Under the Hood

There are those that relish the thought of purchasing smartphones and then taking them apart, piece by piece, in order to quantify structure and cost. Such a group is TechInsights, who are known for their detailed teardowns of various CE devices. They have been kind enough to afford us a detailed look at one of their smartphone teardowns, which we summarize below.

The phone being disassembled here is the Sony (SNE) Xperia 1V, a device released in July of 2023. Sony is not a major smartphone brand but is known for the high quality of their phones, so the example below should be a guide as to what to look for in a high-end smartphone. We note that when the Xperia 1V was released, it sold for $1,399. The phone weighs 188 grams, runs on Android, and has a 6.48” OLED display, along with four cameras, and runs on a Qualcomm (QCOM) Snapdragon 8 Gen 2 processor.

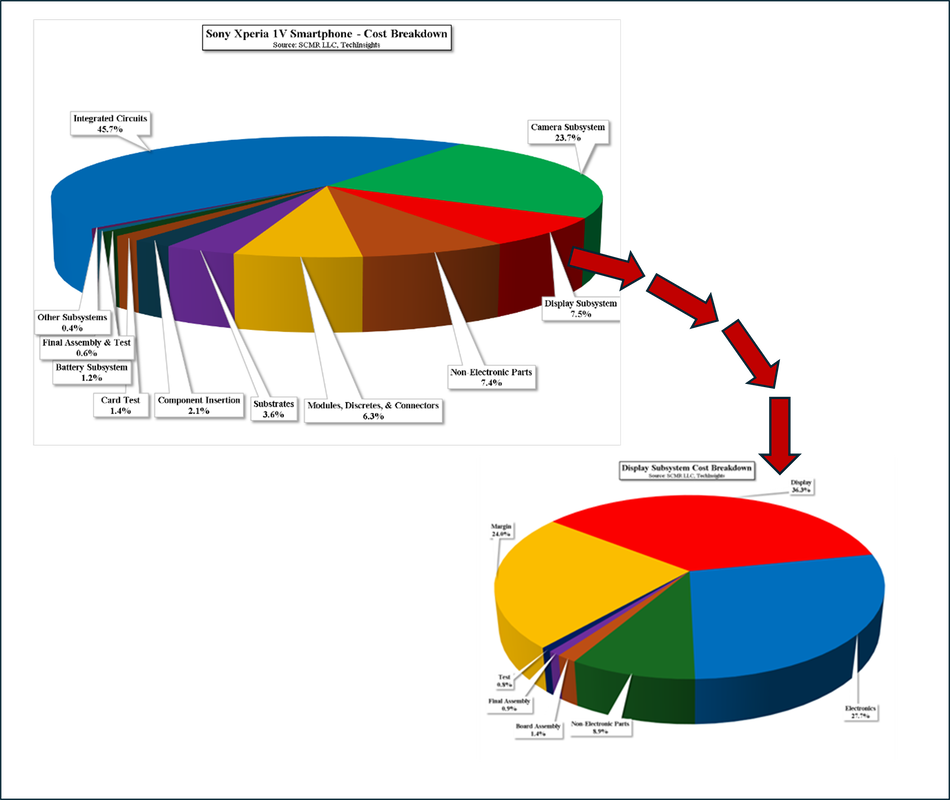

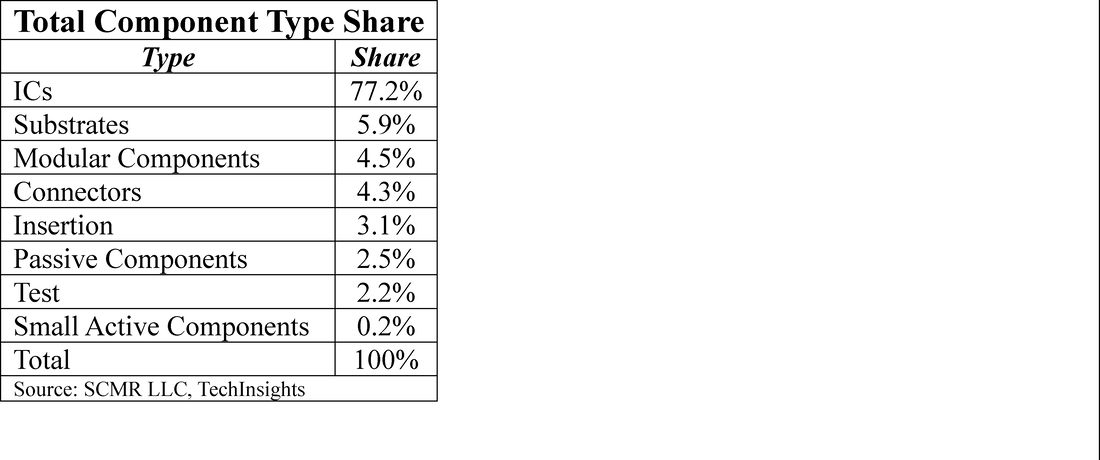

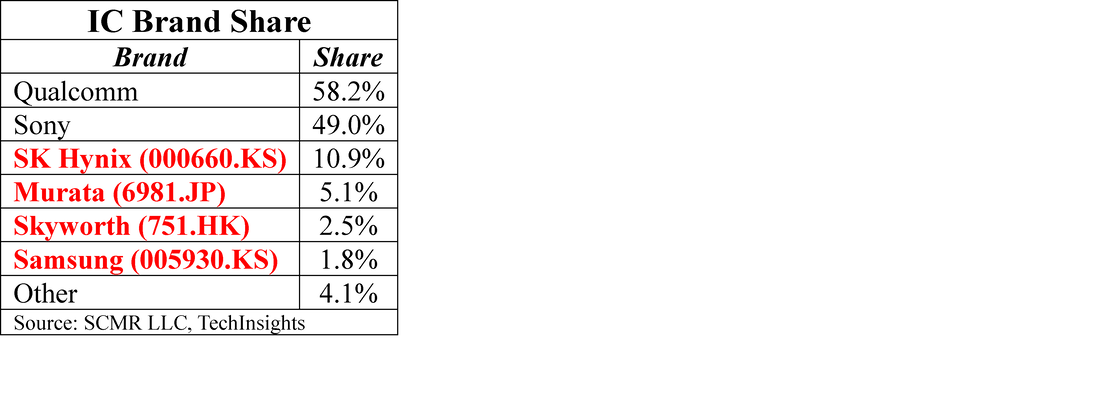

While the greatest share of the BOM is the broad category of integrated circuits (45.7%), the camera subsystem captures 23.7%, due to the fact that it covers 4 cameras and associated electronics, lenses, etc. The display subsystem, which is a single 6.48” OLED display and a touchscreen, along with a polarizer and cover glass (total of 70 components), is next at 7.5%, followed by non-electronic parts (frame, etc.) at 7.2%. More relevant to the investment community would be the breakdown of the total component types and the IC category on a branded basis. As can be seen in the table below, the IC category carries the largest cost share by a large margin, putting significant weight on the brand share shown in the table that follows.

RSS Feed

RSS Feed