AUO to Buy Automotive Controls Company

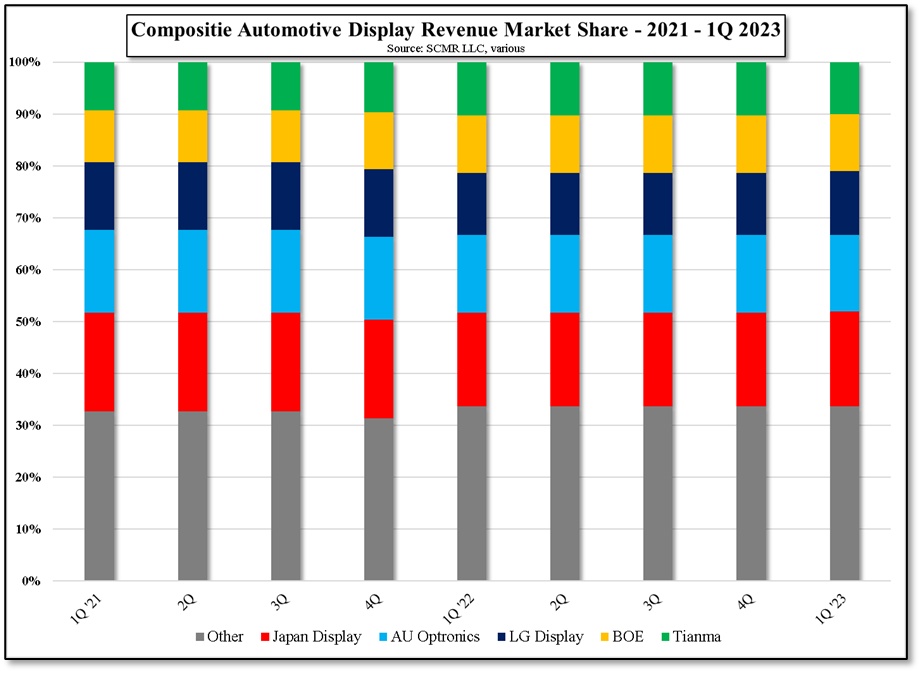

AUO began that process earlier than many other panel producers, but automotive display market share tends to remain stable for the reasons mentioned above and has not changed appreciably over the last few quarters. That said, the automotive display market is oriented toward hybrid or electric vehicles, although not exclusively, but given China’s large share of the electric vehicle manufacturing market, Chinese panel producers have at least a starting advantage over automotive display producers from other regions, with Chinese display producers BOE (200125.CH) and Tianma (000050.CH) having a combined 21%+ share. Rather than compete on a capacity basis, AUO’s general philosophy has been to produce high-end, non-generic products, and does the same in the automotive space. We would expect to see other acquisitions that give them additional expertise in the automotive space, especially as LCD is by far the dominant display type in automotive displays, with Mini-LED backlighting beginning to appear as a way to compete with OLED displays.

RSS Feed

RSS Feed