The Mini-LED Obsession Continues

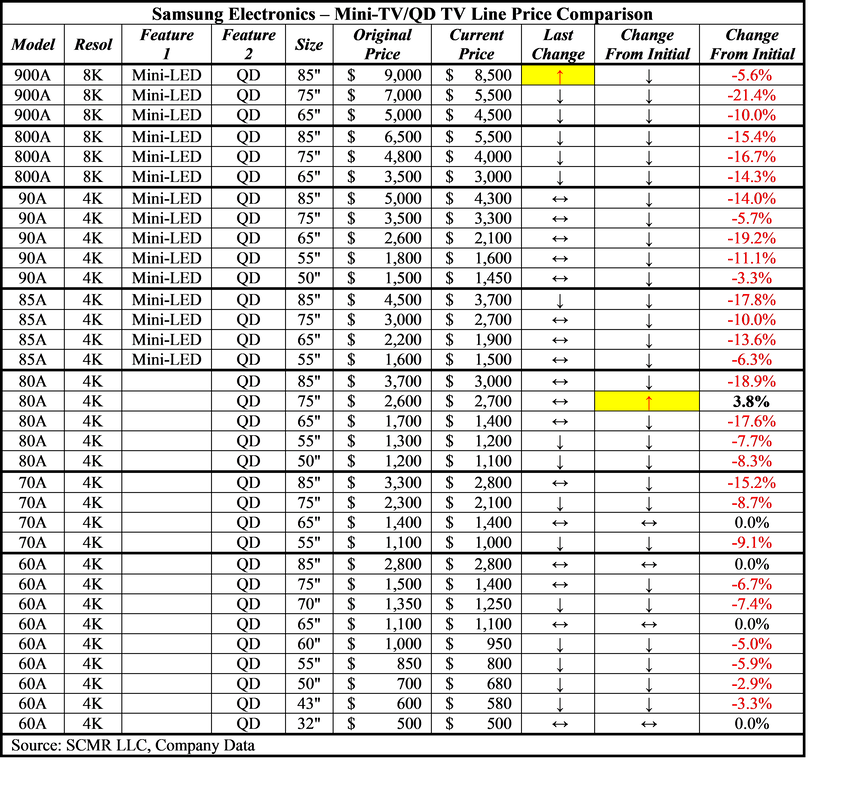

Using the same 33 set Samsung TV lineup that we have used since the May 20 release, we show the following:

- The composite group, which includes six 8K Mini-LED/QD TVs, nine 4K Mini-LED/QD TVs, and eighteen 4K quantum dot enhanced TVs, is priced 14.5% lower than original pricing.

- The 8K Mini-LED TVs are priced 21.8% lower than original pricing

- The 4K Mini-LED TVs are priced 15.3% lower than original pricing

- The ‘QD only’ 4K TVs are priced 11.7% lower than original pricing

- Of the 33 sets in the group, 15 are at their lowest price point since original pricing

- Of the 33 sets, none are above their highest price point

- Of the 33 sets, 3 are equal to their highest price point

- Of the 33 sets, 2 have not changed from their original price

- Of the 33 sets, 20 are at a lower price than when we last checked (8/24/21)

RSS Feed

RSS Feed