Mini-LEDs - More

At the onset, it is important to understand that Mini-LEDs and their applications are not new or a radically different technology from what has existed since LCD displays were commercialized. LCD technology is based on using liquid crystal as a ‘gate’ that opens and closes, letting light through the crystal or blocking it before it reaches a color filter that breaks it down into three colors for each pixel. In early LCD displays that light was produced using fluorescent light strips but that type of light was not well suited for effective color production. Eventually fluorescent LCD backlights were replaced with LEDs which gave display designers a bit more color quality and required less bulky components that allowed displays to become thinner and lighter.

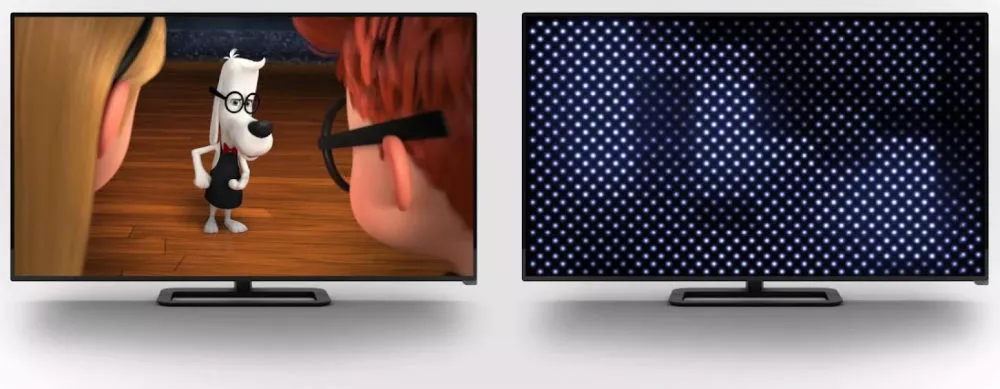

LCD backlights based on LEDs initially began as rows of LEDs mounted on one or two edges of the display. These LEDs were mounted so the light would be generated horizontally, shining into the edge of an acrylic plate (light guide) whose optical characteristics spread the LED light across the entire display. Such edge-lit backlights were always on, using the liquid crystal pixels to block or unblock the light according to the image, but while this was a step up from fluorescent backlights, due to the physical characteristics of liquid crystal, some of the LED light passed through the liquid crystal even when it was ‘closed’. This made pixels that should have been black a bit gray and at the same time, the LED light from areas where the liquid crystal was ‘open’ leaked into pixels that were ‘closed’ causing a halo or bloom effect.

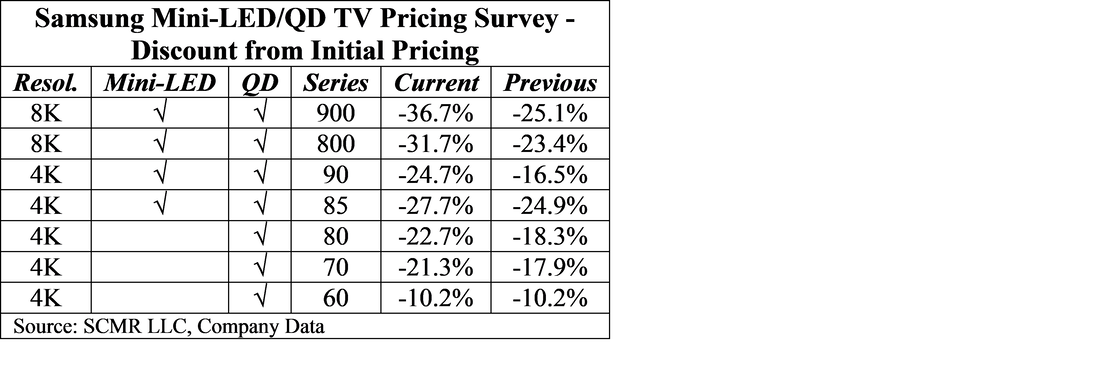

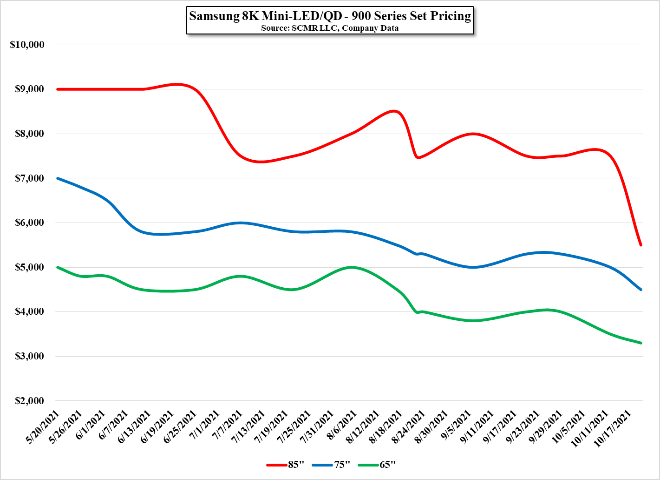

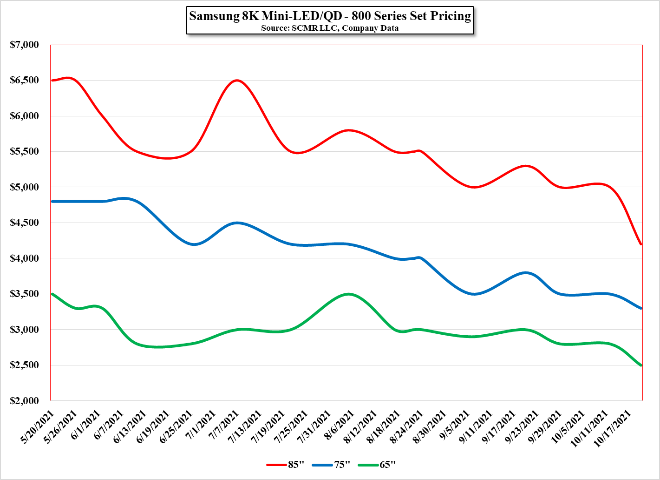

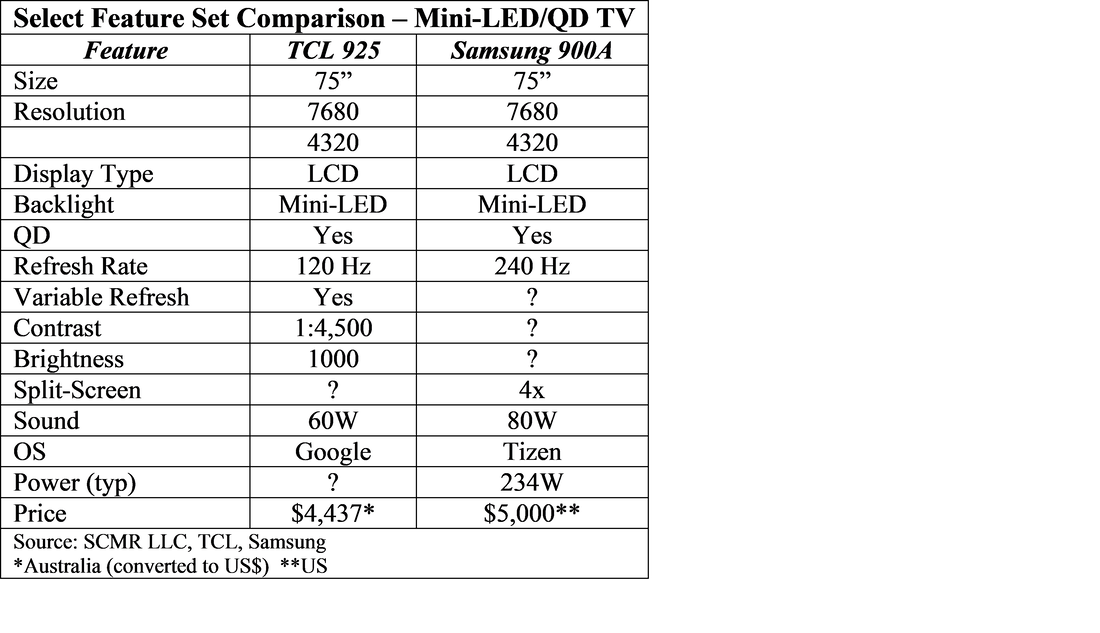

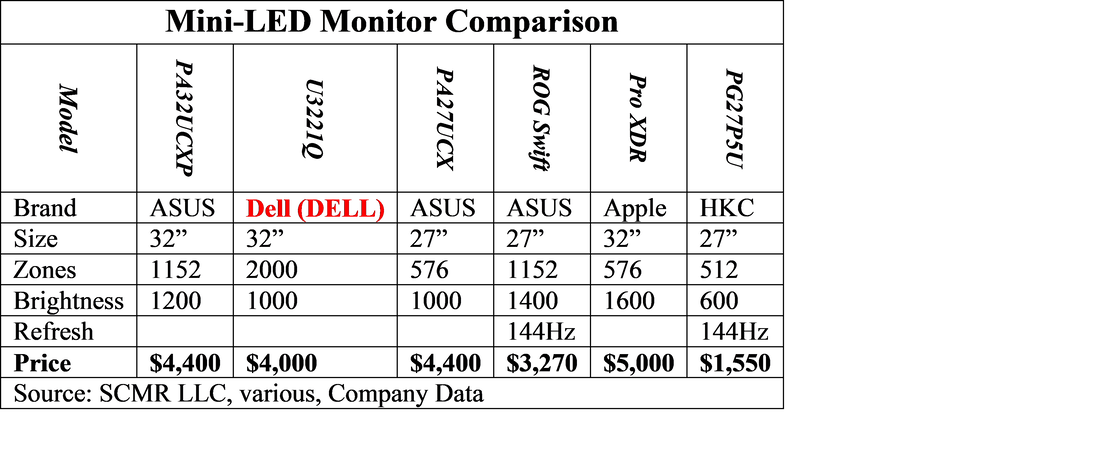

More LEDs and more control circuitry mean it takes more time to produce. At the chip level die need to be tested both to make sure they work and to check color and brightness. Then they are usually transferred to an intermediate medium and then placed on the final substrate. Increasing the number of LEDs and decreasing the size adds time and therefore cost to the backlight, and as Mini-LED levels, the cost increases as typical process equipment is not designed to operate at such dimensions and speeds. We have noted that new technologies for sort and transfer are being developed, but it will take time for costs to be reduced, leaving Mini-LED displays in the ‘premium’ category.

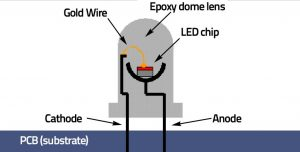

By scaling production and equipment to these new levels, especially taking cues from semiconductor tools that are adept at smaller device sizes, costs can be reduced and one such path is based on the Mini-LED array itself. Most LED backlights are built on PCBs, which mounts the LEDs on a T-pack that is soldered to the PCB board or by using surface mounted LEDs, which are packages that connect the LED to the PCB. Smaller LED backlights were relatively easy to produce this way, but as the number of LEDs increased, the control circuitry became more complex, and the size of displays continued to increase, PCBs had to also increase in size, now fitting TVs over 80”.

This became considerably more burdensome for TV designers, and with the move to Mini-LEDs, which can bring the LED count to 20,000 or more, PCB boards began to become unwieldy, having to be mounted in frames to keep them rigid. Mini-LEDs are now transitioning to a process called COB (Chip-on-board) where the LED itself, not a package/LED is mounted on a substrate such as glass, that already has control circuitry in place. This technique, which uses deposition processes similar to those used to produce TFT (Thin-film transistor) backplanes for displays, allows for more densely packed Mini-LED displays, and because spot soldering is not used, the failure rate is considerably less than with SMT arrays. Given the smaller size and large numbers of Mini-LEDs used in displays, the cost of repairing a defective Mini-LED is high, which adds value to the COB process. As the industry develops such processes, the price of Mini-LED backlights will decrease while the characteristics continue to improve.

All in, while Mini-LED technology is an evolution of long-standing LED backlight technology, as the cost decreases and availability increases, the technology will help to prolong the life of LCD technology, giving some protection to the massive investments made in LCD capacity over the last 20 years. While OLED is certainly a competitive display technology, the cost of producing OLED displays remains high compared to LCD, and while OLED display quality has a number of superior characteristics to LCD displays, Mini-LEDs narrow the gap, at least from a consumer perspective. Each iteration in the saga of LED LCD backlighting has proved expensive at the onset and eventually come down to levels where it has little effect on the average price of LCD TVs.

While Mini-LEDs do have their particular cost issues currently, the fact that existing process technology can be used to improve production costs gives us hope that Mini-LED premiums will become less onerous by the end of 2022. Apple’s (AAPL) careful adoption of the technology in the iPad and MacBook, and potential expansion across those lines next year will certainly help to give confidence to chip producers and array developers, which will increase competition and reduce costs further. While still in the early stages of implementation, we see much activity in the LED space toward such product development and dedicated Mini-LED capacity expansion backed by both display and LED producers who see the technology as a way to extend LCD investment lifetime without massive spending, while we expect consumers will be happy to see another level of LCD display improvement, as long as it doesn’t cost much more than they are used to paying for pre-Mini-LED technology.

RSS Feed

RSS Feed