Off Again

While negotiations seemingly were bogged down on price, with OLED supplier LG Display allegedly offering prices lower that what it receives from parent LG Electronics (066570.KS), Samsung has been said to be driving a very hard price position and with the rapidly falling price of LCD TV panels, it seems the negotiations have broken down again. A spokesman from Samsung was quoted as saying “If we are to use LG OLED panels in our products this year, the discussion would have to be concluded by now. So chances are slim that we will release TV sets with LG OLEDs. Still the possibilities remain open for future orders, although nothing is decided.”

As we have noted, with Samsung Display’s decision to end its production of large panel LCD displays, parent Samsung Electronics purchases its LCD displays from a number of panel producers, some of whom it has a financial connection with, such as Chinastar (pvt), owned by TCL (000100.CH), who purchased Samsung Display’s Suzhou LCD fab in August of 2020, with Samsung taking a 12.3% stake in TCL at the time. Samsung also purchases LCD panels from China’s BOE (200725.CH) and Taiwan-based AU Optronics (2409.TT), among others.

While the decision to terminate the large panel LCD display production business at Samsung Display was made by the board, we believe, based on the composition of the board, that Samsung Electronics was fully represented and was part of that decision, and while there was certainly some difficulty involved in establishing volume relationships with other suppliers, Samsung Electronics as a whole saw weaker TV set sales but higher profits from Samsung display during panel price increases and saw the opposite during LCD panel price declines. As the industry began to transition toward OLED, especially small panel OLED, we believe Samsung management was looking to capitalize on that growth and the long-term decline in LCD panel prices, which stimulate TV sales, without the offset of LCD TV panel losses at Samsung Display.

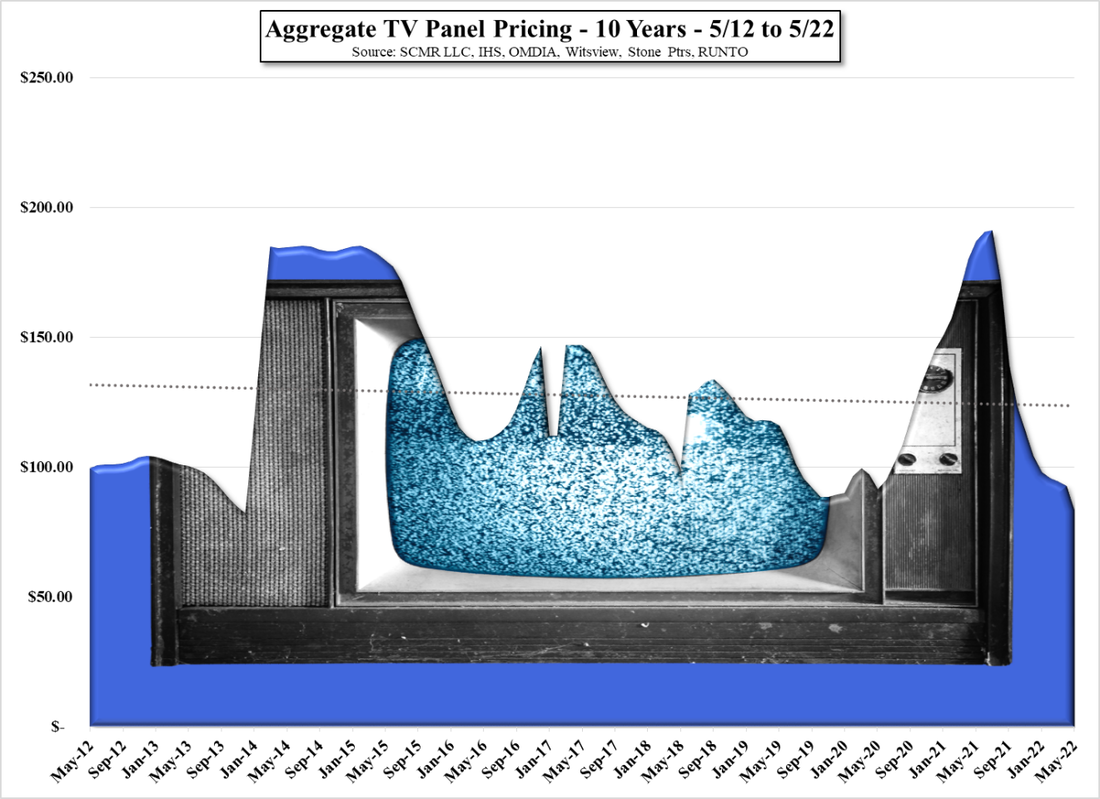

The strategy suffered during the COVID-19 LCD TV panel price hike, but has since moved in Samsung’s favor, as in theory, TV set sales should increase as set prices decline, without the offset of large panel LCD losses at Samsung Display. We note that of the 120 data points in Figure 1, 41.7% have been over the trend line, leaving 58.3% of months below trend, leading to a downward trend. During the COVID-19 pandemic and the rise in LCD TV panel prices, the spread between LCD TV panel pricing and OLED TV panel pricing shrank, making Samsung more focused on offering OLED TVs to its customer base, but as that spread increased beginning last July, that necessity lessened and Samsung had less pressure to offer OLED TVs and more leverage with its QD/Mini-LED and pure quantum dot TVs, which are both based on LCD panels. It would seem Samsung believes that scenario will continue through the end of this year and therefore has a greater incentive to lowball LGD for OLED displays and less pressure to come to a deal before the holidays. We expect that Samsung will be highly promotional in regard to its quantum dot and QD/Mini-LED TVs this holiday season and will have less inclination to negotiate with LG Display until next year.

RSS Feed

RSS Feed