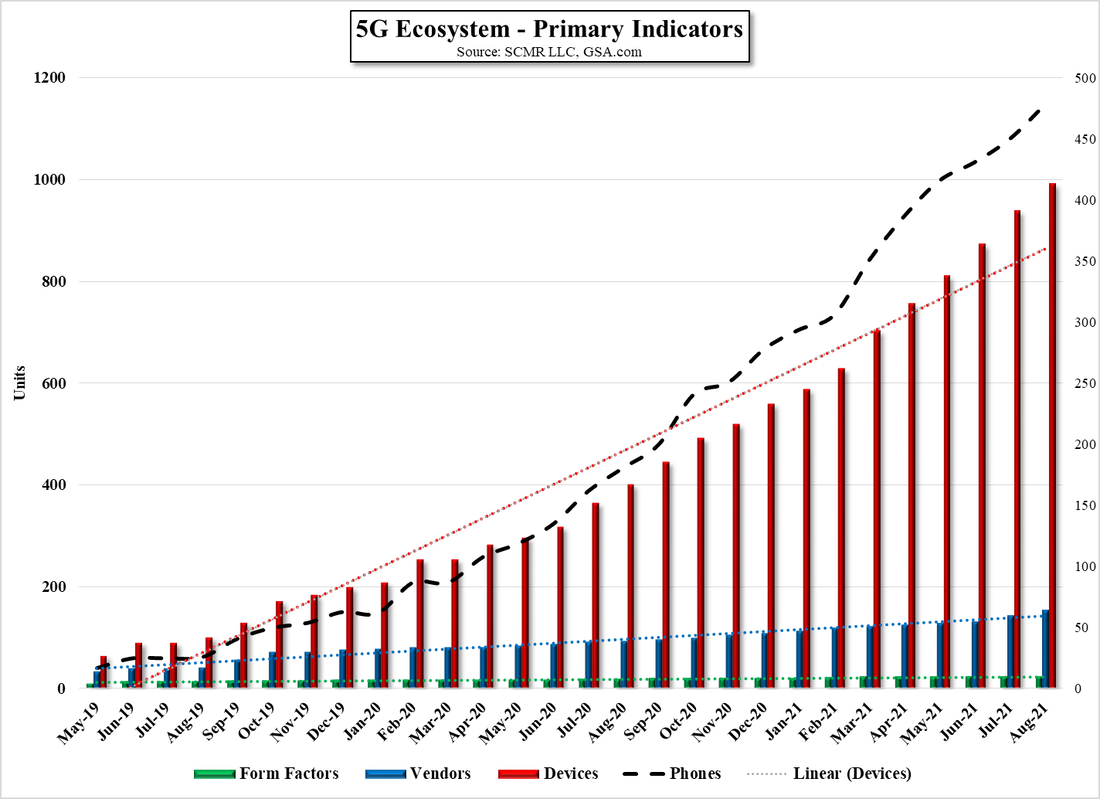

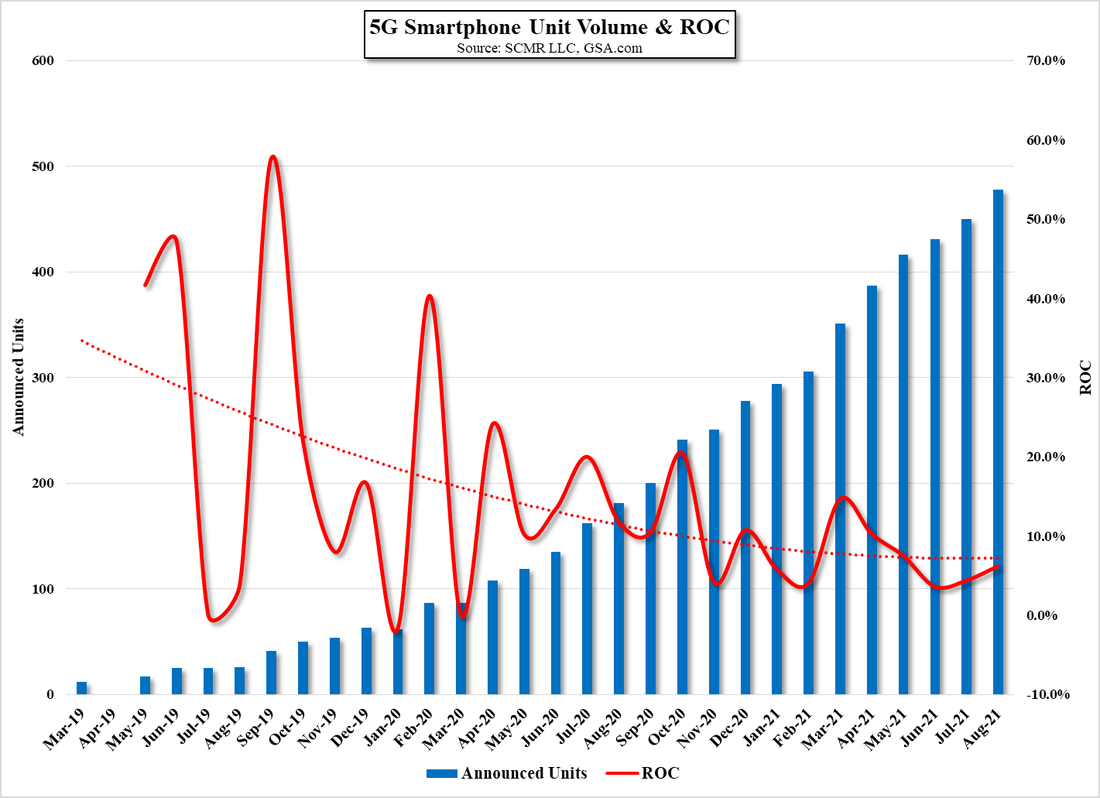

- 5G form factors continue to increase (22 currently), with phones making up the largest share (~50%) (See Fig. 1)

- 596 5G phone models have been announced with 530 commercially available from 40 vendors, with 8 additional vendors with announced models.

- There are 5 suppliers of 5G chipsets and 47 commercially available 5G mobile processors/platforms (up 88% y/y) and 17 commercially available 5G modems, up 70% y/y.

- 55 5G Chipsets support sub-6 GHz spectrum (60.4%), while 36 support mmWave (39.6%)

- 82.1% of all announced 5G devices support sub-6 while 12.4% of announced devices support mmWave.

RSS Feed

RSS Feed