And Speaking of Prices…

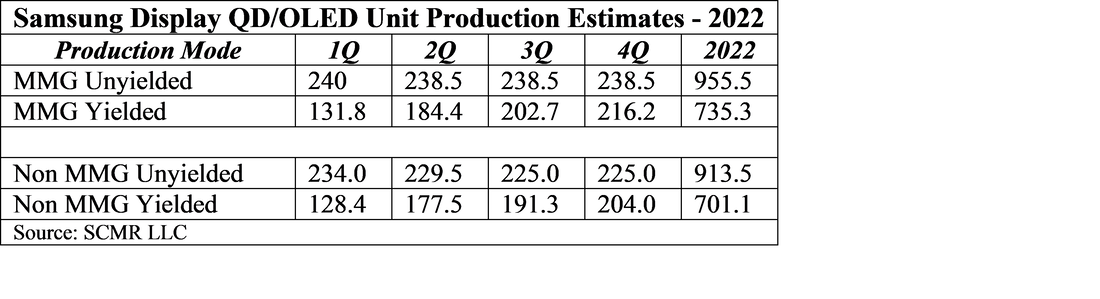

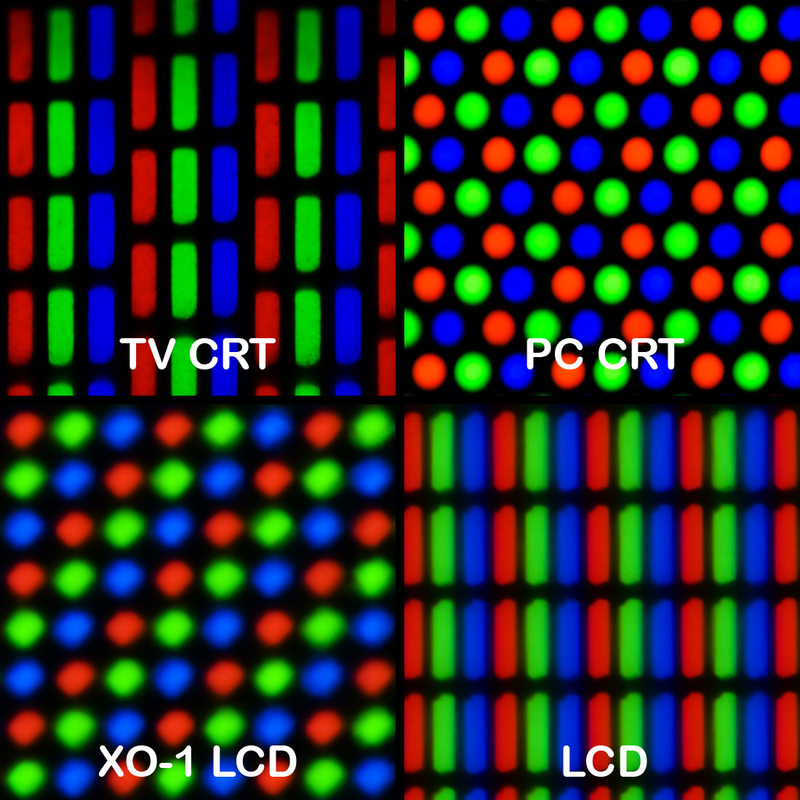

As SDC perfected the use of quantum dots as a replacement for the color filter in a large panel setting and developed a production line for same, we begin to look at QD/OLED as a competitive product against a number of other TV display modalities, such as LCD, Mini-LED LCD, Mini-LED LCD with quantum dots, WOLED, and micro-LED, and to that end we have to look at how the sets using QD/OLED are priced. In fact, while there will be a small segment of the buying public that will buy a QD/OLED TV because it is new, (those who answer surveys with “I am always the first to try new technology”) the ability of the technology and its application to be a viable competitor to other TV display technology is the key to success, no matter how much is spent on marketing, and that will have a great deal to do with how it is priced.

There has been much in the marketing literature for QD/OLED about ‘perceived’ specifications, separate from hard metrics, which leads us to believe that Samsung is ready to do battle with other TV modalities, and is passing through the initial release stage where price is almost irrelevant. In fact, Samsung itself brought to our attention the fact that its two QD/OLED models have just been put on sale, with the 65” model being discounted from $2,999 to $2,099 for Labor Day, a 30% discount, and the 55” model reduced from $2,199 to $1,699, a 22.7% reduction. This follows a previous price reduction from $2,999 to $2,599, so the reductions from the initial offering prices are substantially higher. (See our note of 7/11/22 for details). Samsung is also offering phone and tablet trade-ins to be applied to the reduced price, and no-interest financing of the purchase price in 4 installments or monthly over four years (4 year option comes to $43.75 and $35.42 monthly) and delivery in 5 days, or pick-up (Best Buy) in 3 days. Amazon is a few dollars lower.

All of this comes down to the fact that the competition in the OLED space has now been stepped up, although to pin down where the QD/OLED sets would fall against other 55” and 65” TVs is a task that involves classification by specifications and price across a multitude of TV brands ranging in price (4K) from $250 to ~$3,600. Given that Samsung Display’s capacity is relatively limited with one fab in production for these displays, the question we ask is why is Samsung competing on price this early in the product cycle? The obvious answer is to sell more QD/OLED TVs, but with near-term capacity relatively limited, we see this more as a way to bring the technology into the eye of the general public rather than the cognoscenti that have a vested interest in staying close to the TV space.

Samsung is very good at building momentum behind products where they are the exclusive supplier (flexible OLED, foldables, LTPOP, etc.), but in this case the difference between Samsung’s QD/OLED product and other large panel OLED displays is a bit more subtle, forcing Samsung to more down the price curve a bit faster than they might if there were no other large panel OLED TV competitors. That said, Mini-LED LCD and QD/Mini-LED TV have given some extra life to the premium TV market and in order to maintain their TV leadership role across the globe, Samsung must continue to broaden its product portfolio. Adding another category here, at what is becoming a reasonable price point, is a move that will make sure they have appeal to every potential TV buyer, regardless of the price range or quality level.

RSS Feed

RSS Feed