Point of View

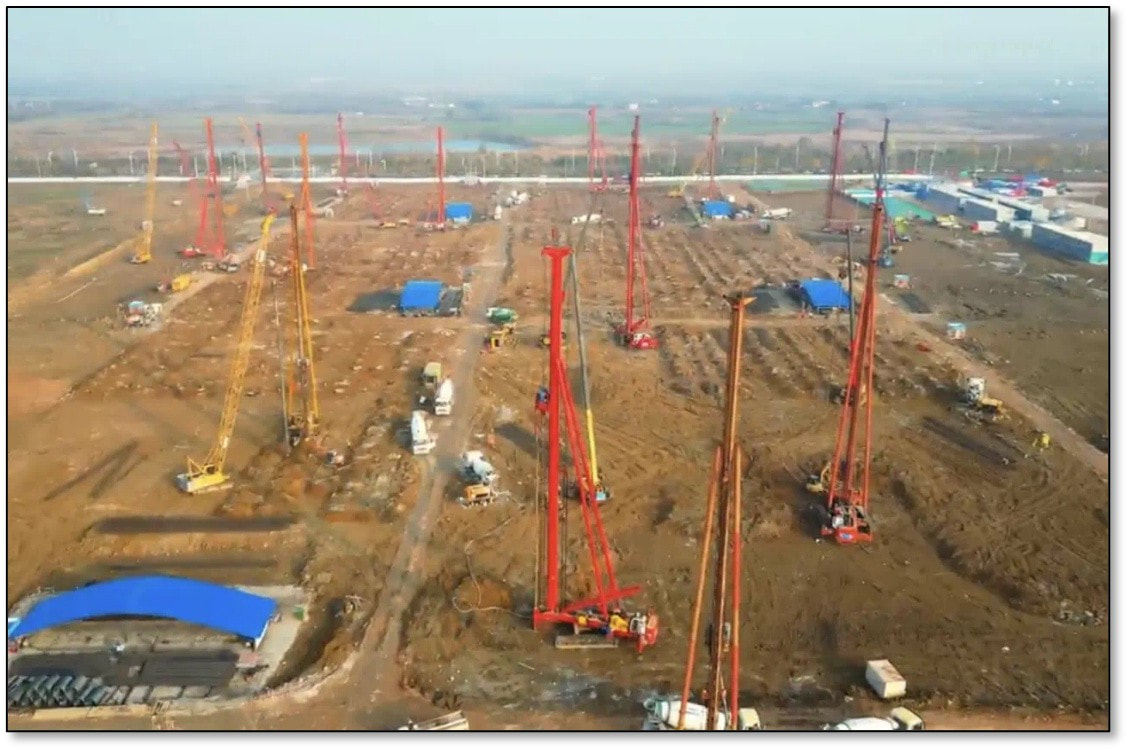

SDC has been quite careful about revealing where they are in the development cycle for their Gen 8.6 A6 line conversion at their Asan campus in Korea, although we believe they took delivery of their first (of two) deposition tools in March of 2024. BOE is thought to have taken delivery of its first Gen 8.6 OLED deposition tool around the same time and both companies are thought to be producing sample product. SDC is expected to begin mass production of OLED IT displays in 1Q or 2Q of next year, while BOE is not far behind.

That said, we believe SDC already has commitments from Apple (AAPL) for a portion of their projected IT OLED output, while BOE does not. Even with that commitment, SDC still has not taken delivery of its 2nd deposition tool that will give it the 15,000 sheet/month capacity that its fab is capable of. On the other hand, BOE is already considering ordering its first deposition tool for its phase two lines, regardless of the fact that it has yet to secure orders for its first line. We expect BOE has already ordered its deposition tool that will compete its first 15,000 sheet line and will take delivery next year, so a phase 2 tool will put BOE on track for an eventual 32,000 sheet fab, twice that of SDC.

If we are correct about the scheduling, BOE could wind up ahead of SDC in 2027. That said, not everyone at BOE seems to agree on how the scheduling should work. Executives are pushing to place the orders for these new deposition tools while production line managers seem to be more hesitant, opting to wait until client product commitments have been secured. There is also the question of yield, as these are new tools that have never been in mass production, which means that should BOE secure commitments but be burdened with low yields, the onus will be on line managers, while if yields are higher and the line are running full, the executives will likely take credit.

It’s a hard call, especially given the high price of the tools ($300 million+), with an incorrect decision saddling the company with little revenue and high depreciation, the inverse being potential orders from customers and an inability to supply enough product. Our guess would be that they place the order for the 2nd line’s tools (It takes about a year to build) but with the option to postpone up to a year if necessary. It might cost more to gain that option, but what’s another million or two when you are spending 300 or 400.

RSS Feed

RSS Feed