Wonik Wins - Eventually

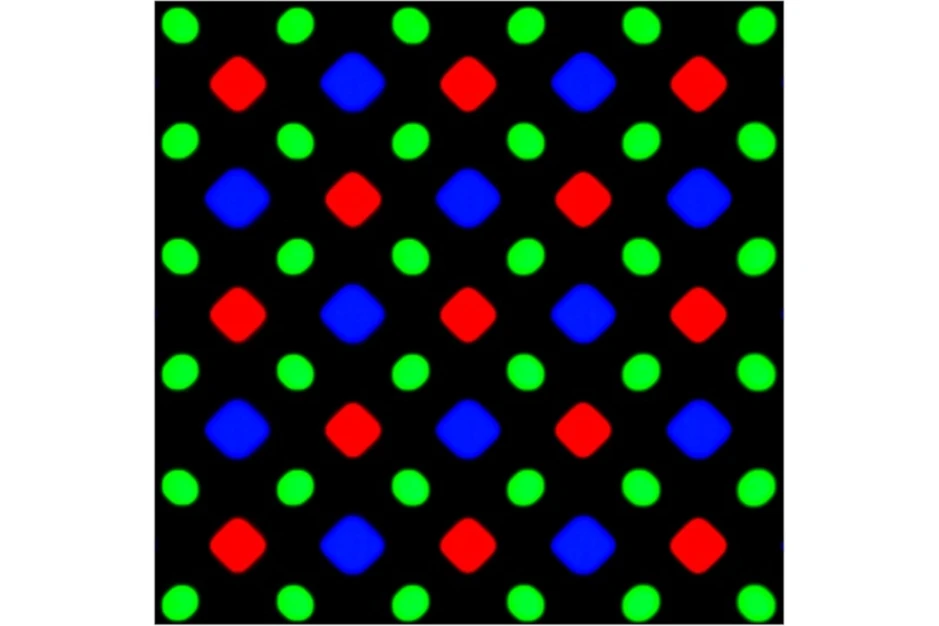

Much will depend on the success of the QD/OLED displays with parent Samsung Electronics, who has had an on-again/off-again view of the technology. SDC has also been considering shifting its QD/OLED technology to quantum nano-rods, which, if done, would delay the etcher sales further, although the process at the TFT level is similar. The competition between dry etcher companies for SDC’s large panel RGB OLED project continues, although the status of the project itself remains dependent on the ability of SDC and deposition tool partner Ulvac (6728.JP) to finalize a mass production vertical deposition tool that will allow for fine metal mask RGB large panel production without the size limitations that currently limit RGB OLED to Gen 6 fabs.

RSS Feed

RSS Feed