Japan Display Goes Litho…

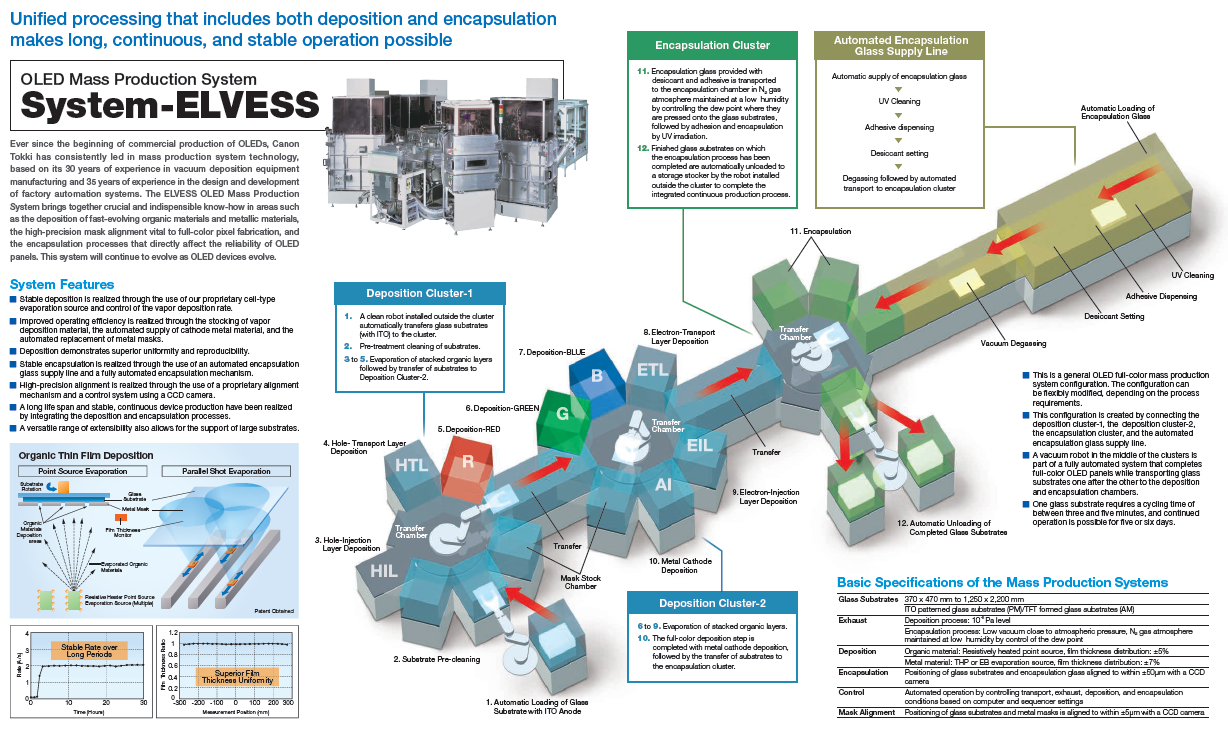

There are problems with OLED material deposition, one of which is the masks themselves. They are made of INVAR, a nickel-iron alloy that is able to maintain shape and uniformity under the temperature conditions used in CVD (up to 500⁰C) but at the same time must be unusually thin and placed extremely close to the substrate to create precise sub-pixel placement. The requisite thinness limits the size of these masks, as they begin to sag above Gen 6 substrate size, and the buildup of material on the mask surface requires they be cleaned and replaced regularly, pushing OLED display producers to look for alternative deposition methods.

One promising technique is ink-jet printing where multiple nozzles place OLED material droplets on the substrate as they move across its length. This allows for precise control over the materials, resulting in a substantial reduction in the amount of OLED emitter material waste but in order for the material to pass through the nozzles, it must be put into solution which means mixing the emitter materials with a solvent which can change the characteristics of the OLED materials or require ‘soluble’ materials that are different from those used in CVD deposition.

JDI’s eLEAP (environmental positive Lithography with maskless deposition Extreme long life, low power, and high luminance Any shape Patterning) is claimed to increase emission efficiency by 60%, which is more than 2 times that of the FMM method and is not limited to Gen 6 substrates. The process is green in that it is more ‘environmentally positive’ without masks that need to be regularly cleaned and therefore uses less toxic material and produces less CO2 emissions. JDI is combining this technology with its expertise in IGZO TFT backplanes to create what it calls a breakthrough in display technology.

While we cannot verify many of JDI’s claims, there are some points that are do make sense. We expect that the JDI system involves the use of supercritical Carbon Dioxide, which is a form of ‘dry ice’ that is low-cost, non-flammable, and can be used as a developing solvent that does not degrade OLED materials, which are critically sensitive to water, air, and many of the solvents used in lithography, and possibly fluorinated solvents that have less onerous characteristics toward organic (OLED) materials. Since lithographic patterning is only limited by the size and shape of the substrate, almost any shape display could be patterned in theory, and given that no metal masks are used, three of the claims are possible.

RSS Feed

RSS Feed